In the face of high inflation and rising interest rates, many investors are turning to safer low-risk investments to ease the stress of a volatile market. And while lower risk generally comes at the expense of higher returns, it’s wise to have some risk-mitigating assets in your portfolio during periods of volatility.

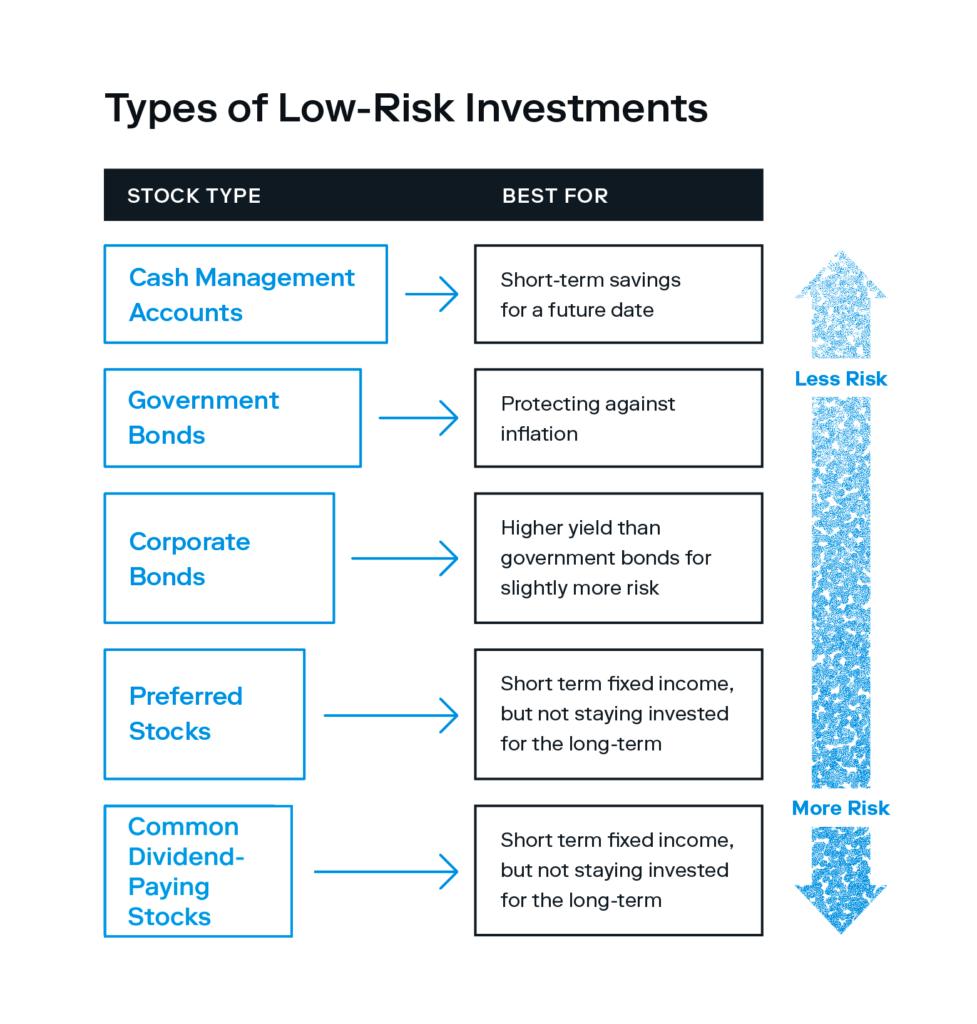

Low-risk investing means buying assets that are less likely to incur significant losses than, say, more unpredictable stock picks. Low-risk investment options can include cash management accounts like certificates of deposit, Treasury securities like Series I bonds, and even stock options like preferred stocks.

You are viewing: Which Option Is An Example Of A Low-risk Investment Apex

Even though many of these investments are unlikely to see the same returns as riskier investments like growth stocks, they serve other purposes, like preserving the value of your investment (federally insured investments like Treasury securities, for example, won’t ever dip below the dollar value you purchased them for, making them virtually risk-free) or providing a steady stream of interest income.

Ultimately, choosing from the investments below will depend on your goals, time horizon, and risk tolerance. If it’s high growth you’re after, consider investing in riskier assets like dividend stocks for a longer period of time—at least five years or more. This gives you enough time to ride the ups and downs of the market (less risk) while still realizing higher returns over time.

That said, there are plenty of safe investment options to consider. Here’s what we’ll cover:

- 1. High-yield savings accounts

- 2. Certificates of deposit (CDs)

- 3. Money market funds

- 4. Money market accounts

- 5. Treasury bills, notes, and bonds

- 6. Series I bonds

- 7. Corporate bonds

- 8. Dividend-paying stocks

- 9. Preferred stocks

- 10. Fixed annuities

- 11. Index funds

Let’s get into it.

1. High-yield savings accounts

Best for: investors with short-term financial goals or who want access to cash

A high-yield savings account (HYSA) is much like a traditional savings account, but it pays more in interest. These accounts are insured by the Federal Deposit Insurance Corporation (FDIC), so you can count on your funds being protected even if the bank were to fail.

