Most customers of small businesses typically purchase products on credit. In other words, they promptly provide the goods and services, send an invoice, and then receive payment a few weeks later. Businesses keep track of all the money their customers owe them using an account in their books called Accounts Receivables.

Here, we’ll discuss What Is Accounts Receivables, Accounts Receivables Meaning, how Accounts Receivables function, how it differs from accounts payable, and how good accounts receivables management may help you get paid more quickly.

You are viewing: Which Of The Following Best Describes Accounts Receivable

What is Accounts Receivables (AR)?

Accounts Receivable (AR) are the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. Accounts Receivables Balance Sheet as a current asset. Any amount of money owed by customers for purchases made on credit is AR.

The term “Accounts Receivables” describes the unpaid bills or cash that customers owe a business. The term describes accounts that a company is entitled to get since it has provided a good or service. Receivables, also known as Accounts Receivables, are a company’s line of credit that typically include terms that call for payments to be made within a somewhat short time frame. It typically ranges from a few days to a fiscal or calendar year.

Due to the customer’s legal duty to pay the debt, businesses include accounts receivables as an asset on their balance sheets. They are regarded as liquid assets since they can be pledged as security against a loan to cover immediate expenses. It typically ranges from a few days to a fiscal or calendar year.

Where can you find Accounts Receivable?

Your Accounts Receivables balance can be seen on Accounts Receivables Balance Sheet or general ledger under the heading “current assets”. Because they add value to your business, Accounts Receivables are categorized as an asset. (In this situation, as an upcoming monetary payment.)

Your main ledger will display your total amount in Accounts Receivables, but to examine individual client outstanding balances, you’ll typically need to consult the Accounts Receivables subsidiary ledger.

Why Accounts Receivable Management is so important?

AR is a vital part of a balance sheet because it represents bills that should be paid to a company and could require steps for collection.

Payments of Accounts Receivables can lower a business’s debt, lower financing costs, and enhance cash flow, which can then be used to raise dividends, invest in Capex (capital expenditures), raise risk capital, or provide new products and services.

The Accounts Receivable Process

ACCOUNTS RECEIVABLE CYCLE

When a business sells a good or service and includes payment terms, discounts, or credit guidelines in an invoice to the client, the AR process begins. When payments are received, receipts must be given back, and the payment must be noted.

Companies must have strict policies in place for extending credit, promptly collecting unpaid debts, and maintaining accurate client information. Payments must also be applied to the right client and specific invoice in order to maintain accurate Accounts Receivables.

A corporation may employ an AR clerk whose responsibilities include monitoring accounts to see if they are past due, calling clients to prompt payments, answering client inquiries, maintaining accurate records, and bookkeeping.

An aging report is used by a company’s collections department to keep track of and display unpaid invoices from clients along with the length of the bill’s existence, typically in increments of 30, 60, 90, or more days. A company’s ability to recover payments and lower its Accounts Receivables can be assessed using an aging report.

A lot of companies also market software for automating Accounts Receivables administration and connecting the procedure with an ERP (enterprise resource planning) system, including Oracle, Workday, and SAP.

Streamline your business operations by making people pay faster

While following up on past-due customer payments can be difficult and time-consuming, doing so early on can help you avoid a lot of headaches in the future. Here’s how you can motivate clients to make prompt payments.

What is the “allowance for uncollectible accounts” account?

If you run a business long enough, you will eventually encounter customers that make payments either late or not at all. We refer to it as a bad debt when a customer doesn’t pay and we are unable to recover their receivables.

Long-running companies frequently estimate their overall bad debts in advance to ensure that the Accounts Receivables listed on their financial statements aren’t excessively large. To do this, they will create a mechanism known as a “allowance for uncollectible accounts”.

Let’s imagine your anticipated year sales total is $120,000 and you’ve discovered that on average you won’t collect 5% of your Accounts Receivables.

