Top Class Actions’s website and social media posts use affiliate links. If you make a purchase using such links, we may receive a commission, but it will not result in any additional charges to you. Please review our Affiliate Link Disclosure for more information.

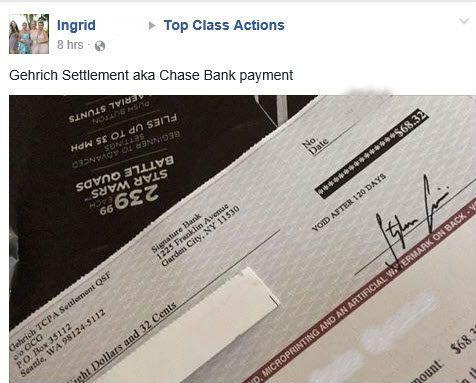

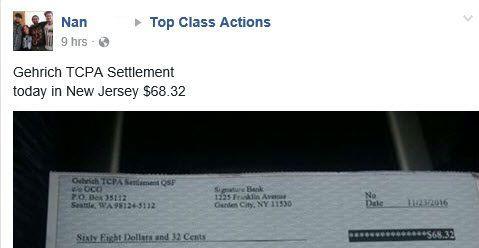

Top Class Actions viewers are starting to receive checks in the mail from a class action settlement that accused Chase Bank USA NA and JPMorgan Chase Bank NA of violating the Telephone Consumer Protection Act by placing robocalls and sending unwanted text messages without the prior consent of the recipient.

Top Class Actions viewers are starting to receive checks in the mail from a class action settlement that accused Chase Bank USA NA and JPMorgan Chase Bank NA of violating the Telephone Consumer Protection Act by placing robocalls and sending unwanted text messages without the prior consent of the recipient.

You are viewing: What Is Chase At Class Action Guide

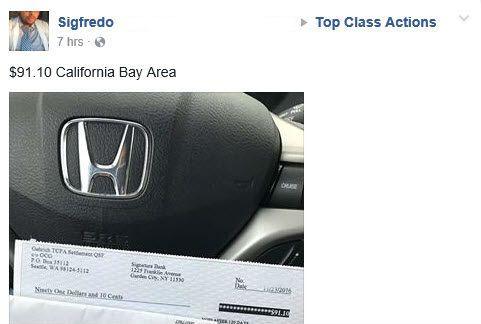

According to comments and posts on the Top Class Actions Facebook page, Class Members who submitted timely and valid claims for the Chase Bank class action settlement began receiving checks worth as much as $91.10 on Nov. 26, 2016.

If you filed a claim for the Chase TCPA class action settlement, keep an eye on your mailbox because checks are on their way!

The Chase settlement resolves allegations that the banking corporation called consumers regarding their Chase credit card or bank account without permission of the account-holder. According to the class action lawsuit, Chase also placed calls to individuals who weren’t customers and not the intended recipient of the phone call or text.

Only consumers who received a wrong-party automatic alert either via robocall or text message were eligible to a cash payout from this settlement. Chase account holders who received an automated call regarding their account could opt-out of the settlement.

Chase Bank and JPMorgan Chase Bank did not admit to any wrongdoings but agreed to pay $34 million to settle the claims.

Class Members included all U.S. residents who received a wrong-party automatic alert or collection call from Chase Bank between July 1, 2008 and Dec. 1, 2013.

The deadline to file a claim for the Chase TCPA class action settlement passed on Sept. 10, 2015.

Read more : What Color Shoes Goes With Champagne Dress

Congratulations to our Top Class Actions readers who submitted a valid claim and got PAID! If you missed out, sign up for our free newsletter to receive updates on new class action lawsuits and settlements. You can also check out which class action settlements are still accepting claims in our Open Class Action Settlements section.

The plaintiffs are represented by Burke Law Office LLC, Terrell Marshall Daudt & Willie PLLC, Ankcorn Law Firm PC, Saeed & Little LLP, Hyde & Swigart, Kazerouni Law Group APC, Law Offices of Todd Friedman PC, and Casey Gerry Schenk Francavilla Blatt & Penfield LLP.

The Chase Bank TCPA Class Action Lawsuit is Jonathan I. Gehrich, et al. v. Chase Bank USA NA and JPMorgan Chase Bank NA, Case No 1:12-cv-05510, in the U.S. District Court for the Northern District of Illinois, Eastern Division.

UPDATE: On June 23, 2017, Top Class Actions viewers who filed valid claims for the Chase Bank TCPA class action settlement started receiving a second disbursement check worth as much as $9.80.

Join a Free TCPA Class Action Lawsuit Investigation

If you were contacted on your cell phone by a company via an unsolicited text message (text spam) or prerecorded voice message (robocall), you may be eligible for compensation under the Telephone Consumer Protection Act.

GET A FREE CASE EVALUATION NOW

Source: https://t-tees.com

Category: WHAT