When it comes to choosing the valuation method for your insurance coverage, sometimes actual cash value (ACV) or replacement cost (RC) – sometimes also referred to as “replacement cost value” (RCV) – may not be the best match to meet a property owner’s needs, or even be available. In these cases, policies that provide functional replacement cost (FRC) valuation, or endorsements that do so, offer an alternative. This valuation method is most commonly used to insure older structures built with obsolete materials and by outdated or custom methods; structures where the RC often exceeds the market value.

What is functional replacement cost?

Here’s how one ISO endorsement defines it:

You are viewing: What Is Functional Replacement Cost

Functional replacement cost’ means the amount which it would cost to repair or replace the damaged building with less costly common construction materials and methods which are functionally equivalent to obsolete, antique or custom construction materials and methods used in the original construction of the building.1

What is an example of functional replacement cost?

Common examples of “obsolete, antique, or custom construction materials” that are replaced with functional equivalents include (1) plaster with drywall; (2) clay roofing tiles with shingles; and (3) the elimination or replacement of custom woodwork and masonry. A functional replacement cost policy would cover the cost of replacing lost or damaged property with materials that provide functional equivalents, as opposed to modern-day equivalents, i.e. contemporary materials that approximate the value or workmanship of the originals.

How does functional replacement cost differ from actual cash value and replacement cost?

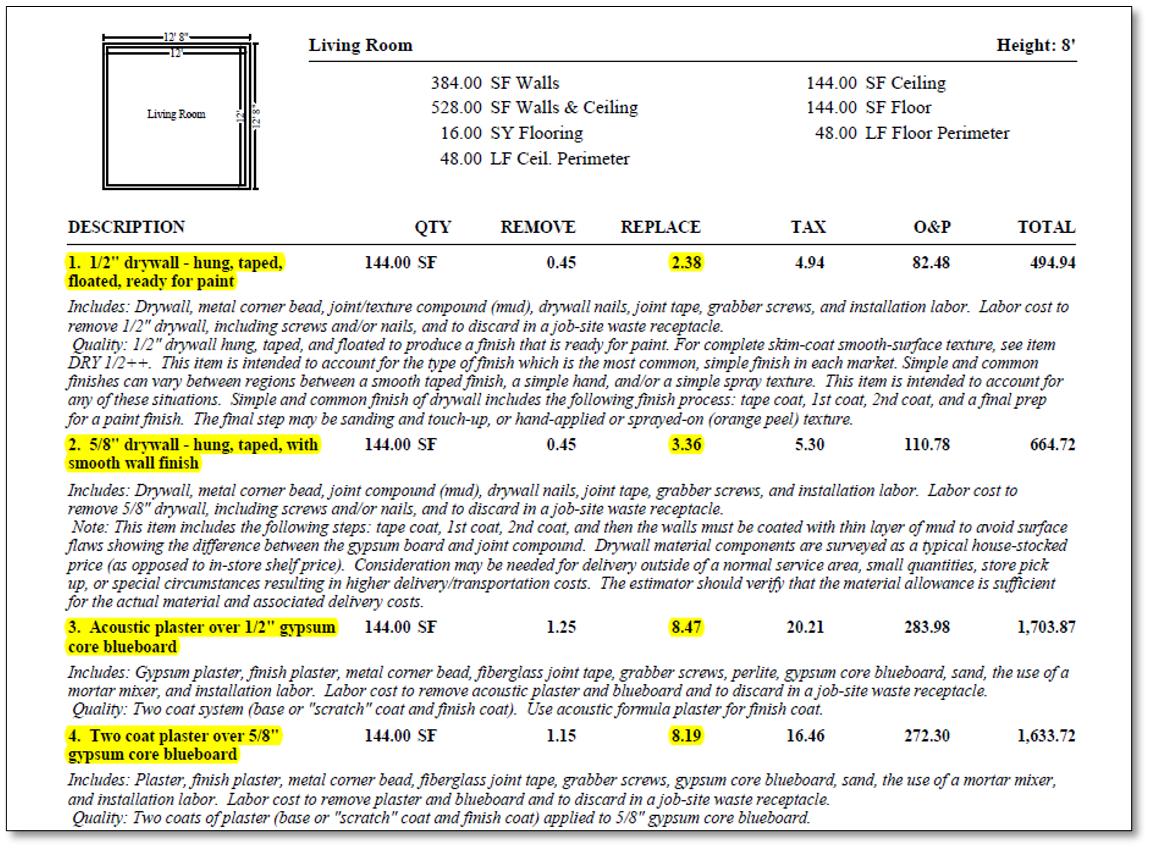

This sample Xactimate® pricing provides an example (see below). For a damaged structure that had plaster walls, a policy that pays out under functional replacement cost may only entitle the insured to $2.38/sq. ft. to replace those same walls with ½” drywall. Under a replacement cost or actual cash value policy, plaster walls are written to be replaced by a modern-day equivalent, such as acoustic plaster over ½” gypsum core blueboard at $8.47/sq. ft. (Unsurprisingly, it would be hard to find new horsehair plaster today!)

