Based on Bitcoin’s past market cycles, we could expect the next crypto bull run to start after the Bitcoin halving in 2024 and reach its peak in late 2025. That said, the cryptocurrency markets are very unpredictable, so making any guarantees about future price movements is very difficult.

Crypto goes through bull and bear markets where prices tend to move in one direction with occasional deviations – these phases are often referred to as “bull markets” and “crypto winters”, respectively. Right now, we’re still in a bear market, and the prices of most top cryptocurrencies are down significantly from their peaks. While the prices of most crypto assets have rallied in the past couple of weeks, we are still far removed from being able to call the recent action a bull run.

You are viewing: When Is The Next Crypto Bull Run Expected

With this in mind, it’s not too surprising that many crypto investors are wondering when the next crypto bull run is going to happen.

In order to make an educated guess about when the next one will occur, we first need to look at the history of the crypto market’s bull markets and bear markets. So far, the cryptocurrency market has been led by Bitcoin, so let’s focus our attention on the history of Bitcoin’s market cycles.

Crypto bull run history: A brief history of Bitcoin bull runs

So far, Bitcoin has seen 3 major bull markets. The first major Bitcoin bull run came in 2013 when the price of BTC exceeded the $1,000 mark for the first time ever. After the peak at $1,150 in December of 2013, it took until January 2015 for the Bitcoin price to reach a bottom. The bottom was hit at a price of around $171, which represented an 85% decrease from the peak. Coincidentally, if you bought $100 worth of Bitcoin at those prices, your investment would now be worth over $200,000.

Bitcoin then began to climb in the second half of 2016, and the rally began accelerating massively in 2017. This Bitcoin bull run culminated in December 2017 when Bitcoin reached a new all-time high price of just under $20,000.

Interestingly enough, the peaks of the 2013 Bitcoin bull run and the 2017 Bitcoin bull run were almost exactly 4 years apart.

When the 2017 crypto bull run began losing steam, it took until December 2018 for Bitcoin to find a bottom. The bottom was reached at a price of about $3,200, which was a decline of roughly 84% from the $19,900 peak.

So, the 2013 and 2017 Bitcoin bull runs and subsequent bear markets had two things in common. In both cases, it took Bitcoin roughly one year to find a bottom after the peak of the bull run was reached. In addition, the drawdowns from peak to bottom were almost identical in terms of percentage (85% and 84%).

The third major Bitcoin rally happened in 2021. This rally reached its peak in November of 2021 at a price of $68,770, which is the Bitcoin all-time high at the time of writing this article. Notably, this peak also came roughly 4 years after the peak in the previous BTC bull run.

So far, the lowest price level reached following the November 2021 peak was $15,600, which was hit in November of 2022. In terms of timing, this more or less aligns with the previous two Bitcoin market cycles, in which it took Bitcoin about one year to hit bottom after reaching a bull run peak. From this perspective, Bitcoin could be a good investment at the moment.

In terms of the severity of the drawdown, the move from $68,770 to $15,600 represents a 77% decrease, which is a slightly lighter crash than what we’ve seen before, but is still a major decline.

At the time of writing, Bitcoin is trading at about $39,200, which is a 151% increase from the lows reached last November. This provides quite a bit of confidence that the $15,600 level was the bottom of this market cycle, although there’s obviously still a chance that we could see even lower prices moving forward.

When is the next crypto bull run expected?

If history is going to repeat itself, we will see a new Bitcoin bull run begin picking up steam sometime in 2024 and reach its peak in late 2025. Of course, we have to keep in mind Bitcoin has only been around for about a decade, so the sample size of Bitcoin market cycles is very small, and we could easily see the market start behaving in unpredictable ways.

The table below showcases the past three Bitcoin bull runs. The minimum drawdown between the peak and bottom price of Bitcoin during each period was at least 77%. Historically speaking, it takes around 4 years for Bitcoin to reach a new peak after bottoming out.

Read more : When To Prune A Maple Tree

Peak (date) Bottom after peak (date) Drawdown between peak and bottom 2013 BTC bull run $1,150 (December 2013) $171 (January 2015) -85% 2017 BTC bull run $19,900 (December 2017) $3,200 (December 2018) -84% 2021 BTC bull run $68,700 (November 2021) $15,600 (November 2022)* -77%

*Lowest price reached so far, not a confirmed bottom of the market cycle.

What will fuel the next crypto bull run?

The cryptocurrency and blockchain space is evolving very rapidly, and it’s already difficult to predict what will happen in the coming months, let alone years or decades. However, we can identify some catalysts that could contribute to a new crypto bull run starting to take form. Arguably, the most important fundamental event that could spark a new crypto bull run is the next Bitcoin halving.