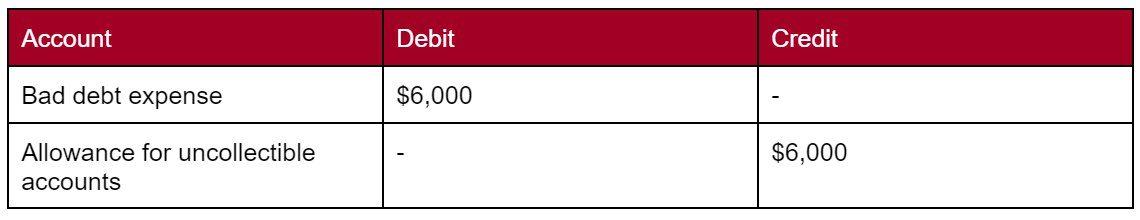

You might increase total sales by 5% ($120,000 * 0.05) to determine your bad debts for the year. Then, you would debit “bad debt expenditure” by the same sum ($6,000) and credit “allowance for uncollectible accounts” with the result:

What happens if my customers/ clients don’t pay?

We must deduct an Account receivable as a bad debt expenditure when it is obvious that the money won’t be paid.

Let’s imagine that after a few months of waiting, contacting him on his cellphone, and speaking with his relatives, it is evident that Keith has vanished and won’t be paying the $500 invoice you sent him.

Read more : Which Is An Advantage Of Purchasing And Owning A Home

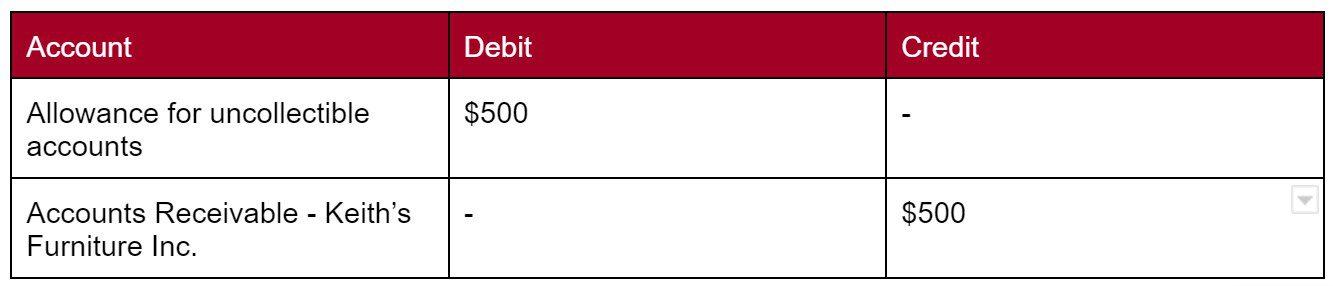

To reduce it by $500 in this instance, you would debit the “allowance for uncollectible accounts” by $500.

Why?

Keep in mind that the allowance for uncollectible accounts account is only a projection of the amount you won’t be able to recover from your clients. There is no longer any doubt as to who will not pay if it is known that a specific consumer won’t.

After making the necessary adjustments to the uncollectible accounts, you would then credit “Accounts Receivables—Furniture Keith’s Inc.” with $500 and deduct it from that account by the same amount. Keith no longer owes you $500 because we’ve determined that the invoice you provided is uncollectible.

The consequent journal entry would be as follows:

What happens when they end up paying you after all

Let’s assume that after a few more months, a mysterious package without a return address shows up in your mailbox. It’s a $500 check from Keith’s Furniture Inc.; he did, after all, pay you!

