Dena Standley | July 17, 2023

Edited by Hannah Locklear

You are viewing: Who Does Alliant Capital Management Collect For

Alliant Capital Management is a debt collector. So a call from them probably means one thing: you are in debt, and the account is past due. Occasionally, the call is misplaced, so the debt may not even be yours.

Even though Alliant Capital Management LLC says they do not sue consumers, your original creditor can take you to court if the recovery is unsuccessful. Even if you are not facing a lawsuit, the calls and harassment can still become a life stressor. And if they decide to report your delinquent account to the credit reporting bureaus, your credit score can take a serious hit.

This article will answer your most pressing questions about Alliant Capital Management, LLC, while providing insight into how to deal with debt collectors in general. First, who are they?

Sued for by Alliant Capital Management? Settle your debt and move on.

Who is Alliant Capital Management?

Alliant Capital Management, LLC is a legitimate third-party debt collection company. It’s been in business since 2013.

Use this address to contact Alliant Capital Management:

1965 Sheridan Drive, Suite 100 Buffalo, NY14223

Or call: 716-362-0907

The official website is alliantcapital.net.

Who does Alliant Capital Management collect for?

Alliant Capital Management collects for various lenders, retail credit providers, and a host of other creditors. You need to establish your alleged original creditor and when the company transferred your account to Alliant Capital.

Where do I file complaints against Alliant Capital Management?

You can report any complaints to the BBB, FTC, or CFPB. You will join dozens of consumers who have already expressed displeasure with Alliant Capital Management.

Although the company has an A rating on its BBB profile, it has had to close 93 complaints in just the last three years. And as of October 2022, it’s not yet BBB accredited. Customer reviews average 1/5 stars. Similarly, the CFPB has reported nearly 250 complaints against Alliant Capital Management in the last ten years.

Let’s take a look at a real complaint against Alliant Capital on its BBB profile:

“Alliant Capital has been contacting people I know trying to locate me, including leaving harassing voicemails on my minor child’s cell phone. They claim to have attempted to contact me via mail, but I have not received any written notice. The voicemail left for me was threatening and vague….”

If these allegations are true, Alliant Capital has a case to answer. Under the FDCPA guidelines, a debt collector should not threaten or harass you.

What should I do when Alliant Capital contacts me?

It’s wise to ask that all communication take place in writing. That way, you have proof of every correspondence, and any agreements you make are on record.

Whether you think the debt is yours or not, you should always ask for validation. Sending a Debt Validation Letter to Alliant Capital Management reports the debt as disputed. They must provide proof of the debt—for example, who is the original creditor? What’s the debt payment history? Which interests apply? What’s the current status of the account?

Alliant Capital should stop contacting you if they can not provide adequate answers to your questions.

Make your Debt Validation Letter in minutes with SoloSuit..

Check your credit report regularly to ensure Alliant is not reporting inaccurate details there. Dispute each error immediately with the bureau that reported the error and the company that provided the erroneous information.

Will Alliant Capital Management sue me?

Alliant Capital Management states on its website that they don’t usually sue. But the threat of a debt collection lawsuit is never too far away when a collection agency contacts you.

