There’s one strategy every real estate investor needs to have in their arsenal: Subject To, or SubTo.

If you’re a beginner looking for a way to get started, especially if you’re low on cash or still trying to build your credit, SubTo can be one of the best ways to get your first deal done.

You are viewing: What Is Subto In Real Estate

If you’re an established investor that’s looking to aggressively expand your portfolio without hitting your credit for every new loan and deal you’re trying to do, SubTo can be a gamechanger.

Or if you’re an experienced investor that’s looking for new ways and new opportunities to capitalize on the leads you’re already getting so you’re walking away with more deals, need to learn the SubTo strategy.

In this guide, we’re going to show you exactly how to use the Subject To investing strategy as well as when you should be utilizing it.

Before we get into how to use it, though…

What is Subject To Real Estate?

Subject To is a creative financing strategy where the real estate investor takes over the homeowner’s existing mortgage & payments.

Picture this.

Mr. or Mrs. Prospect is behind on their $200,000 mortgage and facing a foreclosure.

Then you come into the picture, realize the home is worth $250,000 the way it sits.

Mr. or Mrs. Prospect agrees to sell the property “subject to” you taking over their existing payments.

When you get to the closing table, you give the prospect $25,000, the prospect deeds the house to you, and you begin to take over payments on the property.

Mr. and Mrs. Prospect are happy because they’re avoiding a foreclosure and a massive credit hit while he gets to keep payments up-to-date on the property.

You’re happy because you get a new low-interest loan without having to take out a new mortgage.

That makes Subject To a win-win for both parties involved and you get to do with the property whatever you see fit — within the terms of the contract you negotiated.

It’s a creative financing strategy that opens up quite a few different options for you, when it’s being used in the right way.

Subject To Real Estate vs Mortgage Assumption

While SubTo may feel a little like mortgage assumption, they’re actually different in a couple key ways.

First, with a mortgage assumption, you’re actually removing the seller’s name from the mortgage and then you’re becoming financially responsible to their lender.

You’ll go through the same loan qualifications that you would for a new mortgage, pay closing costs, and usually be required to do a title search.

With SubTo, the loan is staying in your seller’s name so you get to keep the original terms and interest rate without hitting your credit, paying closing costs, or dealing with a ton of extra paperwork and headache.

Since many lenders will not authorize a loan assumption, Subject To becomes the only way to take over the mortgage.

The Pros & Cons of Subject To Real Estate

There are even more benefits that Subject To deals provide to both buyers and sellers, though, as well as a few downsides you’ll need to consider before you enter into these deals.

Pros of Subject To Real Estate To Buyers

- No Credit Checks: When you secure a SubTo deal, credit and credentials aren’t necessary. Cash is only a requirement if you offer it to secure the deal.

- Often Cheaper Deals: With these deals, there’s typically low (or even no) closing costs, up-front cost, realtor fees, bank fees, title fees, or loan fees.

- Quick Way To Build Your Portfolio: These properties will usually grow equity faster than other strategies because the mortgage has already been paid down by the seller.

- Take Over an Existing Low-Interest Mortgage: With interest rates skyrocketing right now, you can take advantage of the seller’s original low-interest rate loan.

- Access Property with No Money-Down/Deposit: Unless you negotiate cash in the terms, you can get access to properties with no money down.

- Close Deals Quickly: There’s no lengthy paperwork or approval process to work through so you get access to the property as quickly as possible.

Pros of Subject To Real Estate To Sellers

- Quick Sale: The SubTo strategy lets them quickly get out from under the property so they can move on with their lives.

- Overcome Financial Issues: If they’re facing foreclosure or need cash in a hurry, a SubTo deal helps them escape the financial pressure they’re under.

- Upfront Payment: In some deals, you may offer to pay them a lump sum to take over the mortgage payments, if the property is worth more than what they owe.

- No Repairs or Extra Investment: They can sell the property as-is, saving them time and money compared to bringing the property up to market requirements.

Cons of Subject To Real Estate To Buyers

- Due-on-Sale Clause: One risk with the SubTo strategy is a “due on sale” clause that’s written into most mortgage contracts which lets the lender demand full repayment if the property is sold.

