Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

Homeowners insurance protects you financially against losses that certain unexpected events — also called perils — cause. If you file a claim, you’ll typically need to pay a deductible before your coverage kicks in.

You are viewing: What Is Aop In Insurance

While its name might be confusing, the All Other Peril (AOP) deductible is the standard deductible that you’ll pay for most damages that occur.

Here’s what you need to know about the All Other Peril deductible:

- What is an All Other Peril deductible?

- What perils are covered by a standard home insurance policy?

- What perils are not covered by an All Other Peril deductible?

- When does an All Other Peril deductible apply?

- How do deductibles affect premium payments?

- How to determine your deductible amount

- Other types of deductibles in home insurance

What is an All Other Peril deductible?

Homeowners insurance policies are very specific about what they do and don’t cover. If you file a claim and the peril that caused the loss is covered, you’ll generally need to pay a deductible before your insurance carrier reimburses you.

But with some perils, such as windstorms and hurricanes, an insurance provider may have a separate deductible. Instead of specifying all the perils covered under the standard deductible, it’s simply called the All Other Peril deductible.

What perils are covered by a standard home insurance policy?

The perils covered by your policy depend largely on the type of homeowners insurance policy you have. A named perils policy only covers the perils specifically named on your policy declaration page. In contrast, an open perils policy covers most losses unless they’re specifically excluded.

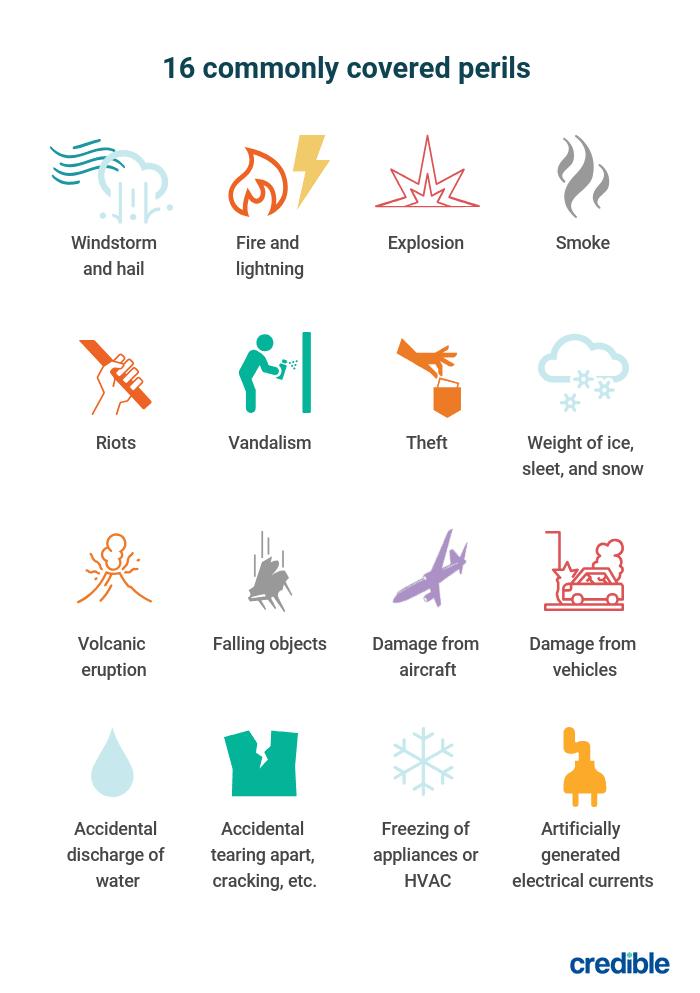

Here are the most common perils a standard home insurance policy covers:

What perils are not covered by an All Other Peril deductible?

An AOP deductible covers most perils. But depending on where you live, your insurance provider may require you to have a separate deductible.

In many states in the South and on the East Coast, for instance, insurance providers require separate deductibles for hurricanes, windstorms, and even hail. And in states like California, some insurers may require a separate deductible for wildfire damage.

These deductibles are separate from your AOP deductible to compensate for the increased risk. In some cases, they may be a percentage of your home’s insured value instead of a flat amount.

Learn More: Does Home Insurance Cover Natural Disasters?

When does an All Other Peril deductible apply?

AOP deductibles apply in most cases when you file a claim. Certain perils, such as theft, vandalism, and explosions, typically never have a separate deductible, so your AOP deductible would cover those events.

But if your insurance policy requires a separate deductible for any perils, your insurance policy will list them. Anything not named with a separate deductible or excluded from the policy altogether will be included in your AOP deductible.

Because the specifics of which perils are and aren’t covered under the AOP deductible depend on where you live and your insurance carrier, it’s important to review your policy documents or contact your insurance agent to understand how your policy works.

How do deductibles affect premium payments?

Your policy’s deductibles are the amount that you pay out of pocket in the event of a claim, so the lower your deductible, the more money your insurance provider has to pay.

Read more : What Time Does It Get Dark In Kentucky

As a result, lower deductibles typically correlate with higher insurance premiums. Meanwhile, choosing a higher deductible could help you save money on your premium. Just make sure your deductible is an amount that you can comfortably afford if you file a claim.

How to determine your deductible amount

A standard deductible for a homeowners insurance policy is typically between $500 and $2,000, but in some cases, it can go as high as $5,000.

When deciding on your deductible, it’s important to find a good balance between monthly savings and potential future costs. If you choose a deductible that you can’t afford just to maximize your savings, it could do more harm than good if you file a claim in the future.

On the flip side, you may find the lowest deductible amount appealing, but without knowing whether you’re ever going to file a claim, you’re trading potential savings for a higher monthly premium.

Other types of deductibles in home insurance

As previously mentioned, some homeowners insurance carriers may require separate deductibles for certain perils. These perils can vary depending on where you live and whether your home is at a higher risk for certain types of damage than others.

Common perils that may require a separate deductible include:

- Hurricanes: A hurricane deductible typically kicks in when the National Weather Service gives a tropical storm an official name, declares a hurricane watch or warning, or defines a hurricane’s intensity. It’s generally a percentage deductible, and it’s usually higher than other homeowners insurance deductibles.

- Windstorms/hail: While tornadoes typically don’t require a separate deductible, insurers in some Midwestern states may require a percentage deductible for windstorm- or hail-related damage.

- Floods: Flood insurance deductibles can either be percentage-based or flat dollar amounts. You may also select a separate deductible for your home and personal property. Your mortgage lender might require you to keep your deductible under a specific amount, to ensure that you can pay it.

- Wildfires: A wildfire deductible may be required in states where wildfires are common and pose a threat to homes. It’s typically a flat amount.

- Earthquakes: Homeowners in states with a greater risk of damage due to earthquakes, such as California, Nevada, Utah, and Washington, may have a separate percentage deductible.

If you’re not sure what your AOP deductible includes and what requires a separate deductible, review your home insurance policy paperwork.

Keep Reading: Flood Insurance: What It Covers and When You Need It

Home » All » Home Insurance » What Is an All Other Peril (AOP) Deductible in Home Insurance?

Source: https://t-tees.com

Category: WHAT