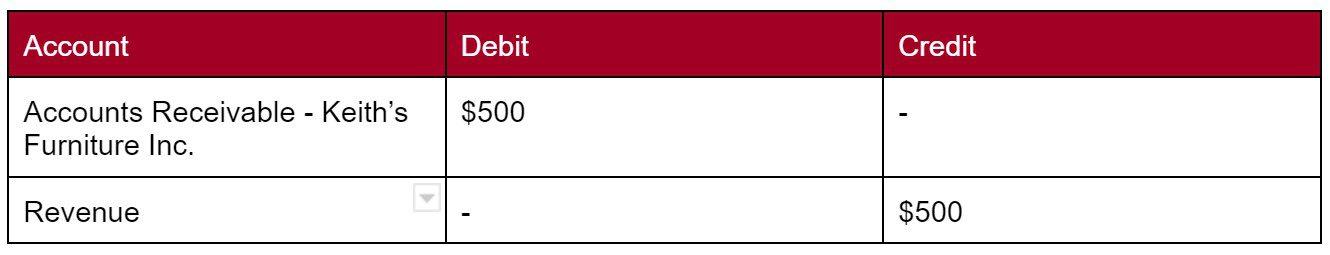

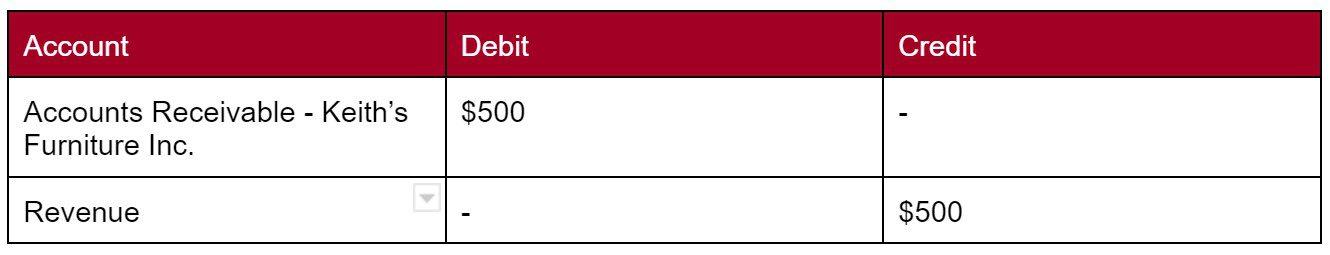

You would first debit “Accounts Receivables—Furniture Keith’s Inc” by $500 again to put the receivable back on your records before crediting revenue by $500 to record this transaction.

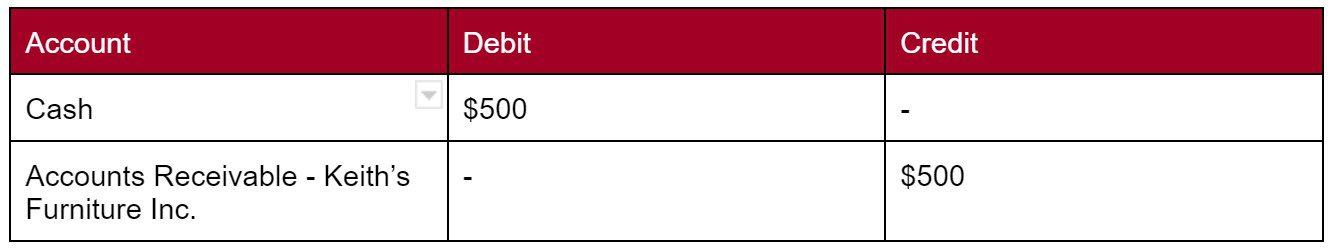

You would finally debit your “cash” account by $500 to record the cash payment and credit “Accounts Receivables—Furniture Keith’s Inc.” by $500 to finalize the transaction.

Bad debts

If the costs of collecting the debt start approaching the total value of the debt itself, it might be time to start thinking about writing the debt off as bad debt—that is, debt that is no longer of value to you. A customer going bankrupt and being unable to pay back their debts can also result in bad debt.

A business “deducts its bad debts, in full or in part, from gross revenue when determining its taxable income”, according to the IRS. These bad debts include “loans to clients and suppliers”, “credit sales to customers”, and “business loan guarantees“.

Accounts Receivables other FAQs

Accounts Receivables vs Accounts Payable

Though lenders and investors consider both of these metrics when assessing the financial health of your business, they’re not the same.

Accounts Receivables, which represents the money that your clients owe you, are assets. On the other hand, Accounts Payable are liability account that represents money you owe another company.

Say you created a logo for your friend Keith’s company, Keith’s Furniture Inc., in exchange for $500 in payment. Keith will record your invoice as an Accounts payable in his general ledger when he receives it because it is money he must pay someone else.

You (or your bookkeeper) record it as an Account receivable on your end because it represents money you will receive from someone else

See more» Accounts Receivable vs. Accounts Payable: All you need to know about their differences

Is Accounts Receivables debit or credit?

Define Accounts Receivables are the cash inflows that the creditor will receive based on the credit period given to the customers as per the prevailing market trend. As per the golden rules of accounting, debit means assets, and credit means liabilities. Accounts Receivables represent transaction exposure in the form of cash inflow shortly. The same shows that an entity will benefit from this exposure directly or indirectly. Hence, whether accounts receivables debit or credit is very simple, one can conclude that Accounts Receivables Is What Type Of Account should be debited and visible on the asset side.

