Key Takeaways

- At the dismay of Congress, members of state and national farm organizations, and countless other stakeholders, USDA fundamentally altered the methodology for delivering ad hoc disaster assistance to farmers impacted by catastrophic weather events. By implementing a progressive payment factor, and selectively reimbursing farmer-paid crop insurance premiums, USDA designed a disaster of a disaster assistance program by creating deliberate disparities in assistance available to farmers and ranchers harmed by natural disasters.

- USDA is openly acknowledging that the use of the progressive payment factor and select farmer-paid premium reimbursements creates winners and losers among farmers, benefiting approximately 80% of farmers eligible for disaster assistance at the expense of the remaining 20% with the largest economic losses due to catastrophic weather events.

- The Biden-Harris administration should pause implementation and delivery of the 2022 Emergency Relief Program (ERP) and determine an equitable and uniform approach to administer assistance to farmers and ranchers impacted by 2022 natural disasters rather than the current approach which penalizes producers who experienced the greatest financial harm.

It is well documented that members of Congress (here, here, and here), more than 140 state and national farm organizations, and other stakeholders (here, here, and here), are concerned about the methodology the U.S. Department of Agriculture (USDA) used to administer the 2022 Emergency Relief Program (ERP); an ad hoc disaster assistance program for farmers and ranchers impacted by eligible natural disasters, such as hurricanes, drought, and wildfires, in calendar year 2022. With the existing ERP structure for 2020 and 2021 disasters already in place, producers and Congress expected USDA to provide a similar and expedited approach for 2022. Despite this, and nearly a year after Congress provided the emergency assistance, USDA implemented two major changes to how this new disaster assistance program shall be administered that results in farmers with the most devastating losses receiving the least amount of relief.

You are viewing: When Will Erp Payments Be Made

Background

The Consolidated Appropriations Act of 2023 included $3.7 billion in agriculture disaster relief to help farmers and ranchers financially recover following weather-related crop and revenue losses. As Republican leaders of the Senate and House Agriculture Appropriations Subcommittees indicated in a letter the intent of Congress was “to mirror the funding and direction for ERP assistance in 2020 and 2021.” The previous ERP program for 2020 and 2021 was similar to the Wildfire and Hurricane Indemnity Programs and largely made program payments based on the type and level of coverage the producer purchased.*

For 2022, the ERP payments were expected to be factored (typically a uniform reduction in payment for all program recipients) given the budgetary constraints related to the funding appropriated for the agriculture disaster aid and the economic losses experienced by farmers and ranchers. Rather than equitably factoring all payments by the same uniform, pro rata amount, USDA instead chose a “Progressive Payment Factor” approach which benefits farmers with smaller losses at the expense of farmers devastated by natural disasters with more significant financial losses. USDA made this novel determination without Congressional direction, and instead of utilizing the previous methodology to determine ERP benefits. These payments are then again prorated by 75%.

Progressive Payment Factor

The initial payment amount for the 2022 ERP is nearly identical to the previous methodology in 2020 and 2021.* However, as previously referenced, the new modifications to the program payment include 1) the use of a progressive payment factor, and 2) the elimination of the farmer-paid crop insurance premium reimbursement for certain producers.

