SPAXX is Fidelity Investment’s prime money market fund. If you have a Fidelity brokerage account, your idle cash is automatically invested in SPAXX to earn its dividend. SPAXX is the FDIC-Insured Deposit Sweep program.

As a 21-year Fidelity Investments client, I’ve also been a regular investor in the SPAXX prime money market fund. In fact, I currently hold over $2.7 million in SPAXX earning ~5% because I’m looking to upgrade homes.

You are viewing: When Does Spaxx Pay Interest

My $2.7 million in SPAXX is generating a healthy $11,200+ a month in almost risk-free dividend income. Losing this income is one of the main downsides of paying all cash for a home in a high interest rate environment.

What Is SPAXX?

SPAXX is the Fidelity Government Money Market Fund.

Money market funds are mutual funds that hold highly liquid investment products from cash and cash equivalent securities to short-term U.S. government securities. SPAXX specifically holds U.S. government securities and repurchase agreements. They are seen as very low risk but are not guaranteed by the US Treasury.

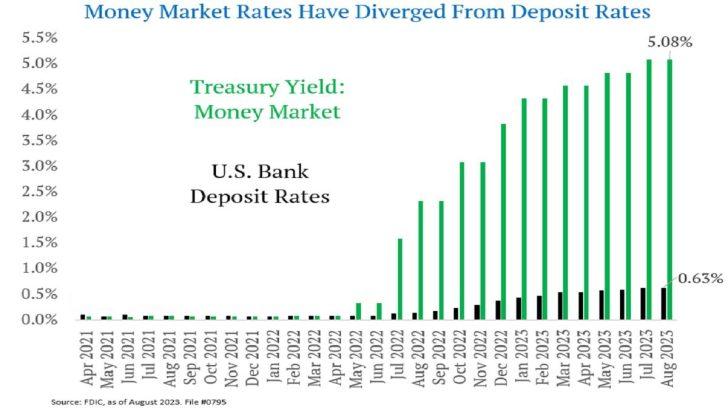

Money market funds typically have low interest rates, comparable with a high-yield savings account. As inflation and interest rates go up, money market fund interest rates go up and vice versa.

As of 4Q 2023, the average money market interest rate is over 5% thanks to aggressive Fed rate hikes since 2022. For those who have money sitting around in a savings or checking account, please move your money into a money market fund like SPAXX. You’ll likely earn much more interest income.

What is the FDIC-Insured Deposit Sweep Program?

FDIC stands for Federal Deposit Insurance Corporation. The FDIC is an independent government agency whose purpose is to make bank deposits safe and stable. It does this mainly by insuring those deposits and paying them back to depositors in the event of a bank failure.

A recent example where the FDIC stepped in was the bank run of Silicon Valley Bank and First Republic Bank in the first half of 2023. These regional banks’ stock prices sold off violently as depositors pulled funds. The FDIC stepped up to bail out these banks with guaranteed funds.

FDIC insurance is common for checking and savings accounts. It can also be found in Fidelity’s FDIC-Insured Deposit Sweep Program. This program sweeps all the uninvested cash in your investment account into an account at one or more “program banks.”

What Is FZSXX? Fidelity’s Higher-Yielding Government Money Market Fund

If your cash balance exceeds FDIC insurance limits ($250,000 per person per account), it will be deposited in the Fidelity Government Money Market Fund Class S (FZSXX) instead. The minimum to invest in FZSXX is $100,000.

Read more : When I Think Of The Goodness Of Jesus

FZSXX has slightly riskier investments than SPAXX with a slightly higher expense ratio. If you look at the fund’s info page you’ll see a higher percentage of its fund going to Agency Floating-Rate Securities. It’s the only way FZSXX money market fund can pay on average a 20 basis points (0.2%) higher yield than SPAXX.

Despite the slightly higher risk investments in FZSXX, all the investments are considered low risk. We’re talking about all investments in U.S. government bonds and related securities.

Please note that neither SPAXX or FZSXX are FDIC insured. Instead, they’re insured by the Securities Investor Protection Corporation (SIPC) instead. SIPC doesn’t protect against investor losses, it only protects against the bankruptcy of a brokerage company and investor fraud.