Is accounts receivables an asset or revenue?

Accounts Receivables is not a revenue account; it is an Asset Account. Contrarily, while using Accrual Accounting, you record revenue along with an account receivable.

When you invoice Keith’s Furniture in the scenario above, you would record the following information in your books:

(If you want to understand why we’re making two entries to record one transaction here, check out our guide to Double-Entry Accounting).

But keep in mind that there are no receivables in cash basis accounting. In such an arrangement, a sale isn’t considered to have occurred until the funds have actually reached your bank account.

Accounts Receivables journal entries

An Accounts Receivables transaction is recorded in the company’s accounting records as an Accounts Receivables Journal Entry. In order to accurately record this financial activity, it is a necessary step.

Read more : Which Of The Following Are Fixed Order Quantity Inventory Models

Accounts Receivables must be recorded in the company’s accounting records, just like every other type of financial activity. By keeping a journal, you can accomplish this.

The foundation of an organization’s or business’s accounting system is journal entries. They keep track of each commercial transaction. Usually, they are recorded in the main journal or general ledger, however, occasionally a supplementary ledger is used instead.

Raw data including the transaction’s fundamental details are first entered into the general journal, where it is organized chronologically according to the transaction’s date. The general ledger or subsidiary is then updated with this data, where it is organized to better reflect the transaction’s nature.

All financial transactions for a business are recorded and compiled in the general ledger, which is the main accounting document. Other financial statements, such as the balance sheet, income statement, and cash flow statement, that support analysis of the company’s finances and performance are created using the information in the general ledger.

Accounts Receivables Turnover Ratio

Companies can also utilize outstanding bills as an asset to secure finance by using AR financing, which leverages their Accounts Receivables.

The accounts receivables turnover ratio of a company becomes crucial when trying to obtain credit that is secured by the money it is owed. The ratio measures a company’s proficiency in turning receivables into cash by counting the number of times it collects its average AR over the course of a year. For instance, a bank might use the ratio to assess the likelihood of repayment or establish an interest rate for lending money to a business based on its accounts receivables.

To get the average Accounts Receivables for XYZ Inc. for that year, we add the beginning and ending Accounts Receivables amounts and divide them by two:

$2,500 + $1,500 / 2 = $2,000

To calculate the Accounts Receivables turnover ratio, we then divide net sales ($60,000) by average accounts receivables ($2,000):

$60,000 / $2,000 = 30

This means XYZ Inc. has an accounts receivables turnover ratio of 30. The higher this ratio is, the faster your customers are paying you.

Thirty is a really good accounts receivables turnover ratio. For comparison, in the fourth quarter of 2021, Apple Inc. had a turnover ratio of 13.2.

To calculate the average sales credit period—the average time that it takes for your customers to pay you—we divide 52 (the number of weeks in one year) by the accounts receivables turnover ratio (30):

52 weeks / 30 = 1.73 weeks

This means that in 2021, it took XYZ Inc.’s customers an average of 1.73 weeks to pay their bills. Pretty good!

See more» Understanding Accounts Receivable Turnover Ratio: Definition, Formula and Examples

Accounts Receivables Aging Schedule

If you have a lot of different clients, it might be challenging to keep track of who is exactly delinquent on which payments. To address this issue, some companies will develop an Accounts Receivables aging schedule.

Here is an illustration of an aging schedule for accounts receivables for the fictitious business XYZ Inc.

Accounts Receivables Aging Schedule

XYZ Inc., as of July 22, 2021

We can quickly determine who is on track to pay within 30 days, who is behind schedule, and who is actually behind by looking at this timetable.

For instance, it is clear right away that Keith’s Furniture Inc. struggles to make on-time bill payments. Calling them and discussing how to get their payments back on track might be a good idea.

See more» Accounts Receivable Aging: Definition, Benefits and Management

Accounts Receivables are a crucial component of a company’s basic analysis. As a current asset, it reflects a company’s liquidity, or its capacity to pay short-term obligations without the need for further financial flows.

See more» Best Accounts Receivable Software for 2023

Source: https://t-tees.com

Category: WHICH