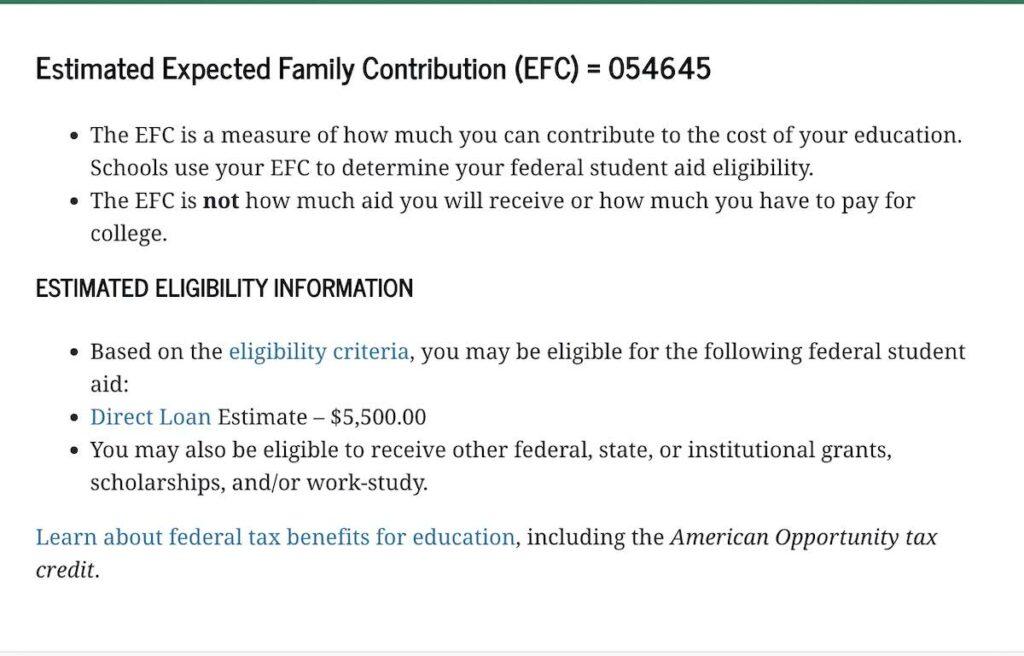

College admissions experts say that filling out the FAFSA should be an important part of the college application process. The information provided on the FAFSA, after all, will determine the expected family contribution (EFC). And if the EFC is too high for the family’s liking, there are ways to lower it.

To lower the EFC, the factor that has the biggest impact on it should be reduced: the family income. Since lying on the FAFSA could lead to penalties, it’s a must to lower the household income legally. There are numerous ways to lower the family income to reduce the EFC without breaking the law.

You are viewing: Why Is My Efc So High

A high EFC should not keep a college-bound high schooler from dreaming of having a degree. Below, we will talk about some of the things that can be done to lower the EFC by bringing down the family income.

But before anything else, let’s answer a few questions about the EFC many parents feel too shy to ask:

Why is my EFC so high?

The EFC is so high, more often than not, because of a high family income. As a general rule of thumb, the higher the household income gets, the steeper the EFC becomes. A high-income background makes financial aid experts think that their families can shoulder a bigger portion of the cost of college.

What should I do if the EFC is too high?

If the EFC is simply too high for the family’s budget, considering private scholarships and private loans may be done. Applying for state grants and private scholarships is possible, too. Having a part-time job to shoulder some of the cost of college and choosing an institution wisely can also help.

What if the EFC is higher than the cost of attendance?

There is very little to no chance for any financial aid if the EFC is higher than the cost of attendance. Most of the time, the only option available for those whose EFCs are higher than the cost of attendance and need assistance in paying for college is to take out unsubsidized loans.

How do I appeal for a financial aid package?

To appeal for a financial aid package, one must check if the college has a procedure for appealing the financial aid package. Usually, it entails doing paperwork and meeting deadlines. It’s also a good idea to research the college’s financial aid policies and special circumstances that can lower the EFC.

Related Article: What Happens If You Miss FAFSA Deadline?

Now that some of the most pressing EFC-related questions have been answered, it’s now time for us to dive into the heart of this article: how to reduce income for the FAFSA.

The household income — this is something that affects the EFC the most. Needless to say, the higher the family income, the lower the eligibility for or amount of financial aid. It’s exactly due to this why the importance of lowering the household income to reduce the EFC cannot be stressed enough.

Fortunately, this can be done in many ways, all of which are legal. The following are some foolproof tips on how to reduce the expected family contribution without getting anyone in trouble:

How to Lower EFC During the Base Year

Family income is a variable that has a dramatic effect on the EFC. As a general rule of thumb, the lower the income, the higher the chances of qualifying for and receiving higher financial aid awards.

Because lying on the FAFSA could result in fines of up to $20,000 or imprisonment of up to five years, or both, reporting the right figures is a must.