SPAXX vs. FDIC vs. FZSXX Comparison

The following table compares the most important features of SPAXX, FZSXX, and FDIC.

Note that Fidelity pays 0.01-0.03% to the “Program Administrator” of FDIC bank deposits, who is often the program bank itself. Also, Fidelity is paid a fee of up to 4% by the program banks for FDIC deposits. So, Fidelity typically makes more money from FDIC than they do from SPAXX.

FDIC And SIPC Protection Of Money Market Funds

Both SPAXX and FDIC have insurance protection. FDIC insurance is better known given the $250,000 / $500,000 guarantee for individuals / married couples. SIPC insurance isn’t well known simply because brokerage company failures don’t happen often, but they do happen.

Think the $50 billion Bernie Madoff scandal. That was handled by the SIPC. Same thing with the FTX crypto scandal. SIPC is trying to recover the missing funds and figure out what went wrong to dish out the appropriate punishment.

The Benefit Of Owning Individual Treasury Bonds Over Money Market Funds

In a high interest rate environment, I’m a big proponent of owning individual Treasury bonds. Here’s my tutorial on how to buy Treasury bonds with Fidelity.

The income from Treasury bonds has preferential tax treatment. It is exempt from state and local taxes, but not federal income taxes. Repurchase agreements, as investments held by SPAXX and FZSXX are not exempt from state and local taxes.

Therefore, SPAXX and FZSXX and other money market funds are also not exempt from state and local taxes. Dividends paid by SPAXX and FZSXX are generally unqualified and taxed as ordinary income when held in a taxable Fidelity brokerage account.

If the money market funds are held in a tax-advantaged account such as a Roth IRA or 401(k), tax treatment is the same for all core position and investment products.

You won’t pay any taxes until withdrawal for a 401(k). For a Roth IRA, you’ve already paid taxes up front during contributions, so you don’t have to pay taxes ongoing or during withdrawal.

