How Do I Choose Between Premium Offset and Reduced Paid-Up?

Obviously, you will need to consider your entire financial, tax, and estate planning situation with your advisors before making your final choice, but here are the main simplified reasons you would choose one vs. the other:

When To Use a Premium Offset vs Reduced Paid-Up Insurance:

Remember, this is where you stop paying premiums out-of-pocket and use your dividends and any prior overfunding to cover the annual premium?

You are viewing: Which Situation Accurately Describes A Reduced Paid Up Nonforfeiture Option

- If you want to maintain maximum death benefit because your health has taken a turn for the worse or your family/business has a lot of financial obligations you want to protect against, then you will definitely want to just offset your premiums. Again, this means that you simply no longer pay them out of pocket. Utilizing dividends and prior overfunding will hinder your cash value growth somewhat, but it is usually nominal if you have been diligently paying significantly more than the base premiums during the early years of the policy

- Maintaining your ability to pay premiums in the future is another reason to temporarily offset premiums. If you want to resume paying premiums in the future, you can do so even after offsetting premiums for a number of years. Choosing to offset premiums is not an irrevocable decision unlike electing “Reduced Paid-Up status for your policy. Offsetting can be a temporary election. You can offset premiums at any point in the lifecycle of the policy so long as that annual dividend payout is large enough to cover the base premium and/or you have significantly overfunded your premium payments in the past.

In a nutshell, offsetting premiums either temporarily or even permanently will probably be the way to go if:

- Your health has taken a turn for the worse

- You’re just not ready to irrevocably reduce your death benefit for financial reasons

- You want to keep your option open to contribute more money to your policy in the future.

Now that you get the gist of a premium offset, let’s discuss the reduced paid-up insurance non-forfeiture option (a.k.a. RPU) that is available on every whole life policy by law.

When To Use the Reduced Paid-Up Insurance Option:

Remember, this is where you elect the irrevocable option to contractually stop paying premiums ever again?

- If your burning desire is for maximum cash value performance going forward, you don’t mind reducing the death benefit, and you are sure that you will never want to contribute any more premiums to your policy again, then electing the reduced paid-up insurance option may be your best option.

- The longer that you have had the policy and the more extra premium payments you have made along the way will determine how big of reduction is necessary. (Note: if you elect to have future dividends go towards purchasing Paid-Up Additions, then your death benefit will continue to increase again from that new lower Reduced Paid-Up amount even though you’re no longer paying premiums.)

Read more : Which Of The Following Will Occur After Ovulation

Warning: Although the insurance company is obligated to accommodate your request for reduced paid-up insurance at any time during the life of the policy, we highly recommend that you wait at least 7 years utilizing this option. Electing Reduced Paid-Up status anytime during the first 7 years may cause your policy to lose some of the favorable tax benefits afforded to permanent life insurance.

To summarize, choosing the reduced paid-up insurance option is best when you are sure that you no longer contribute any more premiums to your policy. We find that this most often comes into play when a client is about to retire and losing some permanent death benefit is not a major concern. Often at this point, their main priority becomes maximizing cash value performance with the least amount of “mortality charges.”

If so, it may be time to explore what electing Reduced Paid-Up status will do to your policy.

Seeing the Effect of either the reduced paid-up option or premium offset on the Same Policy:

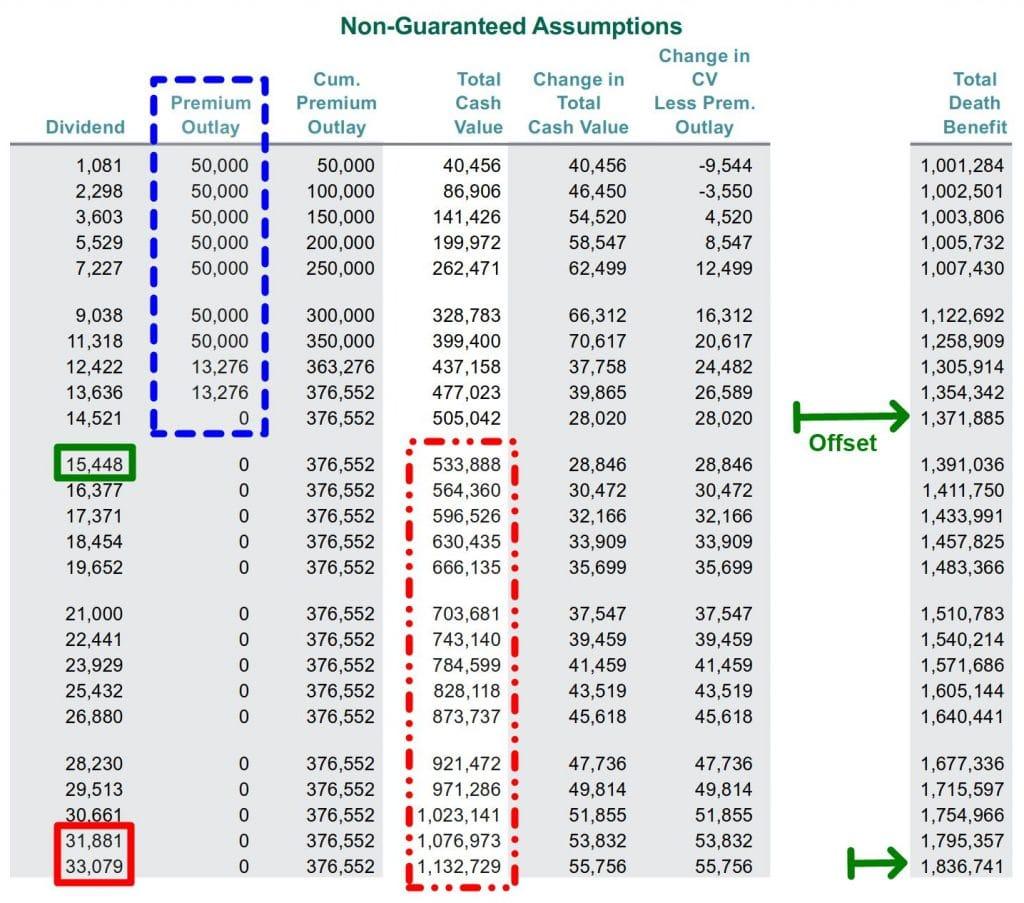

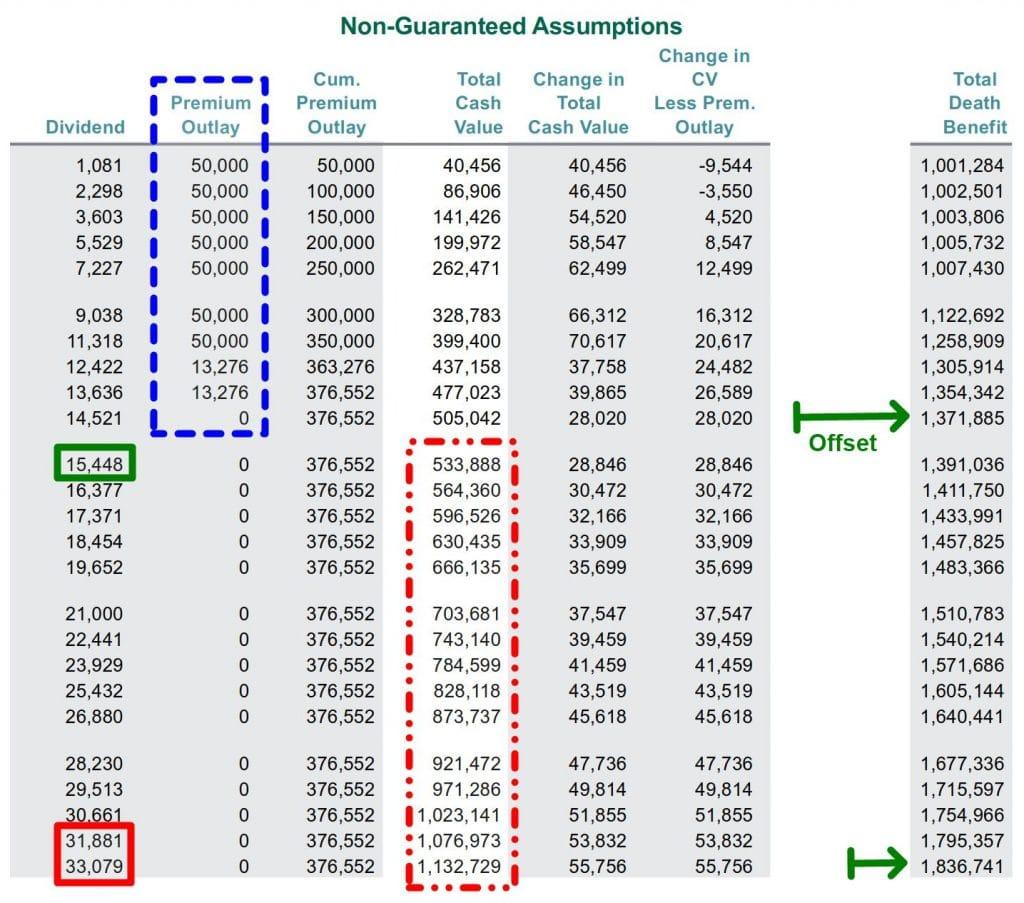

The insured on the policy used is of a 47-year old male with a standard rating class (3rd down from the best rating). We wanted to use an example where the insured is not very young, nor in great health, so people can see how well a Whole Life policy can perform without cherry-picking the most favorable types of situations.

In the examples below, the maximum allowable $50,000 annual premium is paid for seven years in a row, and then the minimum $13,726 premium is paid for 2 more years. After year 9, no further premiums are paid.

This way, you can clearly see an apples-to-apples comparison between offsetting premiums and electing the reduced paid-up option in year 10.

Read more : Which Of The Following Is An Example Of Visual Communication

The death benefit for this 47-year-old male with a standard rating starts at $1,000,203. It is comprised of a $333,401 base Whole Life policy with a Supplemental Term Rider adding $666,802 of additional temporary death benefit. This allows the majority of the initial $50,000 premiums to go towards purchasing Paid-Up Additions, which increases both the early cash value as well as the permanent death benefit.

The two examples you’re about to see are exactly the same from years 1-9. The differences begin in year 10 after premiums cease, and continues to diverge through year 25 shown. Below is an image of each scenario separately with a bulleted explanation for each. After that is an image showing the two scenarios side by side to compare on one screen (desktop or bifocals recommended).

