For many Americans, an annual salary of $47000 represents a milestone in their career. It signifies moving beyond entry-level wages into more professional pay that provides greater financial stability. However, $47000 per year may prompt questions about hourly pay, take-home amounts after taxes, and whether it allows a comfortable standard of living.

You are viewing: What Is 47k A Year Hourly

This article will break down exactly how much $47000 annually equals on an hourly, weekly, monthly and biweekly basis. We will calculate estimated after-tax wages to understand take-home pay. Additionally, we will compare $47000 to average U.S. salaries and examine whether it is considered a good salary based on location, household size and lifestyle factors.

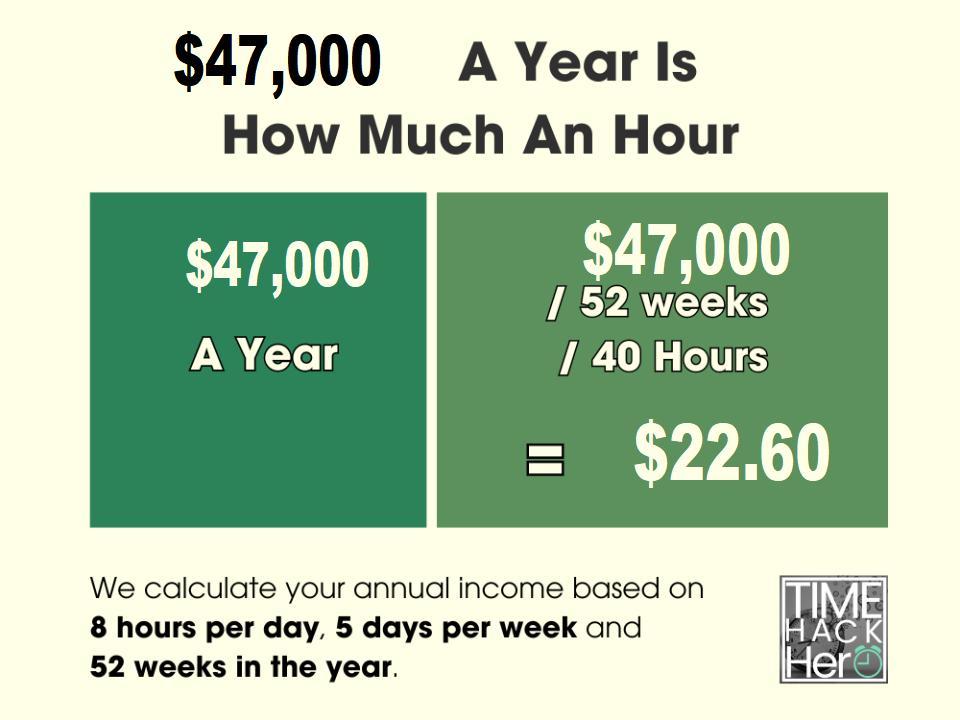

How Much is $47000 a Year Per Hour?

The most basic way to calculate your hourly rate from an annual salary is to:

- Take your annual salary – in this case, $47000

- Divide it by the typical number of working hours in a year:

Annual working hours = 52 weeks x 5 work days x 8 working hours per day = 2,080 hours

- Take your annual salary and divide it by 2,080 hours

Following this formula:

$47000 (annual salary) / 2,080 (working hours per year) = $22.60 per hour

So an annual salary of $47000 breaks down to $22.60 per hour.

This is the most straightforward way to derive an hourly wage from a known annual salary amount. However, there are some additional factors around paid time off, benefits, and hourly versus salaried pay status that can impact your exact hourly earnings.

Adjusting for Paid Time Off

The 2,080 working hour figure excludes any paid time off or holidays. Most full-time employees receive some amount of paid time off each year, which reduces the actual number of hours worked.

For example, if you receive 2 weeks (10 working days) of paid vacation annually, this is 80 hours less you have to work out of the year. Subtracting 80 hours from 2,080 yields 2,000 total hours worked.