In January, we saw the approval of the first spot Bitcoin ETFs in the United States market. These instruments give investors who are accustomed to investing through the traditional market infrastructure to access Bitcoin more easily. In the event of a crypto bull run, this could open the floodgates to a much larger amount of capital to enter the Bitcoin market than we’ve seen in previous bull runs.

Bitcoin halving

Bitcoin halvings are a mechanism built into the Bitcoin protocol that triggers approximately every four years. When a Bitcoin halving happens, the amount of BTC received by Bitcoin miners as a reward for adding a new block to the Bitcoin blockchain is reduced by half. This is generally seen as bullish for Bitcoin, as it reduces the supply of new BTC coins entering the market.

The current Bitcoin block reward is 6.25 BTC, and the next Bitcoin halving will reduce it to 3.125 BTC. At the time of writing, the next Bitcoin halving is expected to occur in April 2024. While the exact date and time of the Bitcoin halving is difficult to determine due to the constantly changing Bitcoin network conditions, we can more or less safely say that the next Bitcoin halving will happen sometime in the spring of 2024.

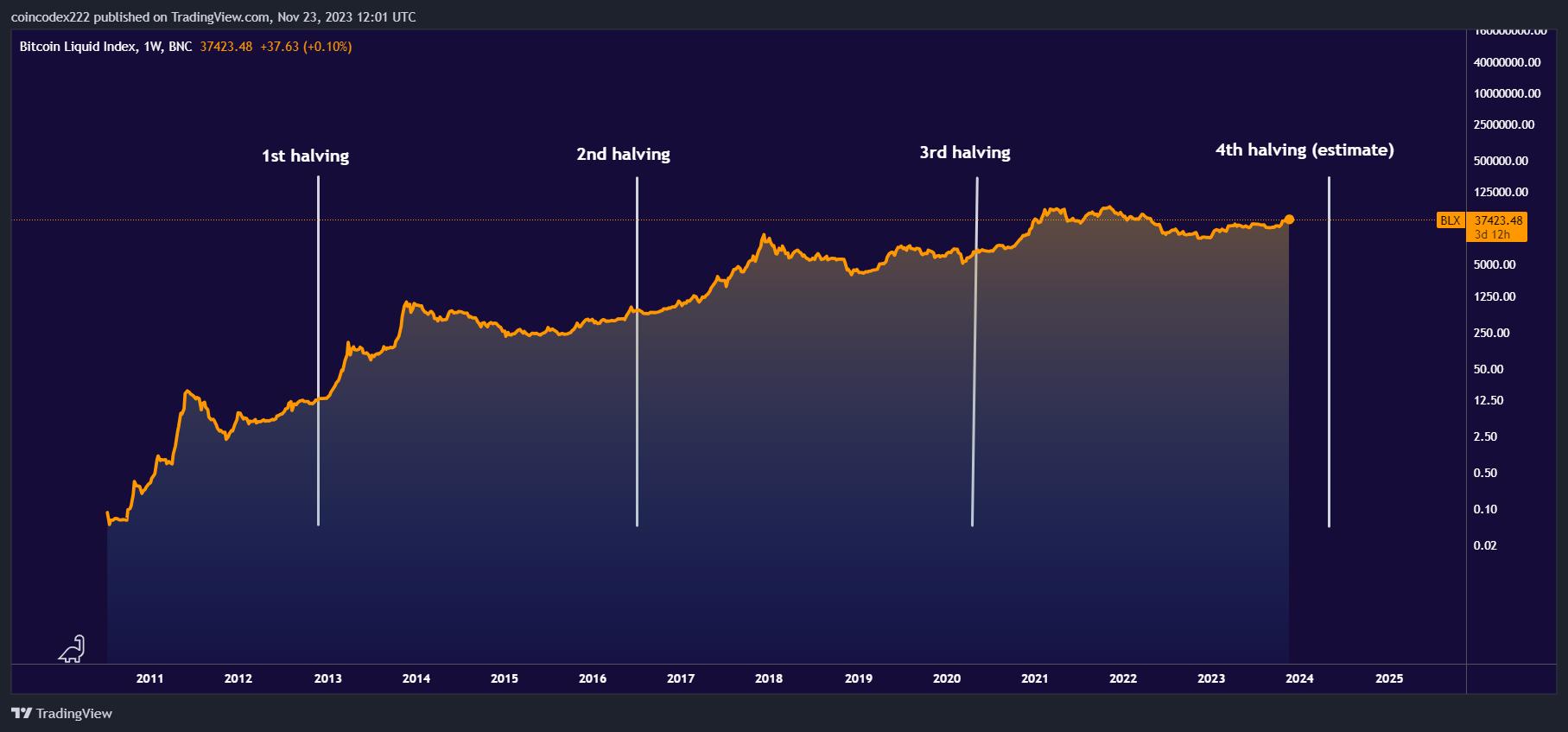

There have been three Bitcoin halvings so far, and each of them was followed by a bull run in the Bitcoin markets. In fact, BTC has reached a new all-time high in each of its 4-year halving periods so far, which you can see on the chart below.

