Friedman was not against giving money to a charitable organisation or helping out friends, he just believed that if anyone wanted to give money to charity or anyone that this should be with their own money. A manager sponsoring the local ballet, soccer club or the Red Cross with corporate funds may be something the shareholders do not want to spend money on. Shareholders may want to spend the proceeds of the businesses’ money on other pursuits. Both shareholders and managers themselves are of course free to give money to charity as well, but their own money. Friedman also argued that if managers spent money on charitable organisations or any other “social” goal, the managers would be acting as a regulator, as they are effectively imposing a tax and deciding where the proceeds of the tax would go to, and this should be determined through a democratic process, not a corporate executive.

Let’s go back to your coffee shop for a little bit.

You are viewing: Which Of The Following Statements Most Accurately Describes Shareholder Primacy

While running the business, you will be both impacted by, and impact, a number of entities in society. Your customers impact whether or not you can stay in business, and at the same time, your service and the quality of you coffee have an impact on the wellbeing of the customers. Your suppliers have an impact on the quality and availability of your coffee, whilst you also impact their ability to be in business. Entities that affect the firm, and/or are affected by the firm, are what we call stakeholders. In reality, stakeholders have an impact on the success of a business.

Shareholder theory does not deny this but rather proposes that stakeholders are a means to an end (maximising wealth for the shareholders, also called shareholder primacy). So for example, if wages can be cut to generate a profit, they should be cut. If dumping waste in a river is cheaper than treating it, the waste should be dumped in the river. If paying liability suits for a defective product is cheaper than making the product safe, then it is best to make the defective product and pay for the lawsuit. The following video shows a debate between Friedman and a student at Cornell University in 1978.

Milton Friedman on Self-Interest and the Profit Motive (YouTube, 6m56s):

Friedman proposes that perhaps the car company should have put a disclaimer on the product saying “this product is $13 cheaper and therefore has an increased chance of x% of exploding under y situation”. Do you think companies should do this? Do you think they do? Do you think people are really “free” if they do not have information on the possible impacts of products on individuals/society when buying a product? Who should be responsible for providing this information?

Enlightened Friedmanite

There is much criticism of Friedman’s view (shareholder primacy), particularly as it is often used to justify focusing on short-term company valuations. If managers are to focus on maximising shareholder wealth in the next year, does that mean they are maximising their wealth over the next 5 years? 10 years? 50 years? Is higher current wealth necessarily in the best interest of shareholders who may hold their investment for years or decades? “Enlightened” Friedmanites take a longer-term perspective. Is it in the best interests of shareholders to clear-cut a forest and maximise current production, without replanting it? Or to sustainably manage the forest resource so that it provides a moderate level of output for decades to come? This long-term perspective can lead to the same result as managing for stakeholders (discussed next), but there is a difference in motive.

Stakeholder Theory (Freeman, 1984)

One of the leading alternatives to shareholder theory is stakeholder theory, proposed by Edward Freeman in 1984.[7] Stakeholder theory asserts that a manager’s goal should not be to maximise shareholder wealth as a primary purpose, but rather to create value for all stakeholders. Freeman intentionally used the word “value” instead of “wealth,” as value includes (but is also broader than) financial outcomes. It includes human well-being, benefits from collaboration, etc.

Read more : Which Piece Of Electrical Equipment Is Not Considered A Device

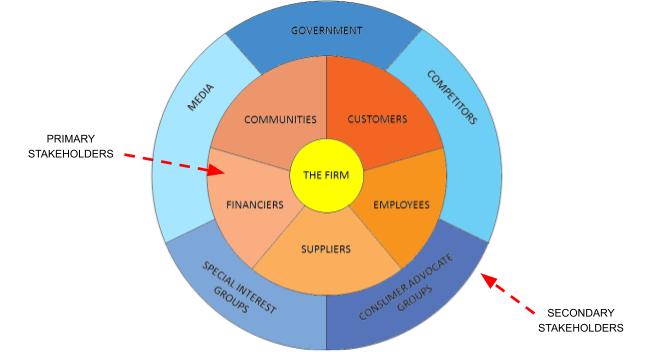

Freeman[9] classifies five primary (most important) stakeholders and their stakes are as follows:

- Financiers (shareholders and debtholders) have a financial stake in the firm and expect a financial return from the firm

- Employees provide human capital to the firm and are impacted by the firm in terms of working conditions. Employees may also be decision-makers in the firm (e.g. if they are managers), or they can also be financiers (e.g. via employee stock options)

- Suppliers and customers have a stake in the firm in terms of exchanging products and services for resources (money)

- Communities grant firms the “right to operate” and can be impacted by the firm’s operations e.g. provision of local services or dumping hazardous waste.

