An escrow officer is a highly-trained and experienced employee of a title company, independent escrow company, or real estate broker. Escrow officers act as neutral third parties to accomplish the closing of a real estate transaction.

Read the article to learn more about an escrow officer’s education, experience, and responsibilities in a real estate transaction.

You are viewing: Which Task Is Not The Responsibility Of An Escrow Officer

Becoming An Escrow Officer Requires Years of Experience

Escrow officers are expert in the complexities of closing a real estate transaction. They are also accustomed to working closely with real estate agents, lenders, and other real estate service providers involved in each transaction.

Read more : Which Shoulder Is The Good Angel On

It is safe to say that most escrow officers learned their craft on the job. Most served an extended “apprenticeship” of several years before earning their escrow officer designation.

In addition, many escrow and title companies provide formalized training in escrow. There are escrow schools, classes through the American Escrow Association, and escrow classes at junior colleges and trade programs.

The real test of an escrow officer’s expertise is the coordination of many transactions simultaneously, all the while answering the telephone, coordinating the signing of documents, overseeing the work of an assistant, and frequently managing an office as well!

Read more : Which State Is Sabinus From

At Escrow of the West, your escrow officer has many years of experience and has closed thousands of escrows—each one individual and unique.

Learn more about our escrow team.

Your Escrow Officer’s Responsibilities

- Receives purchase funds from the Buyer.

- Prepares or secures the deed or other documents related to Escrow.

- Closes Escrow when all of the instructions of the Buyer and Seller have been carried out.

- Disburses funds as authorized by the Escrow instructions, including charges for title insurance, recording fees, real estate commissions, and loan payoffs.

- Forwards recordable documents to the title company.

- Prepares final statements for the parties.

- Secures releases of all contingencies or other conditions as imposed on any particular Escrow.

- Prorates taxes, interest, insurance, and rests.

- Requests a preliminary title search to determine the basis upon which a title insurance policy may be issued.

- Requests a beneficiary’s statement or pay-off demand relating to existing financing.

- Complies with Lender’s requirements, as specified in the Escrow agreement.

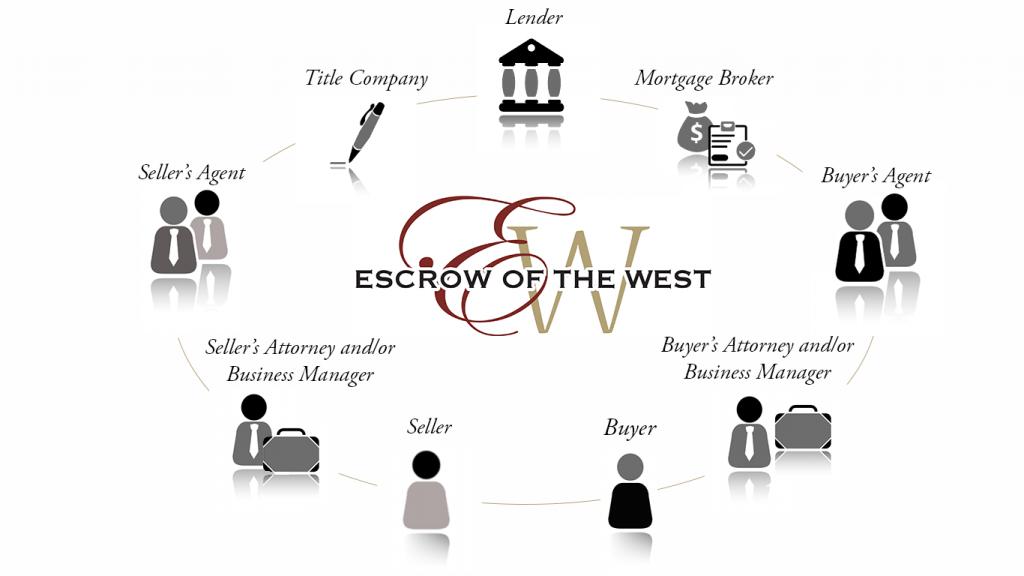

- Your escrow officer serves as a central point of communication between all parties involved, including the buyer and seller, title company, real estate agents, business managers, attornies, and mortgage broker.

- Your escrow officer prepares your escrow instructions. Remember, the key to any transaction is to read and understand your escrow instructions. If you do not understand them, you should ask your escrow officer to explain the instructions.

- Secures releases of all contingencies or other conditions as imposed on any particular Escrow.

- Forwards recordable documents to the title company.

- Requests insurance of the title insurance policy

An escrow officer does not offer legal advice, negotiate the transaction, or offer investment advice.

Source: https://t-tees.com

Category: WHICH