If this trend is going to continue, we could see a Bitcoin bull run starting to gain momentum in the second half of 2024 following the next Bitcoin halving.

Ethereum scalability improvements and the Ethereum triple halving

We’ve mostly discussed Bitcoin in this article, and for a good reason – Bitcoin is by far the largest cryptocurrency by market cap and has dedicated the pace of the crypto market so far.

However, there are also other major projects in the cryptocurrency and blockchain space, most notably Ethereum. While Bitcoin is heavily focused on the peer-to-peer digital currency use case, Ethereum takes things a step further and provides powerful smart contracts functionality that allows anyone to launch decentralized applications.

This has resulted in new types of products, including decentralized cryptocurrency exchanges, NFTs and marketplaces for trading them, decentralized lending protocols, and much more. While these use cases have attracted an impressive amount of users, Ethereum still hasn’t reached mainstream adoption.

One of the issues limiting Ethereum’s potential to reach a large number of users is scalability. To put it simply, Ethereum becomes extremely expensive to use when there is a surge in demand for making transactions on the Ethereum blockchain. This became painfully obvious during the 2021 crypto bull run when the average Ethereum transaction fee could spike above $50 at times.

We’re now in a mostly bearish period in the cryptocurrency markets, and the reduced demand has brought down Ethereum transaction fees considerably. However, fees would become a big issue again if users started to flock to the Ethereum blockchain.

Thankfully, the Ethereum community is well aware of the platform’s scalability limits. There are initiatives on both layer 1 and layer 2 to drastically improve scalability and provide fast and cheap transactions to a large number of users.

The progress on the layer 2 front is especially promising, as we’re seeing platforms like Optimism, Arbitrum, and Polygon zkEVM provide much more efficient alternatives that still benefit from the security of the Ethereum network.

Read more : When Is Parker Days 2023

If Ethereum’s scalability improves sufficiently, it could serve as the foundation for the next crypto bull run. So, if someone were to create a “killer app” for Ethereum that would attract massive amounts of users, the underlying infrastructure would actually be able to support it.

Another factor that will likely work in favor of Ethereum over the long term is the Ethereum triple halving. The Ethereum triple halving is a concept that describes three factors that are putting deflationary pressure on the circulating supply of ETH:

- Lower ETH issuance after the transition to Proof-of-Stake

- EIP-1559 (transaction fee burning)

- ETH staking temporarily removing coins from circulation

The Ethereum triple halving makes ETH a much more attractive asset to hold over the long term, as Ethereum has become slightly deflationary after the network transitioned to Proof-of-Stake consensus. If demand for Ethereum transactions continues to be strong, ETH will likely be deflationary for years to come.

What could go wrong?

Cryptocurrencies are still considered risk-on assets due to their considerable price volatility. Such assets tend to suffer during high-interest environments, which is exactly what’s happening at the moment, as many major economies are raising interest rates to combat inflation. For example, the U.S. Federal Reserve has announced ten consecutive interest rate increases, raising the Fed rate from 0.00 – 0.25% to 5.25 – 5.50%.

While the economic outlook has become a bit more optimistic lately, there are still many analysts that are convinced the US economy has no chance of avoiding at least a mild recession.

It’s difficult to predict what would happen to Bitcoin and other cryptocurrencies during serious macroeconomic turmoil, but crypto assets could very well take a hit as investors would likely look to park their money in safer bets. On the flip side, prominent investors like Kraken CEO Jesse Powell and Galaxy Investment Partners CEO Mike Novogratz believe that Bitcoin could reach $1 million due to its unique properties, like being immune to government-sanctioned monetary policies and its global presence.

Bitcoin price prediction 2024-2025: A crypto bull run prediction

If there is going to be another crypto bull run, it will most likely be led by Bitcoin. For another perspective of when the next crypto bull run could happen, let’s take a look at what the algorithmic Bitcoin price prediction on CoinCodex is forecasting for the future.

Currently, the Bitcoin price prediction suggests that Bitcoin has already entered the bullish phase, which will culminate with BTC reaching $116,000 in October 2024. After that, the price is predicted to drop into the $70,000 territory before establishing a second top above $175,000 in August 2025.

It’s worth keeping in mind that making a Bitcoin price prediction becomes increasingly difficult the further in the future we’re trying to forecast.

