Report Overview

The global golf gloves market size was valued at USD 310.0 million in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 3.13% from 2020 to 2027. Recent advancements in the game, such as the use of GPS and Bluetooth-enabled gloves, have also increased the prominence of the sport, thus encouraging more participation. For instance, Zero Friction’s Distance Pro GPS Glove is a lightweight waterproof golf glove made from tour-quality Cabretta leather and designed using compression-fit technology. The GPS device enables shot distance measurement for a convenient and highly accurate shot. Retailers have been focusing on expanding their distribution network by increasing the number of outlets. For instance, in 2019, golf retailer PGA TOUR Superstore announced its plans to expand its distribution footprint by opening at least six stores in the U.S. This move was aimed at widening the company’s brick and mortar presence by approximately 50% over the next three years. Currently, the company operates 35 stores across 15 states in the country.

The hospitality sector typically focuses on expanding and enhancing its facilities to attract more people. In this respect, hotels in western countries are increasingly focusing on promoting various sports activities, including golf. For instance, the Prukljan project in Europe includes a hospitality tourism zone, an entertainment center, a golf field, and other accommodation capacities. The golf area has been planned on an area of about 160 hectares and will include a golf course surrounding at least 60.0% of the total area. Such developments are expected to increase the demand for the product over the forecast timeframe.

The COVID-19 (coronavirus) is likely to diminish the demand for golf gloves. Numerous manufacturers worldwide have been historically relying on the growth of the Chinese market for finished products and raw materials used in the manufacturing of various types of gloves.

The rising popularity of golf in Asian and European countries has been driving the demand for innovative golf accessories, including gloves. Noticing an increasing demand for the product, prominent market players have been focusing on developing gloves, featuring a breathable design and an enhanced grip.

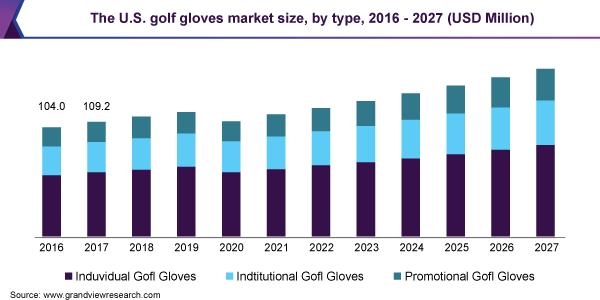

Type Insights

The individual golf gloves segment led the market and accounted for more than 52.0% share of the global revenue in 2019. As the name suggests, individual golf gloves are designed for individual golfers. Until recently, gloves were viewed as just a piece of functional golf equipment.

With the sport increasingly embracing a passion for individuality, individual golf gloves have evolved to become a fashionable accessory. In the near term, numerous companies are expected to capitalize on this growing trend. Individual golf gloves are principally made using leather and are available in a wide variety of colors and sizes.

The promotional golf gloves segment is anticipated to expand at the fastest CAGR during the forecast period. Promotional golf gloves are hybrid variants that are typically customized. As the name suggests, promotional golf gloves are intended to promote a company’s brand or message. Callaway Golf is among the most popular brands within this category and uses premium Cabretta leather to manufacture its promotional golf gloves.

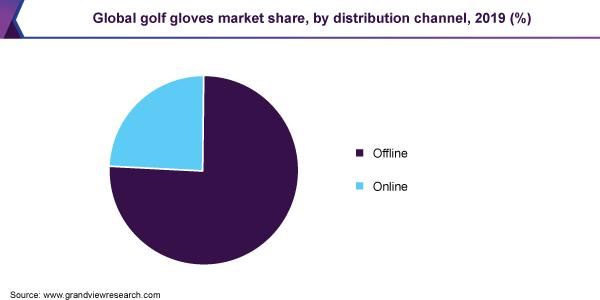

Distribution Channel Insights

The offline segment led the market and accounted for 75.9% share of the global revenue in 2019. The rising presence of sporting goods retailers worldwide will increase the product’s visibility in the near term. For instance, in 2018, Decathlon announced the opening of its stores in Victoria, Australia. Furthermore, the company announced its plans to open five new stores in Victoria by the end of 2020. Such developments are likely to strengthen the position of the offline segment in the near term.

The online segment is expected to expand at the fastest CAGR over the forecast period. Key players are implementing various strategies to attract new customers. For instance, GlobalGolf.com, a U.S.-based online retailer, operates with an online-only version of its demo program. The company allows golfers to try various products from their portfolio for a fee valid for two weeks. In the near term, more offline retailers are likely to focus on distributing their products through the online platform.

Regional Insights

North America dominated the market and accounted for over 57.0% share of the global revenue in 2019. Growing consumer interest in golf as a sport, coupled with the presence of established infrastructure in developed countries, such as the U.S., is among the key factors fueling the regional market growth.

According to the 2019 Golf Industry Report published by the National Golf Foundation, over 36% (more than 107 million individuals) watched, read about, or played golf in 2018. At a macro level, the rising popularity of golf as a sport among an increasingly expanding number of U.S. consumers is likely to contribute to the growth of the North American market in the foreseeable future.

Asia Pacific is expected to expand at the fastest CAGR over the forecast period. Demand for the product in this region is primarily driven by its increasing availability and affordability in countries, such as Japan and India. China has traditionally been viewed as a lucrative market by international golf glove manufacturers, given the relatively low production costs and availability of cheap labor within the country.

Key Companies & Market Share Insights

Prominent market players are stepping up their efforts to strengthen their presence in the global market by principally entering into partnerships with internationally-renowned technology partners. For instance, in January 2019, Mizuno Corporation, a leading Japan-based sports equipment manufacturer, announced its collaboration with Contentserv Group AG, a Switzerland-based company specializing in Product Experience Platform (PXP) services. This partnership was aimed at enhancing Mizuno Corporation’s global business. Such developments are likely to favor market growth throughout the forecast period. Specialist retailers operating within the industry continue to face intense competition from online/offline retailers. High costs associated with maintaining physical stores continue to limit their ability to compete with offline retailers. Some of the prominent players in the golf gloves market include:

-

Callaway Golf Company

-

SRIXON

-

Acushnet Holdings Corp.

-

Under Armour Inc.

-

Zero Friction

-

TAYLORMADE GOLF COMPANY, INC.

Golf Gloves Market Report Scope

Report Attribute

Details

Market size value in 2020

Read more : How Much Is Bob’s White Glove Delivery

USD 285.2 million

Revenue forecast in 2027

USD 396.8 million

Growth Rate

CAGR of 3.13% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 – 2018

Forecast period

2020 – 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

The U.S.; The U.K.; Germany; China; Japan; Australia; Brazil; Saudi Arabia

Key companies profiled

Callaway Golf Company; SRIXON; Acushnet Holdings Corp.; Under Armour Inc.; Zero Friction; TAYLORMADE GOLF COMPANY, INC.

Customization scope

Read more : How Much Money Did Glover Win

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global golf gloves market report based on type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2016 – 2027)

-

Individual Golf Gloves

-

Institutional Golf Gloves

-

Promotional Golf Gloves

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 – 2027)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2016 – 2027)

-

North America

-

The U.S.

-

-

Europe

-

The U.K.

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

-

Central & South America (CSA)

-

Brazil

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

-

Source: https://t-tees.com

Category: HOW