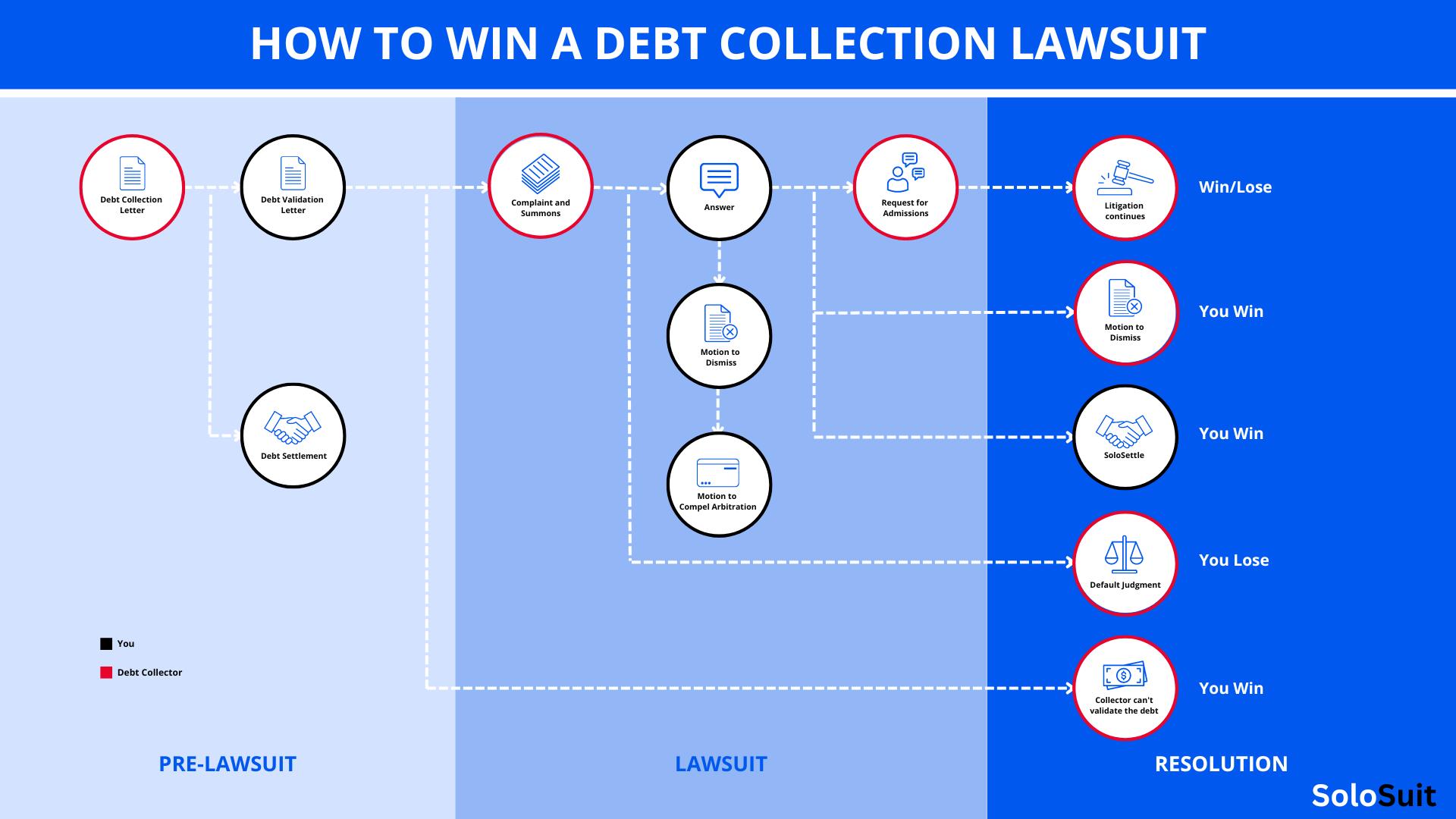

The Debt Validation Letter mentioned above can help you escape a lawsuit. However, you may still have a way out if your creditor takes you to court. The graphic below outlines the different routes a debt lawsuit can typically take:

If you’re being sued for a debt, you must take action fast. Follow these three steps to respond to a debt collection lawsuit::

- Answer every claim on the Complaint document: Read the Complaint document carefully and respond to each claim. You may deny, agree, or deny for lack of knowledge. By denying a claim, you are saying you need proof. If you agree, then you are accepting liability. Denying a claim for lack of knowledge says you don’t understand and may need further clarification.

- Submit your affirmative defenses: Submitting or asserting your affirmative defenses is simply stating your case (why you believe you are not guilty of the claims). For example, you can argue that there’s no basis for the lawsuit because the creditor has not mentioned the law you allegedly violated.

- Send the Answer to the court and the creditor’s attorney: Making sure your Answer reaches the court in time is paramount. You don’t have too long (14-35 days), so respond at the earliest possible opportunity. Granted, you may find creating an Answer document daunting if it’s your first time. If that’s the case, you can conveniently use SoloSuit to make one in 15 minutes. Your answers to a few direct questions are all that we need to generate your legal response. SoloSuit can have an attorney review your Answer and file it with the court at a small fee if you so prefer.

You can learn more about these three steps in this video:

You can draft and file an Answer with SoloSuit in all 50 states..

Here’s an example of how responding to a debt collection lawsuit can be a lifesaver.