If we adjust our $47000 annual salary for 2 weeks paid time off, the hourly rate increases slightly:

$47000 divided by 2,000 hours = $23.5 per hour

Here’s a table summarizing how your hourly rate change depending on paid time off or holidays:

Yearly Salary Paid vacation annually Hourly Rate $47000 0 weeks $22.60 $47000 1 weeks $23.04 $47000 2 weeks $23.5 $47000 3 weeks $23.98 $47000 4 weeks $24.48 $47000 5 weeks $25.00

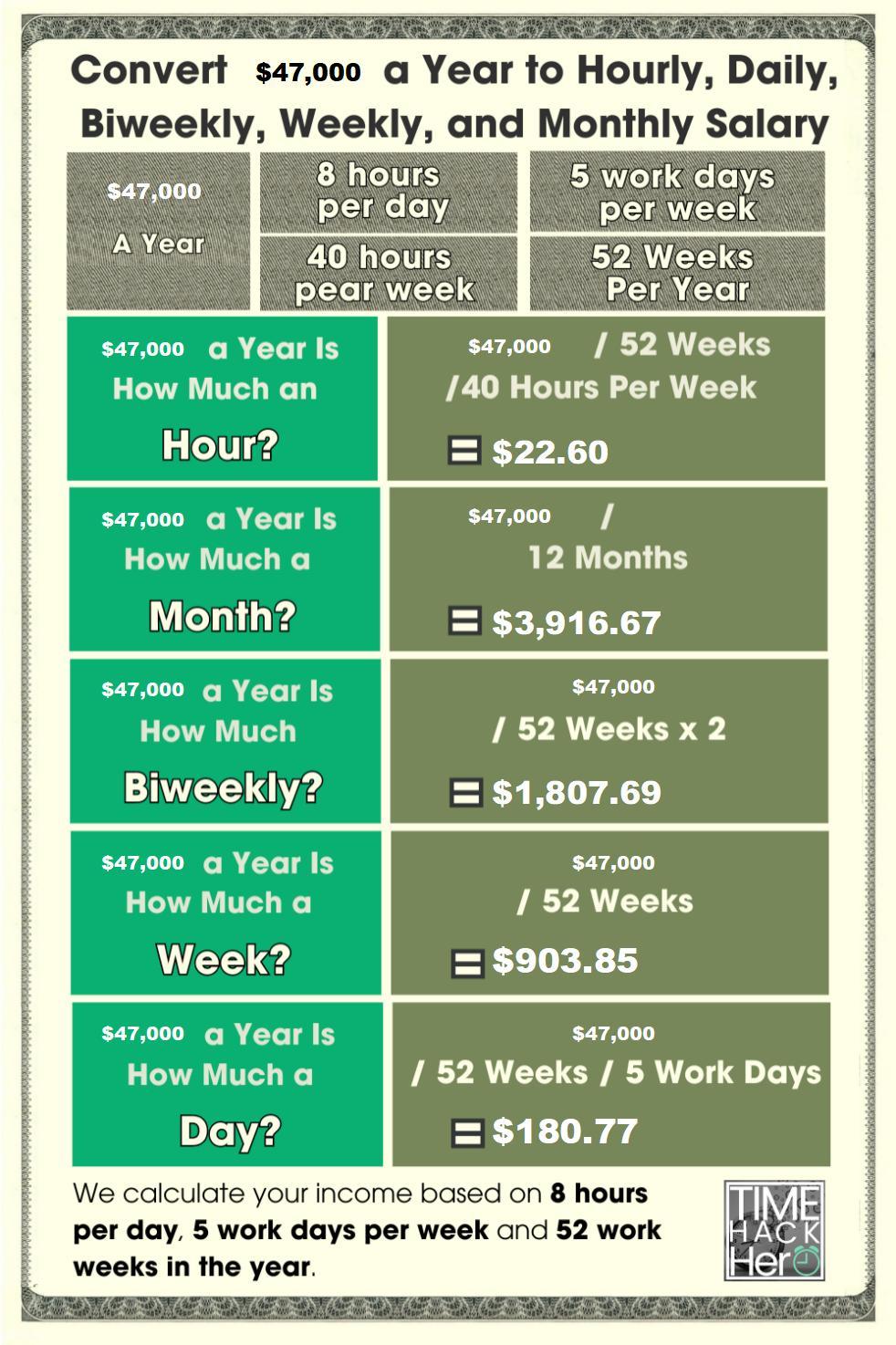

Convert $47000 a Year to Hourly, Daily, Biweekly, Weekly, and Monthly Salary

$47000 a year is How Much a Month?