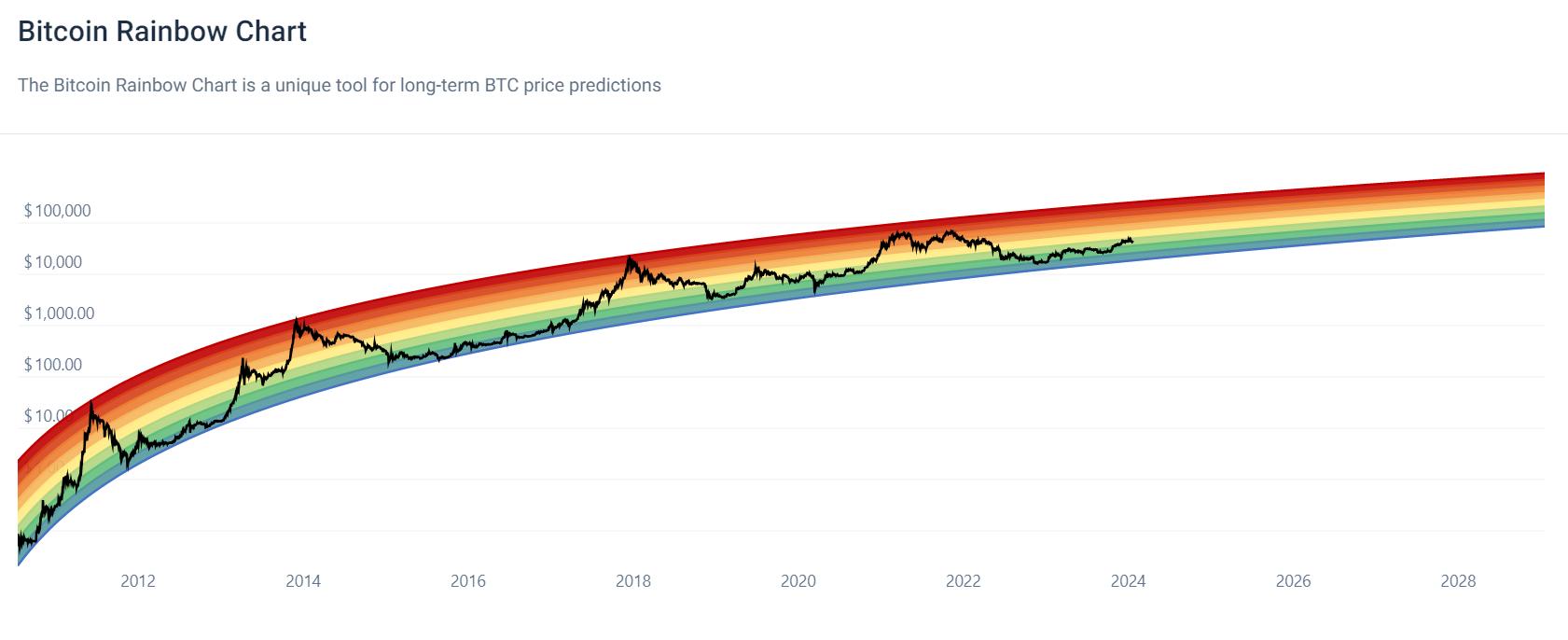

Another useful tool for predicting how the price of Bitcoin could move in the future is the Bitcoin Rainbow Chart. The chart uses color bands to show the range of possible prices for Bitcoin at any given time, thus offering invaluable insight into potential crypto bull run predictions. The colors go from dark red to blue, like a rainbow, hence the name. The red band is the most expensive, and the blue band is the cheapest.

According to the Rainbow Chart, Bitcoin is currently in the accumulation band (indicated by the green color). This means that according to historical price movements, now might be a good time to buy Bitcoin. We suggest you take a look at the chart yourself to see where the important price levels lie, and what the price trajectory of Bitcoin could look like in the future.

So, when is the next crypto bull run expected to happen?

If crypto’s past market cycles are any indication, we could expect the next bull run in the crypto market to begin in 2024, following the Bitcoin halving, and reach its peak towards the end of 2025. There are several indications that the crypto winter has ended and that we could already be at the summit of the next bull run.

From this perspective, investing in crypto at the moment could be worth considering. Outside of Bitcoin, developments on the Ethereum scalability front and the SEC’s approval of a Bitcoin spot ETF could also be an important catalyst for the next crypto bull run.

Crypto has a very short history, so it’s difficult to draw too many conclusions from such a small sample. However, we’re seeing some signs that history could be repeating. For example, the November 2021 Bitcoin peak came approximately four years after the peak in December 2017, and it took about one year after the peak for Bitcoin to reach its (current) bottom, which is what we also saw following the 2013 and 2017 bull runs.

If history is any indication, then now might be a good time to increase your exposure to BTC. If you don’t know where to start, or you feel like you don’t understand what investing in Bitcoin entails, feel free to check our ultimate guide on Bitcoin investing.

Source: https://t-tees.com

Category: WHEN