Are you working with a credit repair company? Have they been truthful about what they do to “fix your credit” or did they just send a dispute to all of your creditors to “remove” errors?

This article is for you.

You are viewing: What Does Meets Fcra Requirements Mean

However, sometimes, in between you filing the dispute and the error being removed, you may see a notice on your report that reads: “Account information disputed by consumer meets FCRA requirements”.

This phrase can be a little tricky! If this is found on your account, let’s look at two options:

- it could mean that the dispute you filed is in alignment with FCRA (Fair Credit Reporting Act) Requirements. If this is the case, the error is likely being reviewed and will potentially be removed after review.

- However, it could also mean that the information you are disputing was found to be accurate and will not be removed. While this is a very simple explanation, this article will look more at what your credit report is, why you might file a dispute, how to file a dispute, and what happens after you file a dispute.

Let’s get started!

1) Watch Out For “Legal” Scam Credit Repair Company

Many credit repair companies may promise you the world that you can get your credit score fixed in 30 days, but what they may not tell you is how they are going to try to “fix” your credit score.

What they may do instead is send a dispute letter to all your creditors, which your creditors will respond with the information showing that the account is legitimate.

Here’s 2 things to look for:

Did Your Credit Score Temporarily Going Up and Then Come Back Down?

Did the Credit Repair Firm Dispute ALL of Your accounts?

2) What Is Your GOAL of Restoring Your Credit?

I need to get a home loan to purchase a home

Best practices for establishing credit with the purpose of obtaining a home loan are

- Opening a revolving line of credit (credit card) if one is not already established.

- Addressing and resolving medical collections. Medical collections are deleted from a credit report if resolved, which can greatly benefit qualifying for a mortgage loan.

- Reducing unsecured debt utilization. Paying down credit card balances, and or consolidating revolving debt into installment debt will increase chances of qualifying for a loan.

- Working negative accounts backwards. The more recent a collection the more impact the account is having on credit. Collections can often be resold or moved as well. If a collection is sold to a new collection agency that account will appear on credit as a new collection because the new agency will report from the time the account was received. When creating an action plan of what collections to address first, work in order from the most recent collection to the oldest collection.

I need an auto loan to purchase my car

Similar to a mortgage, there are helpful guidelines to follow when trying to get the best car loan available.

- Resolving any prior auto loans that may have gone into collections. Make sure you don’t owe a previous auto loan that may be in collections. Auto lenders take previous deficiency balances very seriously and these accounts can often determine whether you qualify or how high your interest rate will be.

- Reducing unsecured debt utilization. Paying down credit card balances, and or consolidating revolving debt into installment debt will increase chances of qualifying for an auto loan and lower potential interest rates.

I need something else

- Charge off accounts that have been charged off by a bank but have not been sent to a collection agency should be the first accounts to look at when handling past due debt. A majority of the time these accounts can be settled for a fraction of what’s owed and benefit credit scores/qualifying for any types of credit.

- Identifying accounts that are not yours or not your responsibility that may be hindering credit. Example, you may be an authorized user on an account that is past or has high utilization. Remove yourself as an authorized user so these trade lines don’t impact credit negatively since you are not financially liable.

3) What Is A Credit Report?

Read more : What Happens If You Violate A Restraining Order Twice

One of the most important statistics of your financial future is often considered to be your credit score. Your credit score is directly tied to your credit report. Your credit report keeps track of your credit history — money you’ve borrowed, paid back, or any financial trouble you’ve had. Because of the importance of your credit score, it’s important that you are regularly checking your report. But what happens if you see an error on your credit report that is damaging your score? Luckily, you can file an account information dispute, which has the ability to remove the error from your account.

Your credit report keeps track of all your financial history. From the first time you open a line of credit, your financial decisions are intimately tracked. Whether you get a store credit card, begin a payment plan on a set of new tires, or take out a loan for a new house, these decisions are recorded and will be documented for the rest of your financial history. The credit report will also keep track of whether or not you repay the money that you borrow. So if you put thousands of dollars on your new credit card, whether or not you keep up with your payments will be reported as well. But why does this matter? What does your credit report do for you?

Why Is Your Credit Report Important?

Believe it or not, your credit report can have an enormous impact on your daily life. Your credit report determines your credit score (which typically ranges from 300-850). The higher your credit score, the better. If your credit report is riddled with late payments and delinquent accounts, it is likely that you will not have a good credit score. If your credit report is clean, then your credit report will likely be amazing.

But what does this mean for you? There are a few implications. One of the biggest things credit score affects is your ability to acquire credit. It also affects the quality of credit you can acquire. For instance, if you have a terrible credit score, it may be harder for you to find a loan. And even if you do find a loan you can acquire, the interest rates are likely to be outrageous.

Alternatively, if your credit report is good, you will have many options for credit. They will likely have good interest rates along with other incentives. As you can see, your financial well-being can be tied very closely to your credit report. This is why it is important to regularly check your credit report. And if you ever find an error, file a dispute. But when is it appropriate to file a dispute? Let’s look at some specific examples.

4) Why Would I Need To File An Account Information Dispute On My Credit Report?

There are many reasons why you might want to file a dispute, here are just a few:

Incorrect Identifying Information

Is your information incorrect on your credit report? Whether it is your legal name, address, phone number, or something else, if the information is incorrect, you want to file a dispute. The odds of something being incorrectly attributed to you because of incorrect information may not be astronomical, but it is certainly a possibility.

