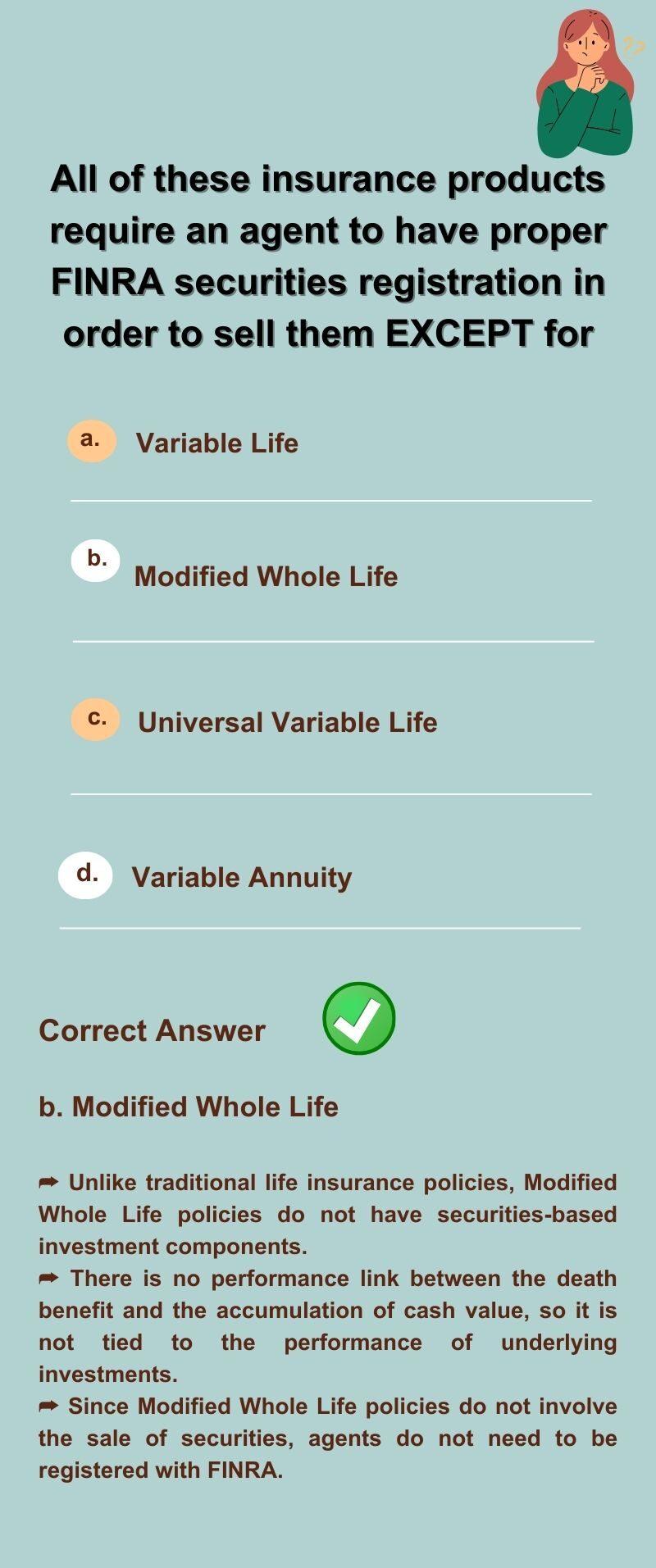

All of these insurance products require an agent to have proper FINRA securities registration in order to sell them EXCEPT for

Options:

a) Variable Life b) Modified Whole Life c) Universal Variable Life d) Variable Annuity

You are viewing: Which Policy Requires An Agent To Register With Nasd

The Correct Answer Is:

b) Modified Whole Life

Correct Answer Explanation:

b) Modified Whole Life does not require an agent to have proper FINRA securities registration in order to sell it.

➦ Unlike traditional life insurance policies, Modified Whole Life policies do not have securities-based investment components.

➦ There is no performance link between the death benefit and the accumulation of cash value, so it is not tied to the performance of underlying investments.

➦ Since Modified Whole Life policies do not involve the sale of securities, agents do not need to be registered with FINRA.

➦ Therefore, Modified Whole Life policies do not require an insurance agent’s registration, making them an appealing option for people who need life insurance but do not want to pay for an agent.

➦ A Modified Whole Life policy can, for example, be used by individuals seeking life insurance coverage for their spouses, children, or parents without the need to hire an agent.

Read more : Which Of These Spells Is Most Similar To Flipendo

Now, let’s explain why the other options are not correct:

a) Variable Life:

➦ The sale of variable life insurance policies requires agents to be registered with FINRA as securities brokers.

➦ Like mutual funds, these policies have a cash value component that is invested in different subaccounts.

➦ Because Variable Life policies combine life insurance and securities, agents must be registered with FINRA since their cash value depends on the performance of the underlying investments.

➦ To sell life insurance and securities, agents must also hold the appropriate licenses.

➦ To provide informed advice to clients, agents must also be knowledgeable about the different types of Variable Life policies and their risks and benefits.

➦ Variable Life policies, for instance, come with different investment options and fees, which agents must be able to go over with their clients.

c) Universal Variable Life:

➦ Similar to Variable Life policies, Universal Variable Life insurance policies are also linked to securities. Policyholders can invest their cash value in a variety of subaccounts, subject to market fluctuations.

➦ FINRA securities registration is required for agents who sell Universal Variable Life policies, since they are selling both life insurance and securities.

➦ Customers need agents who understand the products they are selling and can provide accurate advice.

➦ They must also be knowledgeable about risk management strategies so that they can help customers manage their risks as well.

Read more : Which Of The Following Is True About Gonorrhea

➦ It is also essential that agents understand the laws and regulations that apply to them.

➦ To provide suitable products to their customers, agents must understand FINRA’s suitability standards, which mandate that they consider financial profiles, goals, and risk tolerance before recommending products.

d) Variable Annuity:

➦ Individuals can invest in various sub-accounts with Variable Annuities, and the future income payments they receive are determined by the performance of these investments.

➦ Since Variable Annuities are essentially security products with an insurance component, agents who sell them must be registered with FINRA.

➦ Several decades of holding are required for Variable Annuities, which are long-term products.

➦ Individuals need to understand the risks and benefits of Variable Annuities before investing.

➦ Variable Annuities are also subject to fees and commissions associated with the sale and administration of the product.

➦ Various Annuities, for example, can be complex, so it’s important to understand all the fees associated with the product, such as surrender charges and mortality fees, as well as the investment risks.

Conclusion:

Since Modified Whole Life is a traditional life insurance policy without an investment component tied to securities, FINRA securities registration is not required.

To sell Variable Life, Universal Variable Life, and Variable Annuities, agents must be registered with FINRA securities.

Related Posts

- Which of the following is correct regarding credit life insurance

Source: https://t-tees.com

Category: WHICH