- Untrustworthy Buyers: Sellers will need to trust that you’re going to continue making payments on their property if they sell it to you or be forced to pursue legal action against you.

- Untrustworthy Sellers: If the seller isn’t using the money you give them to pay down the loan, the bank could foreclose on the property and you’ve lost everything you’ve put into it.

- Potential High-Interest Rates: If the seller had bad credit when they originally secured the loan, you inherit the high interest rate when you take it over.

The 3 Types of Subject To Real Estate Deals

If the pros outweigh the cons, there’s 3 common types of SubTo real estate deals.

#1 – Cash To Loan

The “cash to loan” strategy is probably the most common form of SubTo deal.

Read more : What’s The Difference Between Koolaburra And Ugg

For this strategy, you’re paying your seller the difference between their asking price and the balance that remains on the mortgage, while taking over their payments.

To give you an example, if you both agree that the property is worth $300,000 but the mortgage balance is only $250,000, you agree to pay your seller the difference — $50,000 in this case — and then continue covering the monthly payments.

This most commonly happens when a seller is facing foreclosure and needs a quick cash injection to escape the financial pressure they’re under.

#2 – Seller Carryback

The “seller carryback” strategy is probably the second most common form of SubTo deal you’ll encounter.

You’ve probably heard about this type before just using different terms to describe it. It’s most typically referred to as “seller financing” or “owner financing”.

If your lender won’t approve the entire purchase amount for the property, you’ll likely use seller financing.

You’ll take out a mortgage for as much of the value as you can and then make payments to your lender like you would with a traditional mortgage, as well as payments to your seller’s lender.

Then, your seller slowly receives the difference directly from you instead of a quick, upfront cash injection.

Your seller has more control over this type of transaction, in terms of interest rate, down payment, and the length of the loan. They’ll likely require you to put down a down payment ranging from 5% to 25% and have this portion paid off within the next 5 years.

#3 – Wrap Around

The “wrap around” strategy is the least common form of SubTo, for good reasons.

On these deals, the interest rates are based on the original mortgage but interest gets added on top of that original rate.

For instance, if the seller’s mortgage rate is 4% right now, you’ll likely be asked to pay 6% on the wrap around. That means, if the seller’s original rate was high, your interest rate will be even higher.

For that reason, alone, these deals aren’t nearly as attractive as the seller carryback and cash-to-loan strategies.

How To Find Subject To Real Estate Deals

There’s a general rule of thumb you can follow when it comes to finding good SubTo deals: where there’s a crossroads between distressed properties and motivated sellers, a SubTo deal is nearby.

Especially if they’re facing foreclosure with minimal equity and looking for a quick way out of the situation.

To find these sellers, there’s a few different strategies you can use.

Strategy #1: Hit Your Local Neighborhood

Right now, there’s a chance you have homeowners in your local area sitting on distressed properties in financial situations they need to find an escape from.

If you notice properties that look like they could use some TLC, it’s worth knocking on the door and sparking up a conversation with the owner.

If you can’t find any in your immediate area, branch out a bit.

When you’re knocking, especially if you’re uncomfortable walking up to someone’s house and introducing yourself, stick to a script that you can repeat over and over.

Something along the lines of…

“Good afternoon. I’m John and I’m a local real estate investor in the area. I was walking through the neighborhood and found quite a few homes that have been selling recently. Do you happen to know anyone who might be interested in selling?”

Remember, though, your goal at the door isn’t to close the sale — it’s to make an introduction, let people know who you are and what you do, then leave the door open for them to ask you for assistance.

Collect their contact information so you can get them in your CRM and follow back up with them later.

