The General Fund

The general fund is the main part of the budget. It pays for public safety and regular operations and is the part that gets the most attention. The charts below shows where general fund money comes from and where it goes.

You are viewing: Where Is Yucaipa California

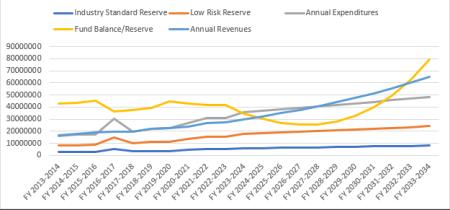

The graph below tells the story of the condition of the City’s general fund. It shows how our ongoing expenditures have outgrown revenues and how that affects our reserve balances. It also compares our reserves to industry standards.

Here are some takeaways from this graph:

- The City is in good financial condition as it relates to reserve balances. This means the City has run budget surpluses for many years and has plenty of money in the bank to weather a “rainy day.”

How do we know this? The yellow line represents the City’s reserve balance. Government accounting standards recommend maintaining fund balances to cover two months of spending. The dark blue line shows this minimum standard. When the state assesses municipal health, it uses a six-month standard. The orange line represents the state’s standard. You can see that the City’s reserve balance far exceeds those standards. In fact, our reserves exceed what we need to cover an entire year of spending.

- Revenues have trended up at a steady pace for more than a decade.

How do we know this? The light blue line shows City revenues. It has grown at a steady 4% rate.

- Expenditure growth has outpaced revenue growth, leading to a structural deficit in 2019.

How do we know this? The grey line represents spending. Aside from 2017 (which shows planned costs associated with building the Yucaipa Performing Arts Center), the grey and light blue lines match each other, showing balanced budgets. In 2019, the grey line begins to trend above the light blue line, showing a structural deficit. Projections show this imbalance to persist for several years.

The bar chart below shows more clearly the start of the structural deficit in 2019.

- Operating in a structural deficit reduces our reserve balances. This means that as spending exceeds revenue, we must dip into reserves to cover the deficit.

How do we know this? As the grey line exceeds the light blue line, you can see the yellow line begin to fall. This pattern will persist until the City returns to structural balance.

- By taking action now to restore balance, we can prevent the City’s reserves from dropping below industry standards. The earlier we take action to correct course, the less severe the actions we have to take.

How do we know this? This graph includes a few assumptions starting in 2023-2024. The assumptions are that the City will hold expenditure growth to 3% (in reality, escalating public safety costs may drive expenditure growth well above 3%) and increase cost recovery and revenue by 8%. According to these assumptions, you see the teal line dip as we use reserves to cover deficits. The yellow line then begins to recover around 2027-2028, before going below the state’s standard for good fiscal health. Without immediate action, expenses will outpace revenues at a rapid pace. Reserves would begin to drop below the state and industry standard in rapid succession. At this point, the City would be in critical financial condition. Like many areas of life, taking immediate action to address a potential issue prevents damages from growing.

A Holistic Look at City Spending

Although the general fund gets the most attention, the City has dozens of other funds. These other funds include special revenue funds. Special revenue funds exist to collect and spend money for a specific purpose. Gas taxes for road improvements and repairs is an example. When you fill up your gas tank, part of the taxes you pay are allocated to the City where they are deposited into an account that can only be used for road improvements and repairs.

Although general fund spending began exceeding ongoing revenues in 2019, the City’s spending city-wide has exceeded total revenue for many years. The graph below shows city-wide revenues and spending, which includes special revenue funds.

When you look at all city funds, you see that we have been out-spending revenues for years. These don’t show up in the general fund, but they have a delayed impact on the general fund. Most of this spending relates to project construction. As we complete construction, the costs move to the general fund as the City must pay to operate and maintain the new facilities.

Cost Drivers

Yucaipa is facing four large cost drivers: 1) project construction, 2) increasing staffing/maintenance demands, 3) public safety, and 4) inflation.

Project Construction

Read more : Where Is The Githyanki Creche

In the chart of all city funds above, we see the City out-spending revenues for several years. Most of this spending relates to project construction. The City has spent years building projects. As those projects come online, the City’s operations become more complex as there’s more facilities to staff and maintain.

Staffing and Maintenance Demands

Related to above, as new facilities come online, costs move to the general fund. Staffing and maintenance are general fund expenses. Although the City enjoys some great facilities, it comes at a cost.

As population grows, there are more demands for services (e.g., police, fire, road maintenance, recreational activities, etc.). As the City runs a lean operation and existing staff are spread thin, this means the City must hire additional staff to provide the needed level of services.

Public Safety Costs

Public safety accounts for more than 50 percent of our budget and is growing at a rapid pace. As a contract city, the state and county pass along their costs to us. We expect regular cost increases, but the state just approved a large pay and benefit increase for CalFire fire fighters. It is very difficult to negotiate cuts to these contracts without losing boots on the ground.

Another complication is that the voter-approved paramedic assessment lacks an inflation factor. Every year money generated from that assessment shrinks in buying power, putting more pressure on the general fund.

Inflation

Inflation continues to drive up the costs of construction, services, payroll, and other aspects of doing business.