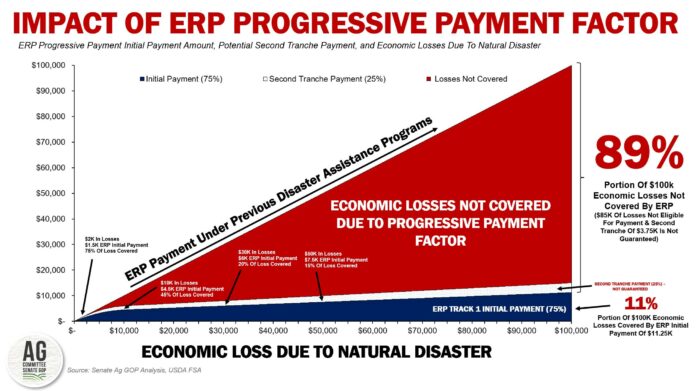

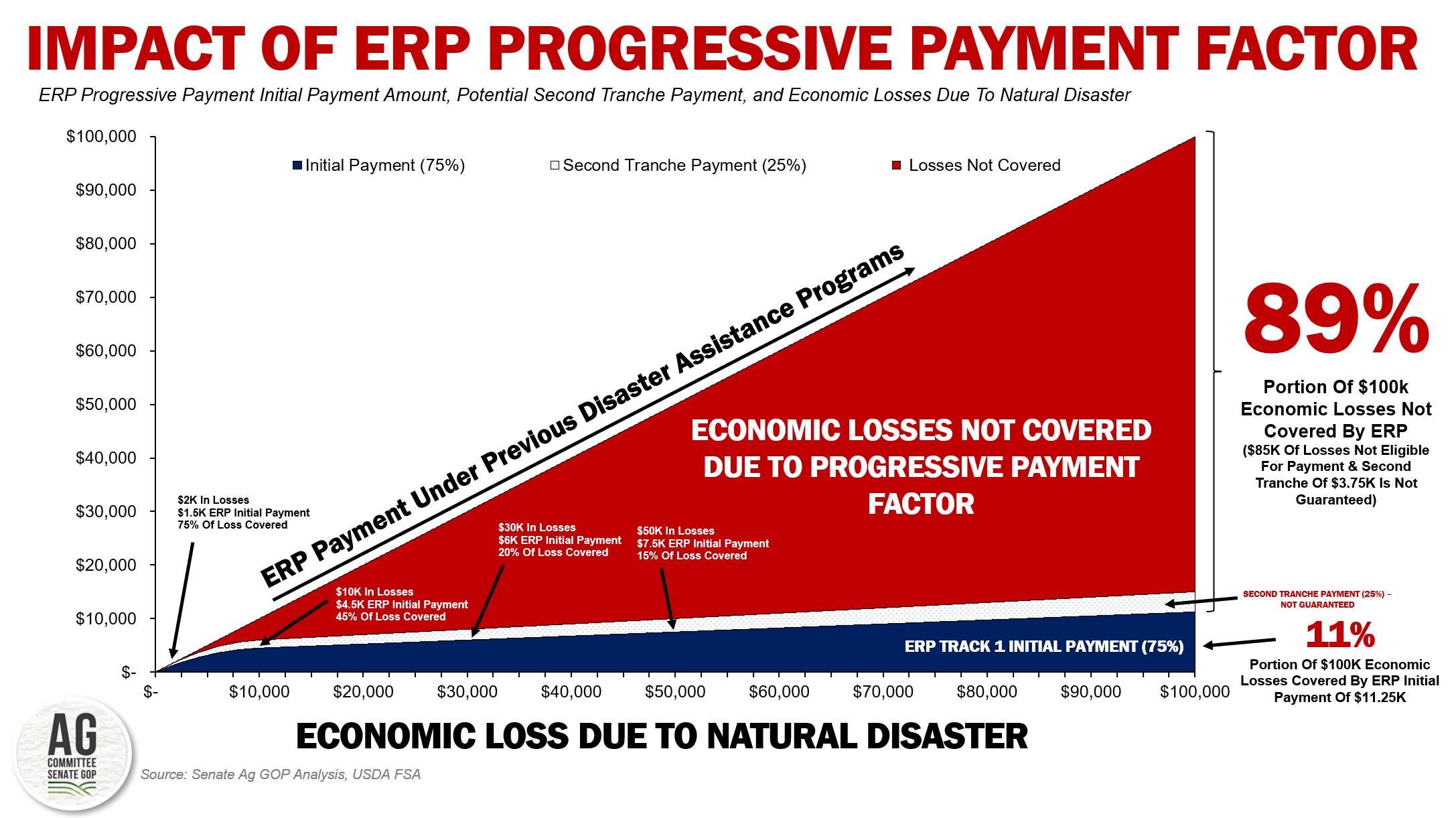

The progressive payment factor acts as a de facto payment limitation, despite Congress’s clear direction on payment limitations, and reduces the ERP initial payment progressively as economic losses increase. For the first $2,000 in losses,100% of the ERP payment is made; for losses between $2,001 and $4,000 80% of the ERP payment is made; for losses between $4,001 and $6,000 60% of the ERP payment is made, for losses between $6,001 and $8,000 40% of the ERP payment is made, for losses between $8,001 and $10,000 20% of the ERP payment is made, and finally, for losses above $10,000 10% of the ERP payment is made. These payments are then prorated by an additional 75%.