But the good news is that you can lower your income during the base year, which is a couple of years before a student enters college. This is why the base year is sometimes called the prior-prior year.

So, in other words, the base year for a student’s first FAFSA runs from January 1 of the sophomore year in high school through December 31 of the junior year in high school.

Going back to lowering your income during the base year…

There are a few steps parents may take in order to keep their income low before their kids go to college and they file the FAFSA. What’s really nice about them is that they are all legal, which means that being penalized should be the least of their worries.

Things to reduce your EFC include:

- Take an unpaid leave of absence.

- Postpone receipt of bonuses until after submitting the FAFSA.

- Sell off bad investments to sustain a capital loss.

- Increase contribution to retirement funds (IRA, 401K).

- Open a health savings account (HSA).

- Lower the salaries of relatives employed in the family business.

- Avoid taking distributions from 529 plans.

- Reduce your child’s assets.

- File as married separately if one parent’s income is below the threshold for income tax return filing.

But keep in mind that one should try any attempt to lower the family income well before the FAFSA is submitted. This is to keep any capital gains that may come into being from increasing the income during the base year.

Refraining From Overestimating Income

Read more : Why Are My Cucumbers Yellow And Fat

It’s not uncommon for families to unknowingly overstate their income. This is an honest mistake that should be avoided at all costs. Otherwise, it could lower the amount of federal student aid they can get their hands on. In some instances, they could wind up with reduced eligibility for financial aid.

One of the reasons why the overestimation of income on the FAFSA happens is that parents mistakenly report the gross income rather than the adjusted gross income.

Simply put, a family’s adjusted gross income is calculated by taking the gross income for the year and subtracting from it every deductible that the household is eligible to claim. It’s exactly because of this why the adjusted gross income is always lower than the gross income. Some common examples of deductibles are:

- Alimony payments

- Contributions to a retirement account

- Student loan interest

- Educator expenses

Failure to report the adjusted gross income can considerably increase the EFC and, at the same time, significantly decrease either the amount of or eligibility for financial aid.

Reporting Only Reportable Assets

It’s true that assets must be reported on the FAFSA as of the date that it is filed. But just because something is an asset doesn’t mean right away that it should be mentioned when completing the FAFSA form.

Needless to say, there are reportable assets, and there are also non-reportable assets.

Reportable assets, as the name suggests, are assets that should be reported. These types of assets are cash-based as well as liquid, which means that they can be turned into cash without much trouble. Some common examples of liquid assets include accounts receivable, stocks and inventory.

These are some reportable assets so that you won’t miss any of them when filling out the FAFSA form:

- Cash

- Precious metals

- Bank accounts

- Brokerage accounts

- Money market accounts

- Stocks

- Bonds

- Mutual funds

- Trust funds

- Investment farms

- Emergency funds

- Businesses

- Real estate

- Assets transferred to minors (UGMAs and UTMAs)

- College savings plans

On the other hand, the following are some non-reportable assets that do not have to be included on the FAFSA:

- Family home (principal place of residence)

- Family farms

- Family owned and controlled small business

- Retirement plan accounts

- Life insurance policies

- Personal possessions (cars, laptops, clothing, furniture, appliances, etc.)

Sheltering Certain Assets

Reportable assets can impact the EFC. So, in other words, the more reportable assets make it on the FAFSA form, the higher the cost of attendance to a college or university due to lower financial aid.

In order to lower the EFC, the goal is to turn some reportable assets into non-reportable assets.

This can be done through what’s referred to as sheltering assets. Bear in mind that there is a world of difference between sheltering assets and hiding assets. One of them can help make earning a degree easier on the pocket. Meanwhile, the other can get someone in trouble.

Sheltering assets for a more affordable college can be done in many different ways. Some of the most common examples of turning reportable assets into non-reportable assets include:

- Making major purchases by the base year to reduce liquid assets.

- Using some of the assets to pay off mortgages, car loans, credit card debts, etc.

- Carrying out major repairs and maintenance needs before completing and filing the FAFSA form.

- Relatives who wish to contribute to college waiting until graduation to help pay off student loans.

- College-bound kids who are part of the family business not receiving any salary.

- Transferring some assets to the name of a younger sibling of the student.

But like lowering the income, sheltering the asset is best done well before the base year.

It’s also a good idea to know that there may be limits to using a non-reportable asset to keep the EFC to a minimum. For instance, a retirement plan is usually subject to contribution limits per year. This is why it may take several years before this approach can be used to one’s advantage.

Related Article: Here’s What Happens If You Stop Paying Student Loan

Keeping Assets in the Parents’ Name

Putting assets in the name of a child is beneficial in that it helps to boost tax savings. It’s for the fact that the tax bracket for children is considerably lower than the tax bracket for adults.

There are downsides to this, however, which become evident when it’s time for the child to go to college.

