When we study demand theory, non-price determinants of demand refer to factors other than the price of the goods we study, where their changes can affect demand. Knowing them is important because they are not described from the model. They are outside the model. We assume these factors are unchanging, constant, or ceteris paribus when looking at the relationship between price and demand.

In fact, in the real world, their changes affect demand. In addition, their changes have implications for the curve.

You are viewing: Which Of The Following Are Non-price Determinants Of Demand

Why are non-price determinants of demand important?

Economists assume constant non-price determinants of demand when explaining demand theory. Hence, they only use price and quantity when explaining. Meanwhile, the non-price factors are not described individually in the model.

Such an explanation then implies two things:

- Use of the term “change in quantity demanded” vs. “change in demand.”

- Quantity change in the curve

Change in quantity demanded vs. change in demand.

Economists use the term “change in quantity demanded” to describe the change in the quantity resulting from a price change. For example, we are examining the relationship between the price of oranges and their demand. When the price rises, the quantity demanded falls. Conversely, if the price falls, the quantity demanded increases.

Meanwhile, economists use the term “change in demand” to describe changes in quantity due to changes in non-price determinants. Take income, for example. We say “a change in income causes a change in demand” instead of using the term “a change in quantity demanded.”

In the demand curve, we do not display income on any of the axes. Instead, we stick to prices on the Y-axis and quantities on the X-axis.

Quantity change in the curve

In explaining demand theory, economists use two variables: price and quantity. The Y-axis depicts the price, and the X-axis represents the quantity. Thus, they isolate the non-price determinants by assuming they are constant or unchanging when explaining the two.

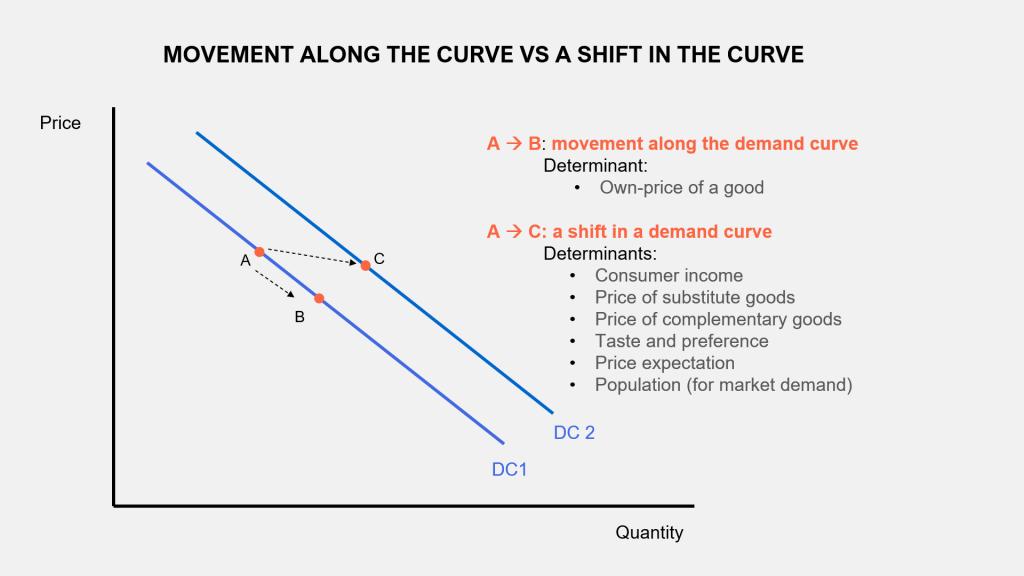

A price change causes the quantity to change. But, it happened along the curve line. The demand curve doesn’t shift right or left. For example, quantity changes from point A to point B on the same curve (DC1).

Meanwhile, changes in non-price determinants also cause changes in quantity. But, it doesn’t happen along the curve line but rather involves a shift of the curve. From the above curve, when the quantity increases (from point A to point C), it shifts the curve to the right from DC1 to DC2. Thus, changes in non-price factors shift the demand curve and change the quantity for any given price combination.

When quantity increases, for example, due to an increase in income, the curve shifts to the right, showing more demand for each price combination. Conversely, when quantity falls, the curve shifts to the left, indicating less demand for a given price.

What are the non-price determinants of demand?

Various factors determine the demand for an item other than its price. Six of them are:

- Income

- Future price expectations

- Price of substitute goods

- Price of complementary goods

- Changes in tastes and preferences

- Changes in the number of consumers

Income

Income is an important factor in explaining consumers’ ability to pay. By definition, demand arises when the will is backed by the ability to buy. In other words, consumers not only want goods, but they also have the money to buy them.

And, as consumers’ incomes rise, they have more dollars to spend on goods. In most cases, increased income will drive more demand, shifting the curve to the right. Conversely, when income falls, there are fewer dollars to spend. As a result, demand falls, shifting the demand curve to the left.

In other words, the demand for such goods is positively correlated with consumer income. And, in microeconomics, we call them normal goods.

Read more : Which Melia Resort Is The Best In Punta Cana

How big is the impact of changes in income on changes in demand, economists then divide normal goods into two categories:

- Luxury goods. Changes in income result in a higher percentage change in their demand. So, for example, consumers’ incomes rise by 5%, their demand increases by more than 5%.

- Necessities. Changes in their demand are less sensitive to changes in income. Thus, when income changes, their demand changes at a lower percentage. For example, if income increases by 5%, their demand increases by less than 5%.

Then, in the specific case, the change in income is negatively related to the demand for the goods. When consumers’ incomes rise, the demand for them falls. On the other hand, when consumers’ incomes fall, the demand for them increases. We call them inferior goods.

