What are Equity Accounts?

The balance sheet of any business comprises of assets, liabilities, and equity. The items in a balance sheet fall into one of these three categories.

The equity accounts section of the balance represents the total investment in the business by shareholders. It includes the amount a business has raised by selling equity and preference shares plus other items such as retained earnings (earnings which are reinvested in the business), treasury stock and Other Comprehensive Income (Loss) – these are sometimes called reserves.

You are viewing: Which Of The Following Accounts Is Part Of Equity

Equity Accounts Explained

Below shows a snapshot of the balance sheet of the Hershey Company. The equity accounts are a part of the liabilities and stockholders’ equity section. Listed below is an overview of the various equity accounts shown in this balance sheet.

The Hershey Company – 2019 Annual Report

Statement of Shareholders’ Equity

The best place to look for a detailed explanation of shareholders’ equity accounts is the statement of shareholders equity which is usually located after the cash flow statement. The statement gives a detailed breakdown of the movements between the different equity accounts during the year. Hershey’s statement of shareholders’ equity is below:

Preferred Stock

Preferred stock represents shares issued to preference shareholders who enjoy more rights than common shareholders. Usually, preferred stock is issued at par value. For valuation purposes, preferred stock is treated as debt. In the example above, the company does not have any preferred stock. Outside financial institutions it’s relatively uncommon to see preferred stock on public company balance sheets. Preferred stock is widely used in private equity capital structures.

Common Stock

Commons stock represents the stock held by common shareholders. The Hershey Company’s equity accounts include common stock and Class B common stock. In the US, it is not uncommon for companies to issue more than one class of shares to investors. Each of the multiple share classes can have different voting rights, restrictions on sale, and dividends entitlements. In most cases the different classes of shares have the same economic rights (a notable exception to this is Berkshire Hathaway).

Additional Paid-in Capital

Read more : Which Presidents Were Cheerleaders

Additional paid-in capital or APIC represents the difference between the issue or subscription price of shares less their par value (usually $1 per share). For example, if the issue price is $10 and the par value is $1, the APIC is calculated by multiplying the total number of shares outstanding by $9 ($10-$1).

Retained Earnings

Retained earnings (RE) is the cumulative net income that has not been paid out as dividends but instead has been reinvested in the business. Businesses can use these earnings to reinvest into the company to purchase assets such as property, plant, and equipment or to pay off liabilities.

In modeling and forecasting retained earnings is calculated as:

RE = Beginning period RE + Net Income/(Loss) – Cash Dividends – Stock Dividends

Unlike building a forecast of retained earnings in a financial model the reality can be more complex. In the statement of shareholders’ equity for Hershey you see retained earnings being increased by net income and reduced by dividends of both sets of shares. However, you also see a big deduction as a result of treasury stock being retired. Often treasury stock is kept, but in this case (which is uncommon) the company has decided to retire the treasury stock so retained earnings is the opposing entry. There is no impact on the income statement from treasury stock retirement. There is also an adjustment for an accounting change related to leases which necessitates a direct adjustment to retained earnings.

Treasury Stock

Treasury stock is an account within a company’s financial statements to account for any share repurchases that the company has made. A company may buy back their own shares from the market to signal the management thinks they are undervalued. Share repurchases are also a tax effective way to return capital to shareholders as an alternative to paying a dividend and the sale of shares is taxed as a capital gain rather than income and capital gain taxes are often lower than income taxes. Notice in Hershey’s case they are repurchasing stock and issuing stock from the treasury account. The issuance relates to the company’s share option program, which is a common reason to issue stock directly out of the treasury account.

Accumulated Other Comprehensive Loss

Other comprehensive loss or other comprehensive income (OCI) represents items that are waiting to hit the income statement. These could be financial investments made by the company, which have increased or decreased in value. However, because the investments have not been sold or converted into cash yet, the gain/loss cannot be shown in the income statement yet. There are exceptions to gains and losses being moved to the income statement. Under IFRS accounting gains and losses from investments held at fair value to OCI are not recycled to the income statement. Most public companies will also publish a statement of comprehensive income. Here is Hershey’s:

You can see here the biggest items are FX adjustments, pensions and OPEBS, and cash flow hedges. Notice the bottom line shows the recycling to the income statement under ‘reclassification to earnings’.

Non-controlling Interest

A non-controlling interest (NCI), formerly known as a minority interest, represents a shareholder or shareholder group that owns a minority stake in a company that is controlled by another company. In this example, the non-controlling interest represents the equity owned by third parties in subsidiaries owned by Hershey.

Group accounts are consolidated, and this drives the recognition of an NCI. The consolidated balance sheet for a group reflects 100% of all assets and liabilities, revenues and expenses, the group controls (this normally means owning a controlling voting stake or over 50% of the shares). This results in the balance sheet of the group being partially funded by investors that retain non-controlling stakes. The equity accounts in the consolidated balance sheet have an NCI on the financing side to reflect this.

Read more : Which Crypto Has 1000x Potential

The non-controlling interest acts like the equity accounts of the non-controlling party. In Hershey’s case you can see the non-controlling interest increasing by their share of the subsidiary’s net income and decreasing by their share of the subsidiary’s dividends.

Equity Accounts Example

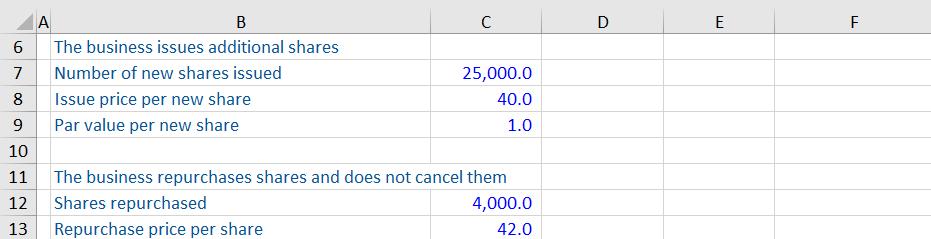

A business is reviewing its equity:

What impact will the transactions have on equity based on the historical figures below?

The first step is to complete the adjustment calculation for each equity item affected by the transactions.

The business has issued an additional 25,000 shares at a par value of 1.0. This increases the common stock account by 25,000 (25,000 * 1.0).

The additional paid-in capital is the difference between the issue price and the par value of the share. This is calculated as the issue price minus the par value multiplied by the number of new shares ((40.0 – 1.0) * 25,000). The result is an increase of 975,000 in the APIC account.

The information states that the business also repurchases 4,000 shares at a price of 42.0. Share buybacks are recorded in treasury stock and reduce the shares outstanding number. The cash balance will decrease and decrease the treasury balance by an additional 168,000 (4,000 * 42.0).

The projected equity items are calculated as follows:

The adjustment for each equity line item affected is added to the historical amount (prior to the transaction).

Source: https://t-tees.com

Category: WHICH