Managing your finances can be difficult. If you struggle to keep up with your finances, but you’re relentless in your efforts, here’s a tip: PFM Verify may be just the financial tool you need. Managing your finances can be complex, but PFM Verify is a simple tool that anyone can use to stay on top of their finances and their financial goals.

What Is PFM Verify?

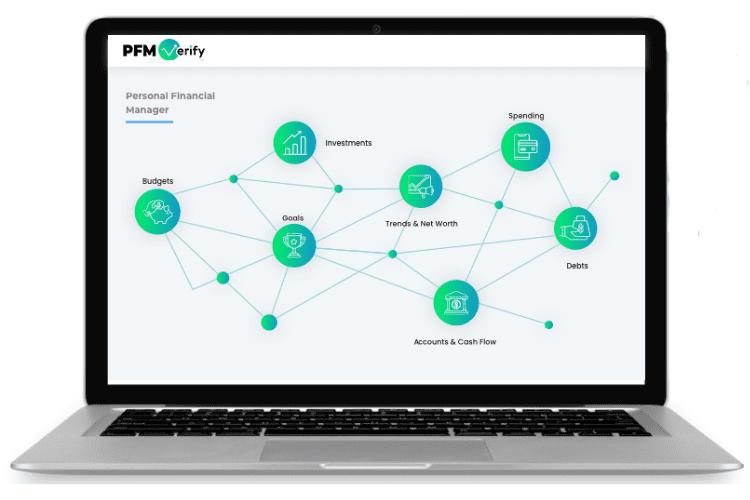

PFM (Personal Financial Management) Verify is a financial tool that provides users with insight into their financial health. The platform empowers users to improve their spending, saving, and investing habits.

You are viewing: What Is Pfm Verify

How Does PFM Verify Work?

Read more : What Is A Cutsheet

When you connect your accounts to PFM Verify, you get real-time updates on what’s happening with your finances. It monitors the day-to-day health of your finances so that you always know your financial status. PFM Verify provides details that may be limited or non-existent to most financial apps. In addition to knowing your income and expenses, you get knowledge of your liquidity ratio, saving ratio and investments, your trends, and you can track your net worth.

What Are the Benefits of Using PFM Verify?

There are four primary benefits to using PFM Verify:

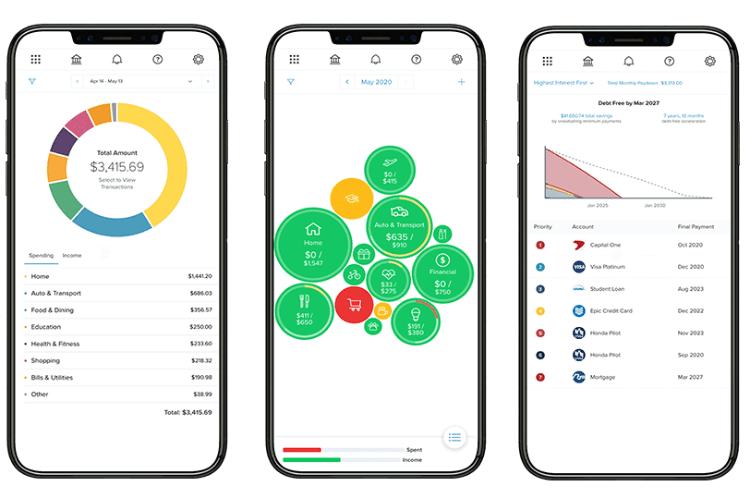

- It’s personal finance software in your hand: Having this tool with you keeps you in the know of your finances at all times. As a personal finance manager, PFM Verify will let you know if your financial state is vulnerable or stable. You’ll be aware of how much money you’re bringing in and where your money is going, and it provides you with the support you need based on your situation.

- It will give you a financial wellness score: PFM Verify will evaluate your financial health based on your habits and give you a financial wellness score. This insight then opens the door for improvement as it helps you to change your habits if needed. If you need to spend less or save more money, PFM Verify will help you do that.

- It allows you to work towards your financial goals: With PFM Verify, you know exactly where your money is going, giving you spending trends. You can even track your expenses by category, so you know where to improve. You can easily search through their unique search filter for easy management and track your spending. The tool will help you set your financial goals and make the necessary changes to stay on target.

- It empowers you to take control of your finances: PFM Verify provides the financial insight you need to take control of your finances. With PFM Verify, you even get access to your credit report. This gives you an even more in-depth look at your financial situation. Get alerts on your phone when there’s a change to your credit report or when a late payment is reported. The credit score simulator will help you determine what you need to do to assume financial freedom and make the changes necessary to achieve your goals. With this leverage, you can always feel confident about your finances.

How Much Does PFM Verify Cost?

PFM Verify only charges you $1 when you sign up, but this is only a seven-day trial period. When the trial period is over, you’ll be charged $29.95 monthly to maintain the service. However, you can cancel the service at any time.

How To Get Started on PFM Verify

Read more : What Is A Sidebar In Court

To get started on PFM Verify:

- Go to their signup page.

- Enter your personal details (they’ll need this to retrieve your personal financial records).

- Provide your name, address, email, phone, and payment information.

- Pay the $1 trial fee and start using the tool.

The Bottom Line

As with any new tool, you’ll need to familiarize yourself with the platform. Many of us are in denial about the true health of our finances. PFM Verify can help bring you out of the dark and into the light, giving you the edge you need to get your finances back on track.

Read More: Financial Empowerment Centers (FECs): How To Get Free 1-on-1 Financial Counseling

Source: https://t-tees.com

Category: WHAT