Converting an annual salary to monthly income simply involves dividing the annual amount by 12 months.

$47000 Annual Salary / 12 Months = $3916.67 Monthly Income

So an annual salary of $47000 equals $3916.67 per month.

$47000 a year is How Much Biweekly?

Divide the annual salary by 26 to determine the biweekly gross pay. Most employers issue 26 paychecks per year.

$47000 annual salary / 26 pay periods = $1807.69 biweekly gross pay

$47000 a year is How Much a Week?

Take your annual salary amount, Divide it by 52 weeks (the number of weeks in a year)

$47000 / 52 weeks = $903.85

$47000 a year is How Much a Day?

Divide the annual salary by the number of working days in a year. The average number of working days for full-time employees in the US is 260 days(52 weeks x 5 days per week).

$47000 / 260 days = $180.77 per working day

$47000 a Year is How Much an Hour After Taxes?

Read more : The Rise and Future of Colt Glover: American Idol’s Rising Star

When you’re paid hourly, determining your after-tax hourly wage based on your gross annual income is important for understanding your net pay. We’ll calculate how much per hour someone would make after taxes on a $47000 salary, explore the key taxes that impact hourly workers, and provide tables to estimate your take-home hourly pay.

Calculating After-Tax Hourly Pay from a $47000 Yearly Salary

Let’s walk through the steps to determine the after-tax hourly wage from a $47000 annual salary:

1. Convert the annual salary to a gross hourly wage.

- $47000 per year

- Working 40 hours per week, 52 weeks per year = 2,080 hours

- $47000 / 2,080 hours = $22.6 per hour gross pay

2. Identify the main taxes that are deducted from each paycheck, and typical tax rates:

- Federal income tax: 10% to 37%

- Social Security tax: 6.2%

- Medicare tax: 1.45%

- State income tax: 0-13% approx.

- An average combined tax rate is around 25%

3. Calculate the estimated annual tax amount:

- Annual salary: $47000

- 25% estimated tax rate

- $47000 x 0.25 = $11750 in annual taxes

4. Determine the after-tax hourly wage:

- Gross hourly pay: $22.6/hour

- Annual taxes on gross salary: $11,750

- Net annual salary: $47000 – $11750 = $35250

- $35250 / 2,080 hours = $16.95 per hour after taxes

Based on this estimate, a $47000 annual salary equates to approximately $16.95 per hour after taxes.

This means this employee gets around $5.65 less per hour after accounting for taxes. Let’s take a closer look at how taxes impact your net hourly pay.

Key Taxes on Hourly Earnings

When you’re paid hourly, there are several taxes withheld from each paycheck that affect your net hourly wage. The main taxes that impact your take-home hourly pay include:

Federal Income Tax

- Levied on all taxable income based on IRS tax brackets

- Progressive rates from 10% to 37% based on income level

- Higher incomes are taxed at higher rates

Social Security Tax

- 6.2% tax on first $147,000 earned in 2023

- Funds Social Security retirement benefits

Medicare Tax

- 1.45% on all earned income

- Extra 0.9% tax on income over $200,000

- Helps fund Medicare health insurance program

State Income Tax

- Rates range from 0% to over 10% depending on state

- Only 43 states levy a state income tax

Local Taxes

- Cities and counties may charge local taxes of 1-4%

- Helps fund regional transportation, infrastructure, schools

When added together, these taxes can reach 25-30% of earned income. State and local taxes in particular vary widely based on where you live and work.

Understanding typical tax rates helps estimate hourly workers’ after-tax wages.

Next let’s look at some sample hourly wage calculations after taxes.

After-Tax Hourly Wage Examples

Below are examples of estimating after-tax hourly pay at different gross wage levels:

$17/hour Gross Wage

- Gross hourly wage: $17

- 25% estimated tax rate

- $17 x 0.25 = $4.25 in tax withholding per hour

- Net hourly wage: $17 – $4.25 = $12.75/hour

$21/hour Gross Wage

- Gross hourly wage: $21

- 25% estimated tax rate

- $21 x 0.25 = $5.25 in tax withholding per hour

- Net hourly wage: $21 – $5.25 = $15.75/hour

$29/hour Gross Wage

- Gross hourly wage: $29

- 25% estimated tax rate

- $29 x 0.25 = $7.25 in tax withholding per hour

- Net hourly wage: $29 – $7.25 = $21.75/hour

Higher gross hourly wages result in more taxes withheld and a larger difference between gross and net pay.