Calculate Your After-Tax Yield Before Investing In A Money Market Fund

Read more : When Is Patch Tuesday November 2023

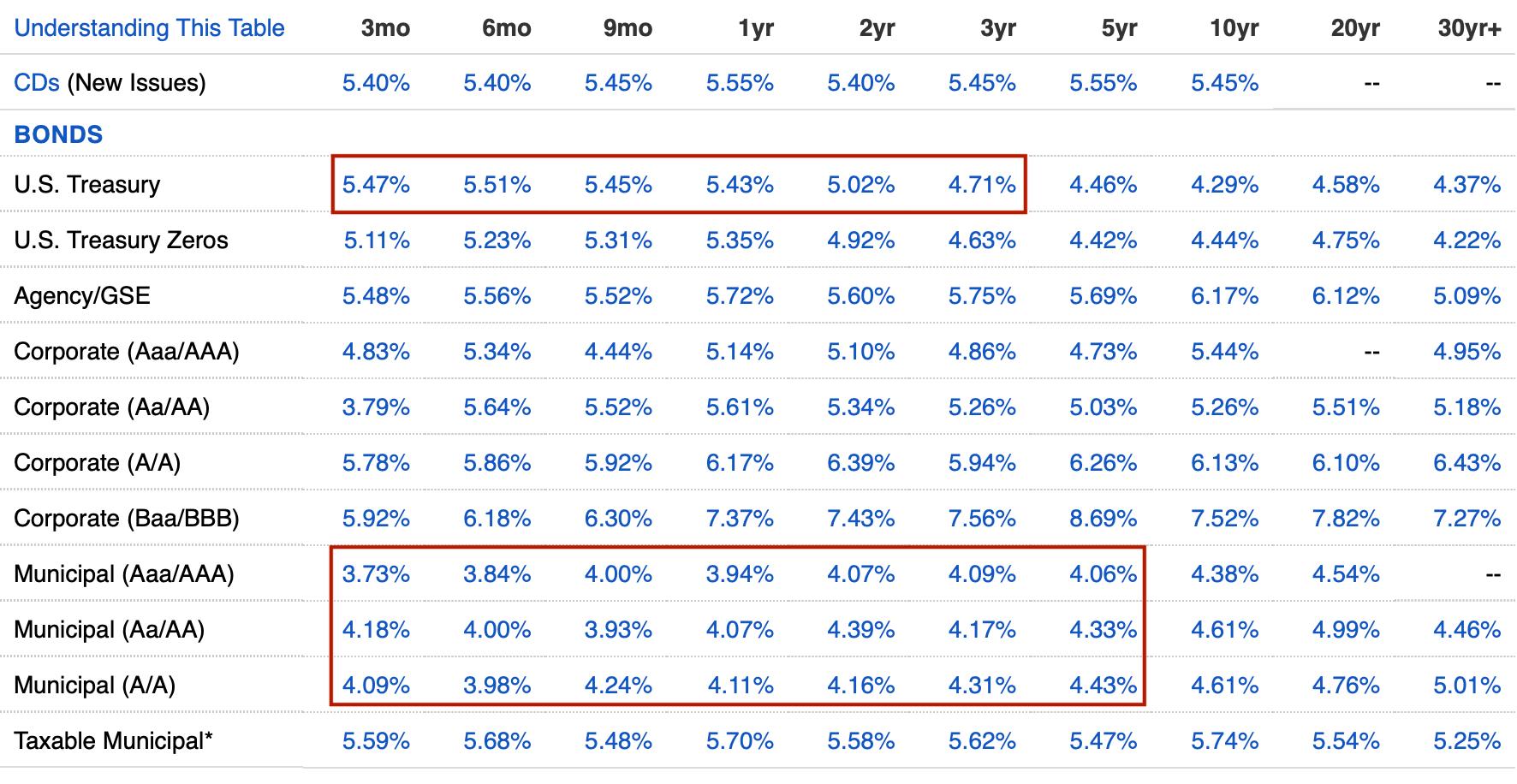

If you are in one of the top marginal federal income tax brackets, owning individual Treasury bonds is likely more appealing. Always calculate your AFTER-TAX yield before deciding to invest in a money market fund like SPAXX and an individual Treasury bond. The same thing goes if you want to invest in individual municipal bonds.

The fixed income market is efficient, especially the Treasury bond market. As an investor, you always want to shop around and compare gross interest rates and after-tax interest rates. Below is a bond table by Fidelity that gives you an idea of various yields and maturities.

Money market and bank deposits hold a steady value of $1.00 per share, so neither has capital gains when it is sold.

SPAXX, FZSXX Are Attractive Money Market Funds

When interest rates are high, investing in prime money market funds like SPAXX and FZSXX are attractive. Vanguard also has an excellent money market fund, VMFXX, which has a very competitive yield as well.

If you want to achieve financial freedom, spending recklessly is the opposite of what you should do in a high interest rate environment. Instead, save aggressively and patiently wait for buying opportunities as some asset prices decline.

Based on the downward trajectory of interest rates since the 1980s, high interest rates aren’t likely to last for more than three years. Therefore, it behooves you to take advantage of money market funds that pay high dividend yields.

When interest rates go back down again, that is when you can rationally start spending more money and investing in riskier assets.

Alternative Investments To Money Market Funds

In addition to investing in money market funds with my ideal cash, I’m also investing in real estate on the west coast. Prices are down from their peaks, but tech growth stocks are back to near all-time highs.

I’m also investing in opportunistic credit funds that are lending to good sponsors and developers at higher interest rates. My hope is to earn 12% – 13% returns with more risk.

When interest rates eventually decline, real estate demand will skyrocket again due to years of pent-up demand. I want to get ahead of that curve. My favorite private real estate investment platform is Fundrise, where you can invest in funds with as little as $10. Fundrise manages over $3.3 billion and predominantly invests in Sunbelt residential real estate where valuations are lower and yields are higher.

Subscribe To Financial Samurai

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Please share, rate, and review!

Join 60,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

Source: https://t-tees.com

Category: WHEN