Settle the debt with SoloSettle

SoloSettle is the perfect tool for you if you acknowledge the debt and are willing to make an offer to settle in exchange for the creditor withdrawing the lawsuit.

Settle a debt for less outside court

Learn more about how debt settlement can benefit you and how to reach a settlement agreement:

The points discussed here can help you deal with Alliant Capital Management at every step—from when they first contact you to removing them from your credit report and winning a lawsuit, SoloSuit can help you each step of the way.

What is SoloSuit?

SoloSuit makes it easy to fight debt collectors.

You can use SoloSuit to respond to a debt lawsuit, to send letters to collectors, and even to settle a debt.

SoloSuit’s Answer service is a step-by-step web-app that asks you all the necessary questions to complete your Answer. Upon completion, we’ll have an attorney review your document and we’ll file it for you.

>>Read the FastCompany article: Debt Lawsuits Are Complicated: This Website Makes Them Simpler To Navigate

>>Read the NPR story on SoloSuit. (We can help you in all 50 states.)

How to answer a summons for debt collection in your state

Here’s a list of guides for other states.

All 50 states.

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Guides on how to beat every debt collector

Being sued by a different debt collector? Were making guides on how to beat each one.

- Absolute Resolutions Investments LLC

- Accredited Collection Services

- Alliance One

- Amcol Clmbia

- American Recovery Service

- Asset Acceptance LLC

- Asset Recovery Solutions

- Associated Credit Services

- Autovest LLC

- Cach LLC

- Cavalry SPV I LLC

- Cerastes LLC

- Colinfobur

- Covington Credit

- Crown Asset Management

- CTC Debt Collector

- Cypress Financial Recoveries

- Delanor Kemper & Associates

- Eagle Loan of Ohio

- Educap

- Estate Information Services

- FIA Card Services

- Forster & Garbus

- Freshview Solutions

- Fulton Friedman & Gullace LLP

- Harvest Credit Management

- Howard Lee Schiff

- Hudson & Keyse LLC

- Integras Capital Recovery LLC

- Javitch Block

- Jefferson Capital Systems LLC

- LVNV Funding

- Mannbracken

- Mariner Finance

- Medicredit

- Michael J Adams PC

- Michael J Scott

- Midland Funding LLC

- Mullooly, Jeffrey, Rooney & Flynn

- Mountain Land Collections

- MRS Associates

- National Collegiate Trust

- Nationstar Foreclosure

- Northstar Capital Acquisition

- NCEP LLC

- NRC Collection Agency

- OneMain Financial

- Palisades Collection LLC

- Pallida LLC

- Paragon Revenue Group

- Pinnacle Collections Agency

- PMAB LLC

- Portfolio Recovery Associates

- Provest Law

- PYOD LLC

- Reunion Student Loan Finance Corporation

- Revenue Group

- Regents and Associates

- RSIEH

- Salander Enterprises LLC

- Second Round Sub LLC

- Security Credit Services

- Sherman Financial Group

- Suttell and Hammer

- T-Mobile

- Transworld Systems

- Tulsa Teachers Credit Union

- UCB Collection

- Velo Law Office

- Velocity Investments

- Waypoint Resource Group

- Weinberg and Associates

- Wolpoff & Abramson

Win against credit card companies

Is your credit card company suing you? Learn how you can beat each one.

- Bank of America

- Capital One

- Chase

- Credit One Bank

- PayPal Synchrony Card

- SYNCB/PPEXTR

- Synchrony Bank

- Target National Bank

- Wells Fargo

Going to Court for Credit Card Debt — Key Tips

How to Negotiate Credit Card Debts

How to Settle a Credit Card Debt Lawsuit — Ultimate Guide

Get answers to these FAQs

Read more : Who Won The Batchlor

Need more info on statutes of limitations? Read our 50-state guide.

Why do debt collectors block their phone numbers?

How long do debt collectors take to respond to debt validation letters?

What are the biggest debt collector companies in the US?

Is Zombie Debt Still a Problem in 2019?

SoloSuit FAQ

If a car is repossessed, do I still owe the debt?

Is Portfolio Recovery Associates Legit?

Is There a Judgment Against Me Without my Knowledge?

Should I File Bankruptcy Before or After a Judgment?

What is a default judgment?— What do I do?

Summoned to Court for Medical Bills — What Do I Do?