Strategy #2: Use Propstream

Read more : What Is The Best Delete Kit For 6.7 Powerstroke

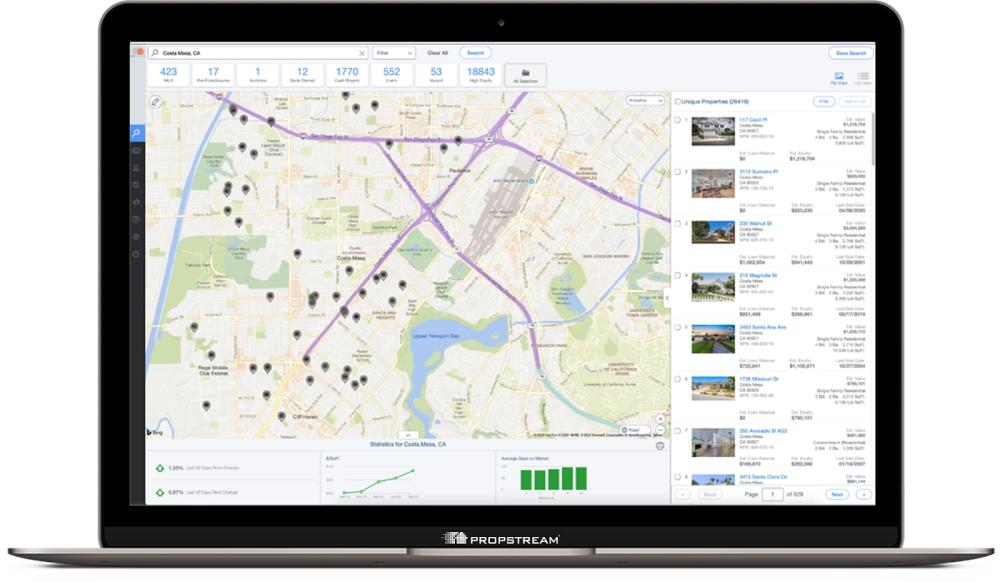

To find even more distressed properties or owners who may be facing foreclosure, you can use a tool like Propstream to build lists of leads you can contact — either by cold calling or door knocking.

Read more : What Is The Best Delete Kit For 6.7 Powerstroke

To find even more distressed properties or owners who may be facing foreclosure, you can use a tool like Propstream to build lists of leads you can contact — either by cold calling or door knocking.

With Propstream, you can look up your local area and quickly identify properties that may have equity built up, with absentee owners, that are sitting vacant, and also happen to be in distressed condition.

Then you can take that list of owners who may be motivated to sell and start contacting them.

You can research properties from directly inside the tool before you begin marketing them, saving yourself a ton of time and keeping you from having to knock doors or make calls to owners that may not necessarily be open to entertaining offers on their property.

When it comes to finding the types of properties we’re talking about here, Propstream will be one of the best tools you have in your toolbox — once you get familiar with using it.

To get started, you can click here to begin your free trial and start looking up properties in your area today.

Strategy #3: Entice Motivated Sellers To Come To You

Another strategy you can use to uncover SubTo deals is to get motivated sellers to come to you first.

If you’ve been knocking on doors and cold calling owners in your area without much success, you can leave door hangers on their door to get their attention and potentially generate inbound calls.

A good door hanger is going to be personalized to the owner and appear handwritten so you can put them out at scale without developing carpal tunnel syndrome.

With the right hangers, too, you can get owners reaching out to you first wanting to know more about the message you left on their door.

Combined with knocking and calling, these door hangers are incredibly effective for generating leads that can develop into profitable SubTo deals.

Strategy #4: Keep Up with The Local News

Your local newspapers are another great source of distressed properties and motivated sellers.

Newspapers are required to publish the addresses of properties that are facing foreclosure, as well as businesses that are struggling or closing up shop.

When you come across these properties, you can send them a unique mailer that’s designed to grab attention with a message that appears handwritten that speaks to the frustrations they’re experiencing.

Here’s an example:

These mailers are incredibly effective for turning those contacts into prospects and getting you into conversations to talk through a potential SubTo deal that benefits both you, and the seller.

Final Thoughts

While SubTo may have risks associated with it, many times you’re going to find that the pros greatly outweigh the cons and SubTo opens up an entirely new path to take your sellers down & get deals done.

It’s a great way to both get started as a brand new real estate investor as well as quickly grow your portfolio without putting up extra cash or putting your credit on the line.

If you want to get started hunting for potential SubTo deals, grab yourself a set of mailers or door hangers, pick up the phone, knock on some doors, and make some introductions!

Always be on the hunt for motivated sellers and put the SubTo opportunity to the test.

Source: https://t-tees.com

Category: WHAT