Unsystematic Risk vs. Systematic Risk: What is the Difference?

Broadly put, risk is an inevitable part of investing, regardless of the hedging and risk mitigation strategies utilized.

The concept of risk can be broadly segmented into two distinct categories: unsystematic and systematic risk.

You are viewing: Which Of The Following Are Examples Of Unsystematic Risk

Unsystematic risk is specific to a company (or industry), whereas systematic risk has much broader implications that affect the economy and financial markets as a whole.

- Unsystematic Risk → Unsystematic risk is company-specific (or industry-specific) risk that can be reduced through portfolio diversification. Some common examples of sources that cause unsystematic risk are unexpected supply chain shutdowns, regulatory changes, and industry headwinds from technological innovation. The effectiveness of portfolio diversification rises if the portfolio contains less correlated investments in different asset classes, industries and geographies.

- Systematic Risk → Systematic risk, often called “market risk”, is inherent to the entire economy and global financial markets, rather than affecting only one particular security or industry. With regard to portfolio diversification, systematic risk cannot be mitigated because of the risk’s broad scope and reachability. The sources of systematic risk include economic indicators (GDP), the interest rate environment, and geopolitical events (e.g. global conflicts). For instance, a global pandemic such as COVID-19 is a recent example of systematic risk with implications that affected essentially all industries.

Does Portfolio Diversification Mitigate Unsystematic Risk?

The notable characteristic of unsystematic risk is the fact that the risk can be mitigated through portfolio diversification, i.e. the strategic inclusion of uncorrelated assets in a portfolio.

Because of the far-reaching scope of systematic risk – wherein the entire economy and financial markets are placed in a position of vulnerability – portfolio diversification is incapable of mitigating it.

Portfolio diversification is by far the most effective method to reduce unsystematic risk, as investing in various securities and asset classes spreads the company and industry-specific risk.

By maintaining a diversified portfolio with holdings across different, uncorrelated securities or asset classes, an investor can reduce the impact of idiosyncratic risk on the returns of the overall portfolio.

Company and industry-specific risks are mitigated by “spreading” the risk across a wide range of investments in different securities, asset classes or geographies.

Read more : Which Is Not A Feature Common To All Games

However, the degree of the impact is not evenly distributed across all industries, as some will be able to recover and return to normalcy far more quickly than others, while others could suffer irreparable monetary losses, resulting in financial distress and requiring restructuring (i.e. filing for bankruptcy protection).

Since unsystematic risk impacts the returns on a specific security (or sector), the risk causes the variability in returns that are not attributable to general economic conditions and market forces (e.g. the interest rate environment).

However, while diversification in theory can substantially reduce the volatility in a portfolio’s returns, it is still not an absolute certain guarantee against potential losses.

What is an Example of Unsystematic Risk?

One recent example of unsystematic risk is the downfall of BYJU’S, a leading privately-held online learning EdTech platform and formerly one of India’s highest valued startups.

Earlier in 2023, BYJU’s had raised more funding at a valuation cap of $22 billion. Since the pandemic, the management team of Byju undertook an aggressive approach to achieve growth at all costs by engaging in M&A.

BYJU’s acquired dozens of companies in their niche, such as the following:

- Aakash

- GradeUp

- LabInApp

- Scholr

- HashLearn

- WhiteHat Jr.

- Great Learning

- Tynker

- GeoGebra

The outcome of the aggressive roll-up strategy and reliance on debt financing?

At present date, BYJU’s is facing a liquidity crisis and missed an interest payment, so it is amid negotiations with creditors as part of out-of-court restructuring.

Byju Liquidity Crisis and Financial Distress (Source: Bloomberg)

BlackRock, a minority investor in BYJU’s, wrote down the startup’s valuation by nearly two-thirds to $8.4 billion.

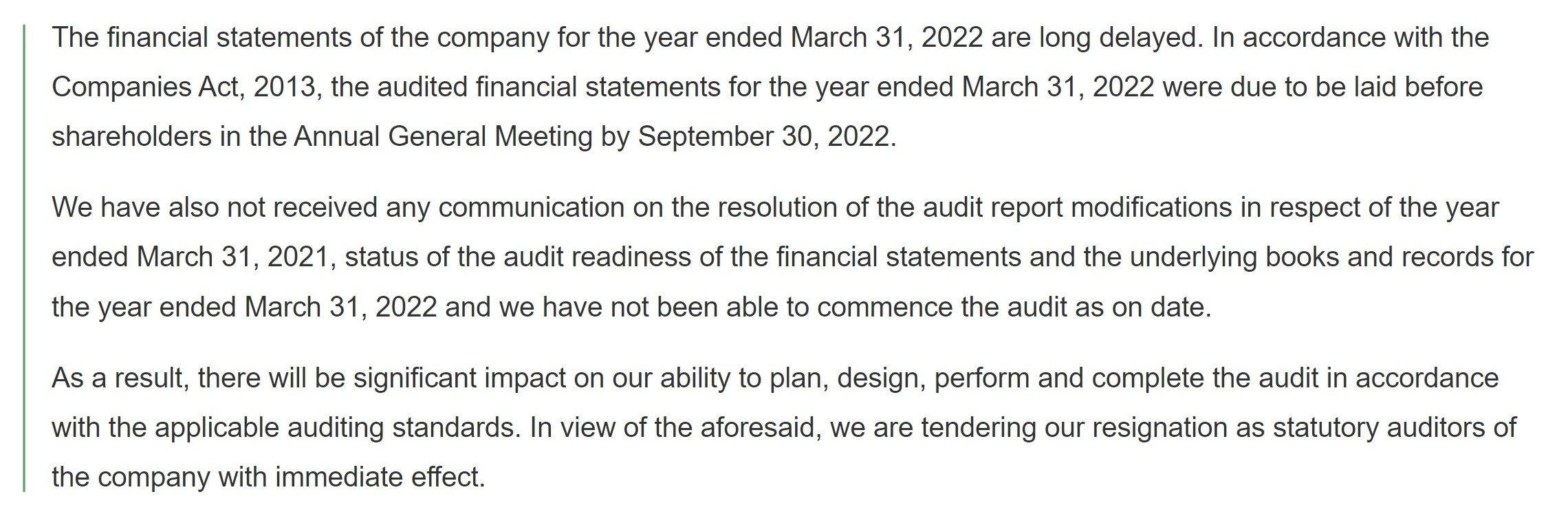

To further escalate the concerns regarding its financial health, Deloitte, the auditors of BYJU’s, stepped down after management continued to delay their obligations to provide their financial statements with minimal communication.

Deloitte Auditor Statement (Source: TechCrunch)

In general, the inability for a company to meet their deadlines to submit financial reports on time is a significant red flag that points towards potential accounting fraud.

Soon after, several board members also left the startup and former partners have disassociated with the startup, which are all negative signs that more legal troubles lie on the horizon.

The reason that the recent financial troubles BYJU’s is an example of unsystematic risk is because the sources of the problems were primarily internal in nature, such as the seemingly overambitious roll-up strategy, reliance on too much debt financing, and management’s inability to meet financial report filing deadlines.

Source: https://t-tees.com

Category: WHICH