There can also be secondary stakeholders, as shown in the diagram below:

There may be conflicting interests between groups of stakeholders and the manager’s job is not to trade-off these conflicts, but to work out a way to create value for all parties. Stakeholder theorists, therefore, argue that managing for stakeholders is simply good business practice. If all stakeholders are managed well this will result in a profitable, well-run firm.

Concept Check: What is happening in the real world?

The Business Roundtable is an organisation that consists of Chief Executive Officers (CEOs) of more than 181 major companies in the United States. The organisation has been issuing statements on the Purpose of the Corporation since 1978, and since 1987 it has defined the purpose of the corporation to be to serve shareholders first and foremost.

In August 2019, “the Business Roundtable”[10] changed its statement to:

We commit to:

- Delivering value to our customers. We will further the tradition of American companies leading the way in meeting or exceeding customer expectations.

- Dealing fairly and ethically with our suppliers. We are dedicated to serving as good partners to the other companies, large and small, that help us meet our missions.

- Supporting the communities in which we work. We respect the people in our communities and protect the environment by embracing sustainable practices across our businesses.

- Generating long-term value for shareholders, who provide the capital that allows companies to invest, grow and innovate. We are committed to transparency and effective engagement with shareholders.

- Each of our stakeholders is essential. We commit to delivering value to all of them, for the future success of our companies, our communities and our country.

The example above demonstrates that there is a change in business sentiment. CEOs are increasingly realising that creating long-term value for shareholders requires creating value for its stakeholders. Through innovative thinking many co-benefits can be created. In some regions like Europe, there is also increasing regulation on disclosure of companies’ social and environmental impacts, so there is more information and transparency for people to make informed decisions.

Shareholder Value Myth (Stout, 2012)

Cornell Professor of Corporate Law, Lynn Stout wrote a book entitled The shareholder value myth[11] in which she discusses the history of the role of companies in society and several inaccuracies about shareholder theory. Watch the video below (for more info here is an article too).

Read more : Which Three Components Are Combined To Form A Bridge Id

The shareholder value myth | Lynn Stout, Cornell University (YouTube, 12m43s):

Shareholder Welfare not Wealth (Hart, 2017)

Lynn Stout’s last point regarding shareholders having pro-social concerns is very similar to Oliver Hart’s thesis below.

In the video below, Oliver Hart (winner of the 2016 Nobel Prize in economics) discusses shareholder theory and provides a new perspective on what the goal of the firm should be. In his paper with colleague Luigi Zingales, “Shareholders Should Maximize Shareholder Welfare not Market Value”[12], thet argues that firms should maximise the welfare of shareholders, which is much broader than wealth. Shareholders are all participants in society and have a range of social and environmental preferences. When a company engages in actions that maximize profits but create externalities that go against a shareholders’ ethical preferences, it is suboptimal to engage in these actions and then let the shareholders “mitigate” the externalities with their own money. Firms should therefore actively seek shareholders’ preferences and values, and act consistently with those. Watch the video below

Shareholders care about more than just profits (YouTube, 4m12s)

Case Study: Gun Control

Hart & Zingales uses the example of Dick’s Sporting Goods, which changed its policy on gun control.

Dick’s Sporting Goods could generate money by selling assault rifles. Friedman would have argued that, if it is a profitable strategy to sell high-powered guns, then the company should do so, pay shareholders the extra dividend, and then the shareholders could decide individually to support gun control organisations. However, shareholders spending their own money to “reverse” the actions of the company would be very inefficient and suboptimal for the shareholders.

Hart argues that it is more efficient for the company to refrain from selling assault rifles in the first place. Shareholders are humans, who have pro-social concerns, and it is assumed that if someone is not only interested in the bottom line, they would prefer to invest in companies that are also interested in issues beyond the bottom line. Hart argues that if a CEO and managers want to show loyalty to their shareholders, their individual concerns should be taken into consideration.

In other words, instead of making money at the expense of all, the pro-social concerns of shareholders should be accounted for when building a strategy.

Discussion: Short Case Study – Merck

Merck & co will pay $4.85 billion to end thousands of lawsuits over its painkiller Vioxx (YouTube, 2m7s):

Source: https://t-tees.com

Category: WHICH