As an example, a farmer with an economic loss of $2,000 would be eligible for $1,500 in compensation with the initial payment and $500 in a possible second tranche payment, resulting in full compensation for the weather-related losses. Meanwhile, a farmer with $50,000 in losses would receive an ERP initial payment of $7,500, representing 15% of the economic losses, and if a second payment is made would receive up to an additional $2,500. Importantly, for farmers with large weather-related economic losses, a large portion of their economic losses are not covered by this version of ERP. Benefits sharply decline as economic losses mount to the extent that a farmer with $100,000 in losses is only guaranteed to receive an ERP payment of $11,250 or 11% of the total loss.

The Consolidated Appropriations Act of 2023 provided legislative direction on how USDA should apply fair and equitable payment limitations regarding ad hoc disaster assistance. Unfortunately, USDA has ensured producers face yet another economic disaster through the poor implementation of the progressive payment factor for ERP for 2022.

Creating Winners and Losers

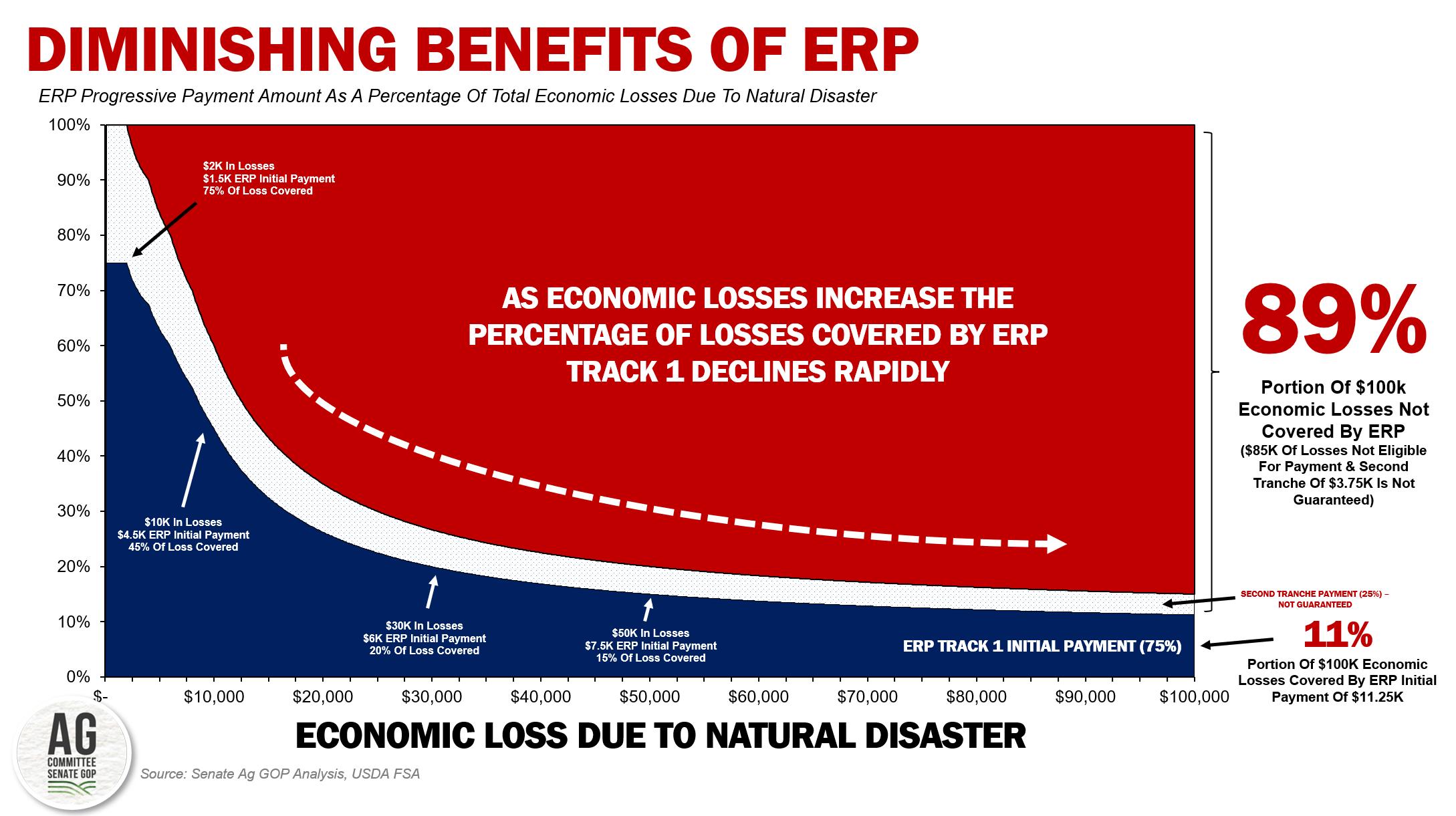

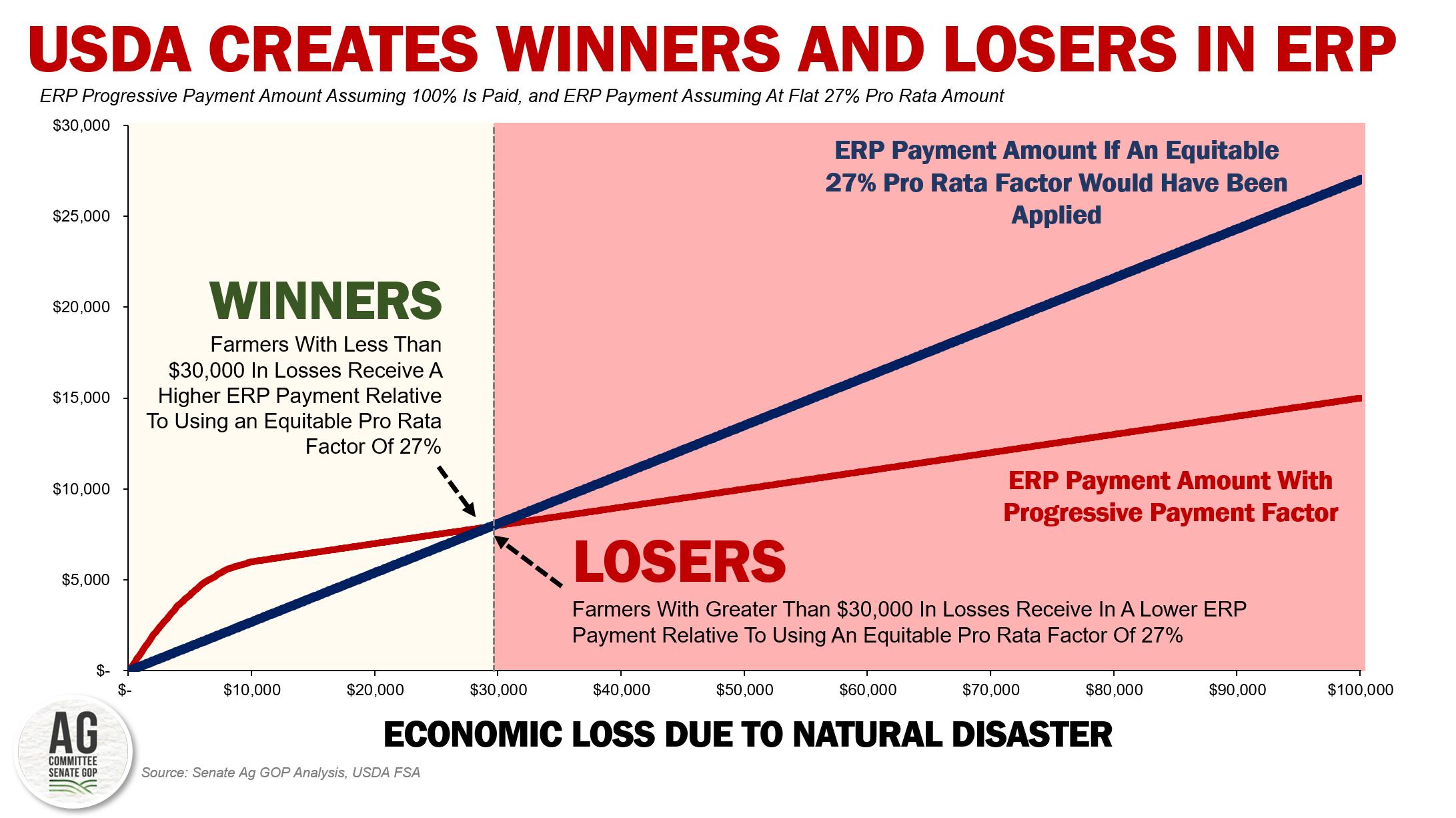

To demonstrate the inequity that is created under the progressive payment factor approach, consider instead uniformly pro-rating all ERP payments by 27% so that all farmers harmed by weather-related disasters would equitably receive an ERP payment equal to 27% of the initial ERP payment amount.

Instead, by using the progressive payment factor, farmers with less than $30,000 in losses, an estimated 80% of farmers, will receive higher ERP program payments relative to an equitable pro rata approach, and farmers with economic losses greater than $30,000 will receive a lower ERP program payment relative to a pro rata approach. USDA is deliberately penalizing 20% of farmers eligible for ERP disaster assistance to inequitably favor the 80%.