Examples of inferior goods are used cars and used clothing. An increase in income prompts consumers to turn to more expensive alternatives because they have more dollars. However, when income decreases, the demand for inferior goods increases.

Thus, an increase in income causes the demand curve for an inferior good to shift to the left. Conversely, a decrease in income shifts the demand curve to the right.

Future price expectations

Buying various goods such as consumer electronics and motor vehicles is expensive. Consumers often have to spend a lot of dollars. So, they must be wise in spending money and consider several factors, including price trends.

Such considerations make some consumers not only look at current prices when deciding to buy. However, they also look at possible future price trends. Thus, their expectations of future prices also affect current demand.

Suppose consumers anticipate prices to go up in the future. In that case, they will buy now before getting higher prices and paying more dollars in the future. As a result, current demand increases, shifting its curve to the right.

Conversely, when consumers expect future prices to fall, they delay buying. If everyone else does, market demand falls, shifting the curve to the left.

Price expectations are important in explaining phenomena such as economic bubbles. When the price is on an uptrend, people will ask for more now. Hence, they can buy and resell it at a profit. Since everyone had the same expectations, demand soared. As a result, the price skyrocketed, surpassing its fundamentals.

Such an upward trend in prices will not last. At a point in time, when the price has been too high and unrealistic, the price suddenly drops. The bubbles then burst.

Some people sell their goods. It caused panic and made many people do the same. They sell goods to avoid further losses. Finally, the price is falling even further.

Price of substitute goods

Two goods substitute each other because they fulfill the same need. So, when consumers have chosen one, they will let go of the other. When the price of one increases, consumers will turn to its substitute. In other words, their producers compete with each other for demand.

Examples are Pepsi and Coca-Cola. When the price of Coca-Cola rises, some consumers will turn to Pepsi. Thus, Pepsi’s demand curve shifts to the right. Vice versa, when the price of Pepsi rises, some consumers turn to Coca-Cola, shifting the curve to the right.

Another example is between the Apple iPhone and Samsung Galaxy smartphones. Nike and Adidas sneakers are also good examples.

Do consumers only consider price in choosing substitute goods? The answer is no. There are other aspects to consider. Availability is one of them.

Read more : Which Animal Dies After Giving Birth

If the price of substitute goods is cheaper but few are available, consumers are likely to be reluctant to buy. Moreover, in obtaining them, consumers may have to incur additional costs. And, such costs can be higher than the price difference between the two goods.

Price of complementary goods

Two items complement each other when we use them together. We need one to use the other. Examples are gasoline with cars, printers with ink, tennis shoes and tennis rackets, and computers with software.

Take a car with gasoline as an example. When the price of a car rises, its demand decreases. The next result is the demand for gasoline falls and shifts its curve to the left.

Conversely, when the price of a car falls, its demand rises and pushes the demand for more gasoline, shifting the gasoline demand curve to the right.

Preferences and tastes

Preferences and tastes explain why consumers prefer a product over its alternatives. So, when their preferences and tastes change, it also affects their demand for it.

For example, consumers have a greater appetite for Coca-Cola. As a result, the demand for Coca-Cola will increase, and its demand curve shifts to the right.

On the other hand, if consumers have no taste for Coca-Cola, they will leave the brand and switch to alternatives such as Pepsi. As a result, the demand for Coca-Cola decreases, and the demand curve shifts to the left.

Preferences and tastes can change from time to time. For example, it can be influenced by the environment consumers live in, their education or income, and promotions.

Many companies invest in branding and promotion to elevate emotions and drive consumer desire for their products or brands. If successful, it makes consumers prefer their brand and are reluctant to switch to other brands. They become loyal.

Nike and Apple are successful examples. The demand for their products is relatively high because customers prefer to choose their brand over other brands.

Number of consumers

More consumers available in the market, more demand for goods. Thus, when more buyers enter the market or existing customers buy more, the demand curve shifts to the right, indicating increasing demand.

In aggregate, population growth is an important factor influencing the increase in the number of consumers. An increase in the population indicates an increase in potential demand. For example, when a city’s population increases, it increases the number of buyers and renters and increases the demand for housing there.

Then, the number of consumers can also be associated with the product life cycle. In the introduction stage, few people know the product. Some individuals are willing to take the risk by buying the new product; others are reluctant. Why take the risk? That’s because there is no evidence the new product can satisfy them, as existing products have done. So, by buying a new product, they take a risk. As a result, product demand is low at this stage.

Then, in the growth stage, demand increases rapidly. More and more consumers enter the market. They may be influenced by advertisements or previous user recommendations. At this stage, growth is supported by new purchases.

In the maturity stage, demand continues to increase but at a slower pace. Most consumers have bought. Thus, demand is driven more by replacement purchases than by new purchases.

When the product enters the decline phase, the number of consumers decreases. That’s usually because substitute products appear. As a result, some consumers turn to them, reducing the demand for the existing product.

What to read next

- Demand Curve: Types, How to Draw It From a Demand Function

- Reasons For a Downward-Sloping Demand Curve

- What is the difference between a movement and a shift in the demand curve?

- What is the Law of Demand? How does it work?

- Three Assumptions Underlying the Law of Demand

- What Are the Five Exceptions to the Law of Demand?

- What is the difference between a change in demand and a change in quantity demanded?

- Individual Demand: Definition, Its Curve, Determinants

- Market Demand: Definition, How to Calculate, Determinants

- What are the six non-price determinants of demand? Examples.

- What Are The Types of Demand?

- Demand in Economics: Meaning and Determinants

Source: https://t-tees.com

Category: WHICH