Path Forward

In the coming year, staff will actively look for ways to keep costs flat and to improve cost recovery. All options for restoring structural balance will be explored. Our financial projections indicate that we can take several years if necessary to restore balance with minimal impact on services. However, ultimately the goal must be to return to a balanced budget, and we will endeavor to do so as expeditiously as possible.

Conclusion

Yucaipa has a long history of budget surpluses. Thanks to those surplus years, the City has strong reserves. However, due to years of construction, the increased complexity of City operations, rising public safety costs, and inflation, expenditures have risen faster than revenues. When you consider ongoing revenues and expenditures, the City entered a structural deficit in 2019. If we don’t act now, projected deficits will grow and deplete City reserves in the coming years. The City has time and resources to correct course with minimal impact to services, but it will require some tough decisions in the days ahead.

FAQs

What surprises did you encounter in this year’s budget?

The City of Yucaipa follows conservative financial practices. It operated budget surpluses for years. It has strong reserves and low debt. However, since 2019, the City’s ongoing costs have exceeded its ongoing revenue. This is a structural deficit.

Can the City pay its bills?

Although it’s not ideal, operating a structural deficit is not as bad as it sounds. Many government agencies go through periods of operating a structural deficit. It does not mean that the City is out of money. Because the City operated budget surpluses for so many years, we have strong reserves. We can use those reserves while we work to return to structural balance.

Read more : Where Does The Ecs Constant Go

Reserves, Savings, “Rainy Day Fund,” What’s the Difference?

Yucaipa has about $38 million in reserve. Reserves include cash and other assets, including receivables from interfund loans. Of that $38 million, about $20 million is available in the form of cash. This $20 million is akin to a savings account, or “Rainy Day Fund.”

How did we get here?

Our revenues have trended up at a steady pace for the last decade, about 4%. However, our costs have risen at a faster pace, about 8%. This imbalance is years in the making and caused by several factors.

Public Safety Costs. Police, fire, and paramedic services account for half of the City’s expenses. We contract with the San Bernardino County Sheriff and Cal Fire for these services. When the state and county approve raises and benefit increases, we pay those costs.

We expect public safety costs to rise every year. However, the state approved a new contract with Cal Fire firefighters that exceeds our expectations. This contract granted raises, benefit increases, and reduced work hours. Our costs will rise beyond expectations, as a result.

Paramedic Expenses. In 2004, voters approved a measure to pay for paramedic services. That measure did not include an inflation factor. The cost of paramedic services now exceeds the revenue generated by the assessment. The imbalance gets worse every year.

Years of Building Projects. Yucaipa has some great public facilities: Community Center, City Hall, Fire Station No. 3, Police Department, YPAC, flood control, parks, etcetera. We’ve been busy at work in recent decades delivering these projects. As these projects come online, the cost to staff and maintain them move to the general fund. Because the City runs lean, existing staff can’t absorb new responsibilities. This means the City has to hire more people or risk closing programs and facilities. As a result, we see more demand for general fund support.

Growth. As the City continues to grow, demands on City government rise. Yucaipa’s staffing levels haven’t kept up with the growing population of the City and are lower than cities of similar size. The FY 23-24 budget includes some additional positions in human resources, accounting, IT, and other critical areas. This year’s budget includes these new positions, so spending in future years won’t accelerate at the same rate.

Why are we just now finding out about this?

As you see, the City’s expenses have grown, and it’s not due to wasteful spending. When projects come online, they make the City’s operations more complex. Complexity increases costs. And these costs come as the City has seen its public safety costs rise at a rapid rate.

These costs began to exceed our revenues in 2019. One-time federal relief funds issued in response to COVID helped the City cover its deficits (that money will be fully spent after the upcoming fiscal year). As a result, while the budget may have looked balanced, it only appeared that way on the surface due to the one-time relief funds that were used to plug the gap. In reality, a structural deficit existed and was growing larger since 2019.

In addition, the City was acutely aware of the growing deficit in the fire fund, which is why it submitted Measure E to the voters in 2019, proposing a ½ cent sales tax to help increase revenue. However, this measure failed to pass.

What’s the significance of all of this?

Structural deficits are only a problem if you run out of money. We are in the fortunate position to have strong reserves. Our reserves provide a cushion for us to take the necessary steps to return to balance. It is important to act now, because the sooner we act, the less severe the actions we need to take later. We want to preserve our reserves, and this requires fixing our deficit spending.

What’s the plan to return to a structurally balanced budget?

Staff is preparing options for Council consideration to ultimately restore balance. In relation to the Fiscal Year 2023-2024 budget, we can take one of two general courses of action: 1) drastic cuts to services such as police, fire, road maintenance and recreational programming to restore balance sooner, or 2) a longer-term approach that holds costs as flat as possible and utilizes more of our reserves (i.e. running a deficit) in the short term until a plan is devised and implemented to restore balance, which could take two or three budget cycles to achieve. The City Council directed staff to pursue the second path.

Where Can I View Previous Budgets?

You can view previous budgets by following this link: https://yucaipa.gov/city-manager/

Source: https://t-tees.com

Category: WHERE