$47000 a year is How Much a Month After Taxes?

Based on the average combined tax rate of 25%, we will directly calculate your after-tax monthly salary.

Your Monthy Salary Before Taxes: $3916.67

Your Monthy Salary After Taxes: $3916.67 – $3916.67 * 25% = $2937.5

$47000 a year is How Much Biweekly After Taxes?

Read more : What Do Redfish Taste Like

Based on the average combined tax rate of 25%, we will directly calculate your after-tax biweekly salary.

Your Biweekly Salary Before Taxes: $1807.69

Your Biweekly Salary After Taxes: $1807.69 – $1,807.69 * 25% = $1355.77

$47000 a year is How Much a Week After Taxes?

Based on the average combined tax rate of 25%, we will directly calculate your after-tax weekly salary.

Your Weekly Salary Before Taxes: $903.85

Your Weekly Salary After Taxes: $903.85 – $903.85 * 25% = $677.88

$47000 a year is How Much a Day After Taxes?

Based on the average combined tax rate of 25%, we will directly calculate your after-tax daily salary.

Your Daily Salary Before Taxes: $180.77

Your Daily Salary After Taxes: $180.77 – $180.77 * 25% = $135.58

$47000 Salary vs Average U.S. Salary

Last Updated: July 18, 2023

The U.S. Bureau of Labor Statistics uses median salary data rather than averages to avoid skewed numbers from outlying high and low numbers. Median weekly earnings of the nation’s 121.5 million full-time wage and salary workers were $1,100 in the second quarter of 2023, the U.S.

If a person works 52 weeks in the year, then this represents a national annual salary of $57,200.

As can be seen, the annual salary of $47000 is lower than the average wage in the United States.

$47000 A Year Budget Example

The 50/30/20 budget is a simple, effective approach to managing your household finances on an annual salary of $47000. This budget method divides spending into three main categories: 50% on needs, 30% on wants, and 20% to savings and debt repayment.

Below, we will provide an example 50/30/20 monthly budget template for a $47000 income, discuss the key categories, and share tips on making this budget work for your lifestyle.

Overview of 50/30/20 Budgeting Method

The 50/30/20 budget allocates:

- 50% to Necessities?- Housing, utilities, transportation, food, insurance, minimum debt payments

- 30% to Lifestyle Spending?- Dining, entertainment, shopping, hobbies, vacations

- 20% to Savings and Debt Repayment?- Emergency fund, retirement, extra debt payments

This creates a simple spending blueprint for any income level. Let’s look at how to apply it to a $47000 annual salary.

50/30/20 Budget Template for $47000 Income

Here is an example 50/30/20 monthly budget template for earnings of $47000 per year:

Monthly Income

- Monthly Salary: $3916.67

- Taxes and Deductions: $979.17

- Net Monthly Income: $2937.5

Recommended Budget Percentages Based On $47000 A Year Salary:

Yearly Salary $47000 Monthly Salary $3916.67 Taxes and Deductions $979.17 Net Monthly Income $2937.5 Category

Ideal

Percentages

Sample Monthly Budget Necessities (50%) $1468.75 Housing: 25% $734.38 Utilities: 4% $117.5 Food: 12% $3352.5 Transportation: 3% $88.13 Insurance: 4% $117.5 Minimum Debt Payment: 2% $58.75 Lifestyle (30%) $881.25 Dining Out: 8% $235 Entertainment: 6% $176.25 Shopping: 4% $117.5 Hobbies: 4% $117.5 Vacation: 8% $235 Savings and Extra Debt (20%): $587.5 Emergency Savings 10% $293.75 Extra Debt Payment 6% $176.25 Retirement Savings 4% $117.5

This sample budget allows you to cover needs, enjoy lifestyle spending, and build savings on an annual $47000 salary.

Source: https://t-tees.com

Category: WHAT