Read more : When Is Chuy’s Full Menu Coming Back

Then, in addition to the progressive payment factor creating winners and losers among farmers, USDA departed from the previous ERP program by specifically reimbursing farmer-paid premiums only for select producers completing a CCC-860 form.

As Congress intended, prior disaster assistance programs reimbursed all producers for their farmer-paid premiums as a way to avoid punishing producers who purchased crop insurance policies to help mitigate risk. In creating the 2022 ERP, USDA chose to establish a perverse disincentive regarding purchasing crop insurance by abandoning the historical practice of reimbursing all farmer-paid premiums.

Conclusion

As part of the Disaster Relief Supplemental Appropriations Act for 2023, Congress provided $3.7 billion in disaster relief funding to USDA and intended for the Department to mirror the funding and direction for ERP assistance as delivered in 2020 and 2021. Instead, the Department made a series of modifications to the program without Congressional direction or consultation that severely limits the ad hoc disaster support provided to farmers and ranchers across the U.S. and deliberately disadvantages family farms that experienced the most significant economic losses.

Instead of maintaining the historical practice of applying a pro-rata, uniform, and equitable approach that would treat all farmers experiencing a weather-related economic loss the same, USDA applied a progressive payment factor that reduces support for higher economic losses and then selectively reimburses farmer-paid premiums on crop insurance – changes that when combined penalize farmers and create winners and losers among farmers who are already faced with immense economic uncertainty given recently experienced catastrophic natural disasters, historic inflation, and record volatility in the farm economy.

USDA recognizes that they are deliberately penalizing 20% of farmers eligible for ERP disaster assistance to inequitably favor the 80%. The solution is a request that has been echoed by members of Congress and stakeholders alike: the Biden-Harris administration should pause implementation and delivery of ERP and determine a more equitable approach to assisting producers impacted by 2022 disasters. Any effort short of that fails agriculture and fails family farmers who have already suffered significant economic harm due to extreme weather events.

*Under the previous version of the ERP Phase 1, program payments for farmers who received a crop insurance indemnity were calculated based on the expected value of the crop, the actual value of the crop, the salvage value associated with the crop, unharvested, or prevented planting factor, indemnities received by the farmer, and the amount of the farmer-paid premium. The expected crop value was a function of the crop insurance coverage level adjusted by an ERP factor. For example, for a farmer who purchased 80% crop insurance revenue protection coverage, the ERP factor would be 92.5%, resulting in a 12.5% increase in the expected value of the crop, i.e., 92.5% – 80%. Payments were then prorated by 75% to ensure adequate funding was available to assist all eligible producers.

Source: https://t-tees.com

Category: WHEN