Since high-yield savings accounts generally allow you to access cash when needed (though some banks may limit the number of withdrawals per month), they’re a good investment vehicle if you may need access to cash in the near future, or if you’re working toward short-term goals like building up an emergency fund.

A high-yield savings account can yield attractive returns hovering around 4.5% – 5%, but always shop around to find the best rates. If you’re willing to change accounts frequently in pursuit of marginal interest rate differences, you might go with whoever is currently offering the highest rate and switch down the line if you find a better rate elsewhere. If you prefer a set-it-and-forget-it approach, opt for a savings account with no minimum balance requirements or fees and a competitive interest rate. Generally, online banks offer a higher rate of interest than brick-and-mortar banks and are secure in that they’re covered by the same FDIC insurance program.

2. Certificates of deposit (CDs)

Best for: investors who need money at a specific future date

A certificate of deposit (CD) is essentially a loan you extend to the bank—your deposit earns interest for a set amount of time, generally at a higher rate than a traditional savings account. The bank benefits because they have access to your deposit throughout the term, and you get that deposit back plus interest once the term expires. CDs are also FDIC-insured, so they won’t ever dip below the dollar value you purchased them for (subject to insurance coverage limits).

A CD requires your money to remain untouched for the designated term period; you’ll pay a penalty for early withdrawals. They’re sold in various term lengths, from a few months to two years. This makes them a good option if you have a large upcoming purchase in the near future.

For example, say you want to put a down payment on a home in two years’ time, and you just received a $10,000 bonus at work. Instead of stashing that in a standard savings account, you could put it in a two-year CD, earn interest for two years, and cash out once the term ends.

3. Money market funds

Best for: investors who want full liquidity

Similar to how index funds are baskets of multiple stocks, bonds, and other assets, a money market fund is a basket of CDs, bonds, and other low-risk assets within a single fund. They’re typically sold by brokerage firms, although some banks may offer them as well—just keep in mind that they aren’t federally insured. And unlike CDs, money market funds are fully liquid, meaning you can use your funds at any time.

While it’s technically possible to lose money on your investment, it’s rare, since money market funds only consist of the safest securities—namely short-term, cash-like instruments that carry little to no risk. Rather than interest-earning accounts like CDs or HYSAs, which are at the mercy of rising and falling interest rates, returns for money market funds depend on the underlying investments within the fund.

4. Money market accounts

Read more : Which Of The Following Is An Advantage Of Zero-based Budgeting

Best for: risk-averseinvestors who want to maintain liquidity

Money market accounts are similar to CDs or savings accounts—they’re a type of federally insured bank account, but they offer more ways to withdraw or spend directly from the account. They yield returns at similar (if not lower) rates as a high-yield savings account. While you won’t see the highest returns with a money market account, they offer the safety of your underlying investment.

Money market accounts are best for those seeking a low-risk investment that still offers access to cash when you need it. Like a high-yield savings account, they work well as a short-term savings vehicle for near-term purchases like a car or for building up an emergency fund.

5. Treasury bills, notes, and bonds

Best for: investors who need to balance their portfolio with low-risk assets

Treasury securities are like CDs in that your investment functions as an interest-earning loan, but you’re loaning to the government (the U.S. Treasury) instead of your bank.

The main difference between Treasury bills, notes, and bonds is the term length (and in turn, your interest rate):

- Treasury bills: term length of one year or less

- Treasury notes: term length of 2, 3, 5, 7, or 10 years

- Treasury bonds: term length of 20 or 30 years

Since Treasury securities are backed by the full faith and credit of the U.S. government, they’re among the safest investments available. So long as you hold them until maturity, you’re unlikely to lose any money.

The longer you hold them, the more you’ll earn in interest; if you sell before the maturity date, you’re missing out on any additional interest payments you would’ve earned. In addition to being highly liquid, Treasury securities are a good way to diversify your portfolio with some low-risk assets during times of market volatility.

6. Series I bonds

Best for: investors who want to protect against inflation and can hold their investment for at least five years

Series I bonds are a type of low-risk bond issued by the U.S. Treasury. If you have cash reserves that you don’t need anytime soon, I bonds are one of the safest low-risk investments available.

Unlike a traditional bond, I bonds have two interest rate components:

- Fixed rate: the base rate you get when you buy the bond (resets twice per year)

- Inflation rate: the inflation-adjusted rate (resets every six months)

This means in addition to the base interest rate, the Treasury also pays an inflation rate twice per year based on the rate of inflation. It’s important to understand the unique features of an I bond to determine if this investment is right for you. Individuals can purchase up to $10,000 of Series I bonds per year and earn interest on them for up to 30 years.

The required term length is one year, but if you choose to cash in between years two and five, you’ll lose 90 days’ worth of interest as a penalty.

The key element of an I bond is that they don’t go up and down in value—regardless of what interest rates are at any given time, the value of your investment will be preserved. They’re a great option if you have money you want to safely preserve until a future time period, like saving for an emergency fund.