Premium-Offset Scenario

Below are some observations to consider regarding the premium-offset illustration above

- The blue-box demonstrates the premiums paid (maximum premiums years 1-7, minimum premiums years 8-9).

- The top green-arrow shows when premiums are offset (notice how the death benefit doesn’t increase quite as much after year 9).

- The green-box indicates how keeping substantially more death benefit entitles the policyholder to a bigger dividend than the RPU scenario initially.

- The tall-red-box shows the cash value growth after offsetting premium. The growth of the Cash Value between years 10-11 = 5.71%, which is slightly lower than the reduced paid-up scenario.

- The second green-arrow shows how the year-25 death benefit remains slightly larger than the reduced paid-up scenario. The RPU was able to close the gap because all of the dividends were used to purchase PUAs every year. Conversely, the offset scenario had to utilize a portion of the dividend to pay the original base policy premium every year.

- The short-red-box at the bottom left of the page shows that dividends start to fall behind the reduced paid-up scenario even though the offset scenario still has a slightly larger death benefit. Although mutual companies won’t unbundle the exact formula, it’s obvious that the lower ongoing cash value has made a difference.

You can compare the Premium-Offset illustration above with the reduced paid-up illustration below.

Reduced Paid-Up (RPU) Scenario:

Source: https://t-tees.com

Category: WHICH