Accounts Incorrectly Reported

Every time you open up a credit-based account, the account is added to your credit report. There are a few ways your accounts can be incorrectly reported. For instance, if you closed an account, but it still shows as an open account on your report, you will want to file a dispute. This is also true is you have an account that shows you have a delinquent payment even if you don’t. Here are a few other reasons you may want to file a dispute for an incorrect account report:

- An account with an incorrect balance

- Incorrect debt limit

- An account incorrectly attributed to you

Identity Theft

If your identity was stolen, it is likely the stolen information was used to create accounts with credit cards. Luckily, most states do not hold you liable for any debt that occurred as a result of fraudulent behavior (namely identity theft). However, if you see that an account or debt is listed on your credit report that was obtained as a result of having your identity stolen, make sure to send in a dispute.

Duplication or Re-addition of Information

If you see the same credit line reported twice, you will want to file a dispute. While this won’t be disastrous, it’s definitely not great. Getting the duplicate information off your report can help ensure a more accurate score and protect you from any dings. You also want to regularly check your credit report after you’ve had incorrect information removed. While not common, there have been instances of removed information being found again at a later date. Because of this, you want to make sure you are regularly checking your report.

Read more : What Is The Best Kratom

Please note that this is not an exhaustive list of reasons to file an account information dispute. If there is something on your credit report that is unfamiliar or inaccurate, make sure you stay on top of filing disputes. Also make sure you are following up on their status. Let’s take a look at how exactly you should file your account information dispute.

5) How Do I File An Account Information Dispute?

Filing an account information dispute is a little loose. There isn’t necessarily a form you fill out and send in — rather, the burden is more on the individual. If you see something that is incorrect on your credit report, you are responsible for gathering proof to back up your claim and writing a letter addressing the issue.

For instance, say you see a credit account listed on your report that says you have two credit cards open with Chase Bank. If you know that you only have one credit card open with Chase, then you would want the second account removed. To do so, you would need to request Chase provide you with a statement saying you only have one account. You would then need to write a letter explaining your dispute and the resolution you want to see (in this case, the removal of the second account).

Once you have gathered proof and written your letter (here is a sample), you will send it to the bureau that has incorrect information on your report. There are three main credit reporting bureaus: TransUnion, Equifax, and Experian. Whichever bureau has the incorrect information is the bureau you will send the letter and proof along to. If each bureau has the same incorrect information, then you will send the proof and letter to each bureau. Alternatively, you can also send that dispute to the business that provided the incorrect information. So, in our example, you might send this letter to Chase to see if they can revoke the incorrect reporting.

6) What Happens After I File An Account Information Dispute?

After you have filed the dispute, the creditors legally have 30 days to respond. There are a few different ways they can respond. They can either remove the error, deny the dispute if they believe they are correctly reporting your credit information, or they can ask for more evidence of your claim. This is where the phrase “Account Information Disputed by Consumer Meets FCRA Requirements,” comes in.

As mentioned earlier, there are a few ways the phrase can be interpreted. The preferable way is that the dispute was found to be correct and the inaccurate information is going to be corrected. However, the other way it can be interpreted is to mean that the information being reported by the bureau was found to be correct and the FCRA requirements will protect the information from being removed from your report. If there is any confusion as to what exactly the phrase is intended to mean, you can always call the credit reporting bureau to see how the information on your credit report is going to be altered.

And, as always, if you have questions on how to file a dispute, what you can file a dispute about, or how to help improve your credit score, feel free to reach out to us at Ascend! We love helping individuals have a better grasp on their financial identity.

Free Credit Restoration Process

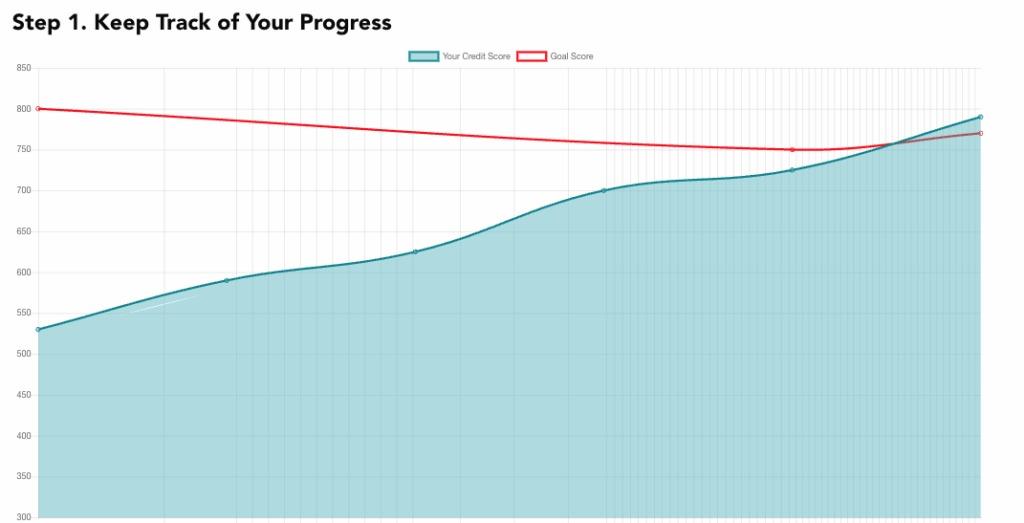

If you are in a position where your credit score has been negatively affected, we actually built a 100% free credit rebuilding portal (picture below) that allows you to track your progress and do it yourself instead of paying potentially thousands of dollars to a credit repair company.

You can create a free login with just an email address and your first name.

The credit rebuilding portal allows you track your progress, understand where common errors occur that should help you make the most informed decision how to fix your credit score if all of your accounts received, “account information disputed by consumer meets FCRA requirements”.

Source: https://t-tees.com

Category: WHAT