Experian, TransUnion and Equifax now offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com.

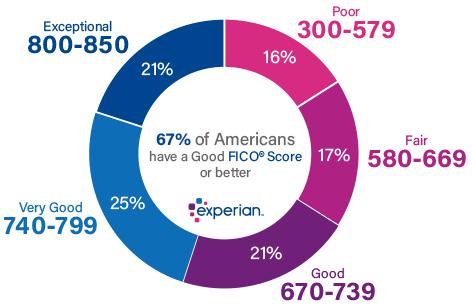

To interpret your credit score, and what it tells you about your borrowing power, you need to understand where the score falls along the score range between the lowest and highest numbers generated by its scoring system.

You are viewing: Which Fico Credit Score Would Represent The Least Risky Borrower

Read more : Which Way Is She Swinging

All credit scores have the same basic goal: helping lenders (and other potential creditors, such as landlords and utility companies) understand how risky it may be to do business with you. High credit scores indicate relatively low likelihood of default and relatively low risk for creditors. Lower scores, in turn, indicate greater risk.

An extremely low credit score, which suggests a history of poor debt management, may cause creditors to decide against lending you money, leasing you an apartment, or issuing you phone or cable equipment. More often, lenders use credit scores, along with other information such as employment history and proof of income, to decide how much they are willing to lend you and at what interest rate. Landlords and utility companies also may use credit scores to help decide whether to charge you a security deposit—and how large it should be.

Read more : Which Lips Do You Have

All other factors being equal, a higher credit score generally means you’ll pay lower interest rates, fees and deposits. Over the lifetime of a loan, even a small reduction in rate can save you thousands of dollars in interest, so it pays to have a high credit score.

Learn More About Credit Score Ranges

- What Is a Good Credit Score?A credit score that’s at least in the high 600s is often considered a good credit score. However, there’s still room to improve. Here’s what to know.

- How to Improve Your Credit ScoreThere are steps you can take to increase your credit score, and the sooner you address certain factors, the faster your credit score will go up.

- What Is a Fair Credit Score?A fair FICO Score is a credit score of 580 to 669 or a VantageScore of 601 to 660.

- What Is the Average Credit Score in the US?The average FICO Score in the U.S. was 715 in 2023, increasing by one point from its 714 average in the third quarter (Q3) of 2022.

- How Is Your Credit Score Determined?Your credit score is determined by a computer model that analyzes one of your credit reports. Here’s what it looks for.

Source: https://t-tees.com

Category: WHICH