Even if the plaster equivalent is depreciated by 70 percent under an RC or ACV policy, the insured is still entitled to the actual cash value of $2.54/sq .ft.; more than is owed under the FRC valuation (with recoverable funds still available under an RC policy).

When should functional replacement cost be used?

Ideally, functional replacement cost can properly address a gap between RC and ACV coverage, and that’s their main benefit for policyholders: FRC policies typically provide more coverage than ACV policies, but less than RC.

It addresses situations when replacement cost valuation would be unnecessary in the event of a total loss, but an actual cash value settlement would not meet the insured’s needs in the event of a partial loss.2

In situations where the full RC would result in very high premiums but ACV would be insufficient to cover partial losses, FRC can help property owners find a workable alternative.

How does functional replacement cost impact my insurance premiums?

Although premium payments under an FRC-endorsed policy may be more affordable compared to an RC policy, prudent policyholders who select this option should fully understand its implications – following a covered loss, a policyholder will usually be entitled to less insurance proceeds than under an RC policy, and potentially less than under an ACV policy.

Forms and Endorsements

The ISO HO 00 08 – Modified Coverage Form — uses FRC as the default for a homeowners’ real property valuation. FRC can also be added to a homeowners policy by endorsement. The ISO Functional Replacement Cost Loss Settlement endorsement, HO 05 30, is:

Read more : What Are Football Gloves Made Of

This endorsement replaces the homeowners loss settlement provisions that apply to the primary dwelling and other structures and states:

- If, at the time of loss, the amount of insurance in this policy on the damaged building is 80% or more of the “functional replacement cost” of the building immediately before the loss4 and you contract for repair or replacement of the damaged building for the same use, within 180 days of the damage unless we and you otherwise agree, we will pay the lesser of the following amounts:5

- The limit of liability under this policy that applies to the building; or

- The necessary amount actually spent to repair or replace the damaged building on a “functional replacement cost” basis.

- If you do not [contract for repair within 180 days] we will pay the least of the following amounts:

- The limit of liability under this policy that applies to the building;

- The actual cash value of the damaged part of the building; or

- The amount which it would cost to repair or replace the damaged building on a “functional replacement cost” basis.

The commercial property equivalent is ISO’s Functional Building Valuation endorsement, CP 04 38. Unlike the homeowners FRC endorsement, the commercial FRC endorsement includes a schedule. The FRC of the property is determined in advance, including anticipated costs to abide by applicable ordinance and law, and eliminates the need for a coinsurance clause.

In the event of a partial loss, the endorsement provides for:

The cost to repair or replace the damaged portion of the building with less costly material, if available, in the architectural style that existed before the loss or damage occurred[.]6

Is functional replacement cost a good option for my home insurance?

Determining what constitutes a “functional” replacement is not always an easy task. Be aware that there are many non-ISO FRC forms that deviate from the provisions cited in this blog, especially in commercial lines.

Be sure to read your policy carefully, and speak with an insurance professional if you’re unsure how an FRC provision will be applied. The attorneys at Merlin Law Group have been helping clients negotiate the complicated ins and outs of property insurance claims for over 30 years. If you’re uncertain what the language in your insurance contract will cover or if you think your insurance provider isn’t living up to the terms of your agreement, contact us today for expert advice you can rely on.

_______________________ 1 ISO HO 05 30 05 11 2 ISO Commercial Property Forms and Endorsements: Functional Building Valuation (CP 04 38). IRMI. Available at https://www.irmi.com/online/cpi/ch006/1l06f000/al006710.aspx (subscription required). 3 Functional Replacement Cost Loss Settlement HO 05 30. IRMI. Available at https://www.irmi.com/online/prmi/ch013/1l13f000/al003730.aspx (subscription required). 4 This acts as a coinsurance clause equivalent with a proportional payout. 5 ISO HO 05 31 grants ACV payment if FRC is less than the ACV. 6 ISO CP 04 38 09 17

Source: https://t-tees.com

Category: WHAT