What Happens If Someone Sues You and You Have No Money?

What Happens If You Never Answer Debt Collectors?

What Happens When a Debt Is Sold to a Collection Agency

What is a Stipulated Judgment?

What is the Deadline for a Defendants Answer to Avoid a Default Judgment?

Can a Judgement Creditor Take my Car?

Can I Settle a Debt After Being Served?

Can I Stop Wage Garnishment?

Can You Appeal a Default Judgement?

Do I Need a Debt Collection Defense Attorney?

Do I Need a Payday Loans Lawyer?

Do student loans go away after 7 years? — Student Loan Debt Guide

Am I Responsible for My Spouses Medical Debt?

Should I Marry Someone With Debt?

Can a Debt Collector Leave a Voicemail?

How Does Debt Assignment Work?

What Happens If a Defendant Does Not Pay a Judgment?

How Does Debt Assignment Work?

Can You Serve Someone with a Collections Lawsuit at Their Work?

What Is a Warrant in Debt?

How Many Times Can a Judgment be Renewed in Oklahoma?

Can an Eviction Be Reversed?

Does Debt Consolidation Have Risks?

What Happens If You Avoid Getting Served Court Papers?

Does Student Debt Die With You?

Can Debt Collectors Call You at Work in Texas?

How Much Do You Have to Be in Debt to File for Chapter 7?

What Is the Statute of Limitations on Debt in Washington?

How Long Does a Judgment Last?

Can Private Disability Payments Be Garnished?

Can Debt Collectors Call From Local Numbers?

Does the Fair Credit Reporting Act Work in Florida?

The Truth: Should You Never Pay a Debt Collection Agency?

Should You Communicate with a Debt Collector in Writing or by Telephone?

Do I Need a Debt Negotiator?

What Happens After a Motion for Default Is Filed?

Read more : Who Is Dr Kek

Can a Process Server Leave a Summons Taped to My Door?

Learn More With These Additional Resources:

Need help managing your finances? Check out these resources.

How to Make a Debt Validation Letter – The Ultimate Guide

How to Make a Motion to Compel Arbitration Without an Attorney

How to Stop Wage Garnishment — Everything You Need to Know

How to File an FDCPA Complaint Against Your Debt Collector (Ultimate Guide)

Defending Yourself in Court Against a Debt Collector

Tips on you can to file an FDCPA lawsuit against a debt collection agency

Advice on how to answer a summons for debt collection.

Effective strategies for how to get back on track after a debt lawsuit

New Hampshire Statute of Limitations on Debt

Sample Cease and Desist Letter Against Debt Collectors

The Ultimate Guide to Responding to a Debt Collection Lawsuit in Utah

West Virginia Statute of Limitations on Debt

What debt collectors cannot do — FDCPA explained

Defending Yourself in Court Against Debt Collector

How to Liquidate Debt

Arkansas Statute of Limitations on Debt

Youre Drowning in Debt — Heres How to Swim

Help! Im Being Sued by My Debt Collector

How to Make a Motion to Vacate Judgment

How to Answer Summons for Debt Collection in Vermont

North Dakota Statute of Limitations on Debt

ClearPoint Debt Management Review

Indiana Statute of Limitations on Debt

Oregon Eviction Laws – What They Say

CuraDebt Debt Settlement Review

How to Write a Re-Aging Debt Letter

How to Appear in Court by Phone

How to Use the Doctrine of Unclean Hands

Debt Consolidation in Eugene, Oregon

Summoned to Court for Medical Bills? What to Do Next

How to Make a Debt Settlement Agreement

Received a 3-Day Eviction Notice? Heres What to Do

How to Answer a Lawsuit for Debt Collection

Tips for Leaving the Country With Unpaid Credit Card Debt

Kansas Statute of Limitations on Debt Collection

How to File in Small Claims Court in Iowa

How to File a Civil Answer in Kings County Supreme Court

Roseland Associates Debt Consolidation Review

How to Stop a Garnishment

Debt Eraser Review

Do Debt Collectors Ever Give Up?

Can They Garnish Your Wages for Credit Card Debt?

How Often Do Credit Card Companies Sue for Non-Payment?

How Long Does a Judgement Last?

How Long Before a Creditor Can Garnish Wages?

How to Beat a Bill Collector in Court

Source: https://t-tees.com

Category: WHO