First, it could keep him or her from being eligible for financial aid. Second, he or she is not obligated to spend money toward the attainment of a college degree. This is why parents should think twice before deciding to transfer assets into the name of their little one.

But if they already did and the child is about to attend college soon and they want to keep the EFC low, it’s a good idea to transfer their assets back to their name. However, they should do so before the base year arrives.

Related Article: Are Parents Responsible for Student Loans?

Sending More Kids to College

It may seem like enrolling more than one child in college is counterintuitive. That’s because there will be more tuition and fees and other higher education-related expenses to take care of.

There is such a thing called the sibling factor in the world of paying for college.

Simply put, the sibling factor means that the more kids are attending college at the same time, the bigger the savings the family can make. It has something to do with the fact that sending two or more youngsters to college usually leads to a lower EFC and higher financial aid awards.

Read more : Why Is My Crochet Circle Curling

Note: The sibling factor may go away with the new FAFSA

As a general rule of thumb, the EFC is slashed according to the number of children in college.

For instance, if there is only one child going to college, the entire EFC goes toward his or her education. But if there are two kids attending college at the same time, the EFC is cut in half — each college student gets one half. And if there are three children going to college simultaneously, the EFC is cut in thirds.

Besides a lower EFC, there are a couple of other reasons why sending more kids to college is better for the family’s savings. And they’re none other than increased financial aid eligibility and higher financial aid awards.

Having multiple children going to college is not the only thing that can help lower the EFC.

It’s not just having more than one child in college that can help bring down EFC into small portions. There is one more member of the family who could go to school to make the cost of college affordable to all concerned parties. It’s the one we will talk about next — now is not the best time to stop reading!

A Parent Attending College as Well

Are you a parent who wishes to finish college because you failed to do so during your first attempt or has to earn an additional degree for career purposes?

Then attending college just like your kids might cause the savings to add up. That’s because the school you like to attend can deduct a parent’s college expenses from the income. In some instances, the institution might explore other forms of compensation just to bring down the cost of college.

Any financial aid a parent in college receives does not count as income on the FAFSA. Similarly, any federal student loan a parent receives for college does not reduce a child or the children’s eligibility to obtain financial aid.

However, just see to it that you genuinely want to get your hands on a degree.

It’s true that going back to college can reduce the EFC, which can benefit you as well as your youngsters. However, as a parent who is busy raising a family or having a job, or both, it may not be worth it to go through the additional stress and exhaustion of being a college student and a parent at the same time.

Increasing Household Size

Another way to reduce income for the FAFSA and lower the EFC is to make the household size larger. Simply put, a person is considered a part of the household if he or she lives at home and receives more than 50% of the support a student applying to a college or university gets from his or her parents.

This is not something that a parent or the student has total control over.

However, if a sibling, aunt or grandparent living at home is thinking about moving out, it’s a good idea to ask the individual if staying for another year or so is possible while the student is attending college.

By increasing the household size and having more members of the family going to college, keeping the EFC low is possible. But take note that, when completing the FAFSA form, questions about the number of people in the household and the number of family members going to college are concerned with the financial aid award year, not the base year.

Becoming an Independent Student

There are instances when waiting for a while for a student to apply to college can help lower the EFC. However, this means that one must be willing to put having a degree at a later time.

On the FAFSA form, ten questions are asked to determine whether a student has a dependent or independent status. The questions are answerable by either a “yes” or a “no”. A single “yes” answer means that the student is independent. Because of this, there is no need to provide information about the parents.

The following are some of the things to meet to have an independent status:

- Being at least 24 years old.

- Being married.

- Being an emancipated minor.

- Being self-supporting and at risk for homelessness.

- Being a recently homeless youth.

- Being in foster care or an orphan after 13 years of age.

- Being a parent who provides more than 50% of the financial support for a child living with him or her.

- Being in active duty military service.

- Being a US veteran.

According to financial aid experts, most college students qualify for independent status because of being married.

It’s important to be aware of the fact that a dependency override may take place. Simply put, it’s when a financial aid administrator steps in and overrides the criteria for dependent students by the US Department of Education. A dependency override may only be granted on a case-by-case basis for college-level students with unusual circumstances.

Some examples when a financial aid administrator might exercise professional judgment are when the student has recently been granted a divorce, comes from an abusive home and has imprisoned parents.

It’s true that the cost of college these days is too steep for middle-class families. While it’s wrong for earning a degree to wreak havoc on the pocket, it isn’t right to lie on the FAFSA for a lower cost of attendance.

Fortunately, there are many different ways to lower the EFC effectively and, more importantly, legally.

Above, we talked about the steps that may be taken to keep the expected family contribution to a minimum. Some of them are relatively easy to pull off, while others can prove to be grueling. In any case, doing their best allows parents to lower the household income and keep the EFC realistic and affordable.

Read Also: How Is a Student Loan Different from a Scholarship

Source: https://t-tees.com

Category: WHY