7. Corporate bonds

Best for: investors interested in bonds with a slightly higher yield than Treasury bonds

Just like the U.S. Treasury issues bonds, so can public companies. In exchange for slightly more risk, corporate bonds can offer higher returns than what you’d yield from Treasury bonds. They still pay a fixed interest rate over a set period of time, and longer term lengths generally correlate to higher returns to compensate investors for taking on interest rate risk. Like other bond investments, corporate bonds are subject to fluctuating interest rates—when interest rates fall, bond values go up (and vice versa).

However, the main risk to be aware of is default risk—if the company that issued the bond were to go bankrupt, they could default on your investment and leave you empty-handed. To mitigate this possibility, it’s best to purchase bonds from healthy, established companies that are less likely to default.

8. Dividend-paying stocks

Best for: investors who are willing to stomach more risk and want fixed income

Read more : Which Joe Dispenza Book To Read First

While dividend stocks don’t have the same guaranteed safety of CDs or Treasury securities, they’re one of the better options if you’re after safe investments with high returns. While they won’t provide the same returns as growth stocks, they’re a favorable investment if you want fixed income in the short term, and can also stay invested for longer periods of time.

Dividend stocks are seen as lower risk because if a stock pays dividends, it typically means the company is mature and well established—not only can they be a dependable source of fixed income in the short term, but there’s also the possibility of the stock value increasing as the company (ideally) continues to grow.

Of course, there’s always the chance that a company will underperform if the market tanks, resulting in dividend payment cuts or removing dividend payments entirely. To mitigate this risk, look for stable companies with a strong track record of consistent growth (not just the one with the highest yield), and diversify your investment across multiple stable companies.

9. Preferred stocks

Best for: investors who want fixed dividend payments that are higher than bonds, but for less risk and overall return than common stock

Preferred stocks are more akin to owning a long-term bond than a stock—like bonds, they offer set dividend payments. The term “preferred” stock comes down to three main advantages:

- Owners of preferred stock get paid out before owners of common stock—but unlike common stock owners, they receive no voting rights in the company

- Preferred stock dividend payments are a higher yield than those of common stock

- Preferred stockholders receive priority repayment in the event of company liquidation or bankruptcy

Unlike common shares of stock, whose returns are based on the success of the business, preferred stock returns depend on the rise and fall of interest rates (just like bonds). If interest rates rise, the principal value of preferred stock declines, and vice versa.

Still, preferred stock is considered less volatile than common stock, since returns aren’t based on stock price fluctuations. The caveat is less potential for higher returns and less capital appreciation overall.

10. Fixed annuities

Best for: investors seeking a dependable income stream to fund a portion of their retirement

Fixed annuities are a contract between you and an insurance company, and can be thought of similarly to a pension. Like a pension, you contribute a lump sum upfront in exchange for receiving regular payments (usually monthly) over a set period of time in the future. Annuities are attractive because of the guaranteed payments they offer, however, it’s important to review the contract carefully and understand any fees associated with the annuity product. Also, many annuity salespersons/advisors work on commission for selling annuity products. The advisor you’re consulting with may be financially motivated to encourage you to purchase the annuity instead of investing in other low-risk investment options.

There are a range of ways an annuity can be structured—you may choose a 20-year annuity, or one that lasts until the end of your life—but a fixed annuity is the most straightforward. Other types of annuities include variable annuities (where your return will vary) or annuities based on market fluctuations. Fixed annuities are the least risky since you’re getting a guaranteed return.

11. Index funds

Best for: long-term investors who can stay invested for a decade or more

It’s important to understand that no matter what investment you choose, individual assets—whether it’s a stock, bond, or something else—are inherently riskier than a diversified fund. That’s where index funds come in.

An index fund is a basket of securities that track a specific index, like the S&P 500 or the Dow Jones. Rather than buying a single stock, an index fund allows you to invest in hundreds or even thousands of different companies, all housed within a single fund. You can invest in an index fund either through an exchange-traded fund (ETF) or a mutual fund.

Highly diversified by nature, an index fund automatically decreases your overall risk—if one company in your fund happens to tank, the success of another can balance it out. They also have a very low barrier to entry, making them suitable for novice investors without a large amount of capital to invest upfront.

Index funds aim to provide returns equal to the index’s performance. (The S&P 500, for example, has provided annual average returns of 10%-11% since 1926.) If you’re seeking low-risk, high-return investments and have at least a decade until retirement, buying and holding an index fund for the long haul is an excellent long-term investing solution.

While any fund that tracks a market index will inevitably carry some risk, it really only applies to the short term. Investors with longer time horizons have plenty of time to withstand the ups and downs of the market and still see strong returns.

It’s important to remember that any low-risk investment means trading higher speculative returns (and more risk) for lower guaranteed returns (for less risk). The suitability of any of the investments above depends entirely on your goals, time horizon, and risk tolerance.

Ultimately, you can realize the highest returns for the lowest risk through a long-term investing approach. A long-term diversified portfolio will always be one of the safest ways to invest, but the less risky investments above can be great additions to a well-rounded portfolio, especially in the face of volatility in the market.

Source: https://t-tees.com

Category: WHICH