Sarah Edwards | December 04, 2023

Edited by Hannah Locklear

You are viewing: Who Does Diversified Adjustment Collect For

It can be tough to distinguish between legitimate phone calls and scammers. But Diversified Adjustment is a legitimate debt collection company and one you shouldn’t ignore.

If you’ve been contacted by Diversified Adjustment Service, it’s because they believe you have an unresolved debt with another party. Here’s how to verify that the debt is yours and resolve your debt quickly.

Sued for debt? Use SoloSettle to resolve it.

Is Diversified Adjustment a scam?

First things first: what is Diversified Adjustment Service?

Diversified Adjustment Service, Inc. is not a scam but a debt collection agency based in Coon Rapids, Minnesota. If you’ve been contacted by someone claiming to represent Diversified Adjustment, it may be because you’re behind on a loan or have credit card debt or unpaid bills.

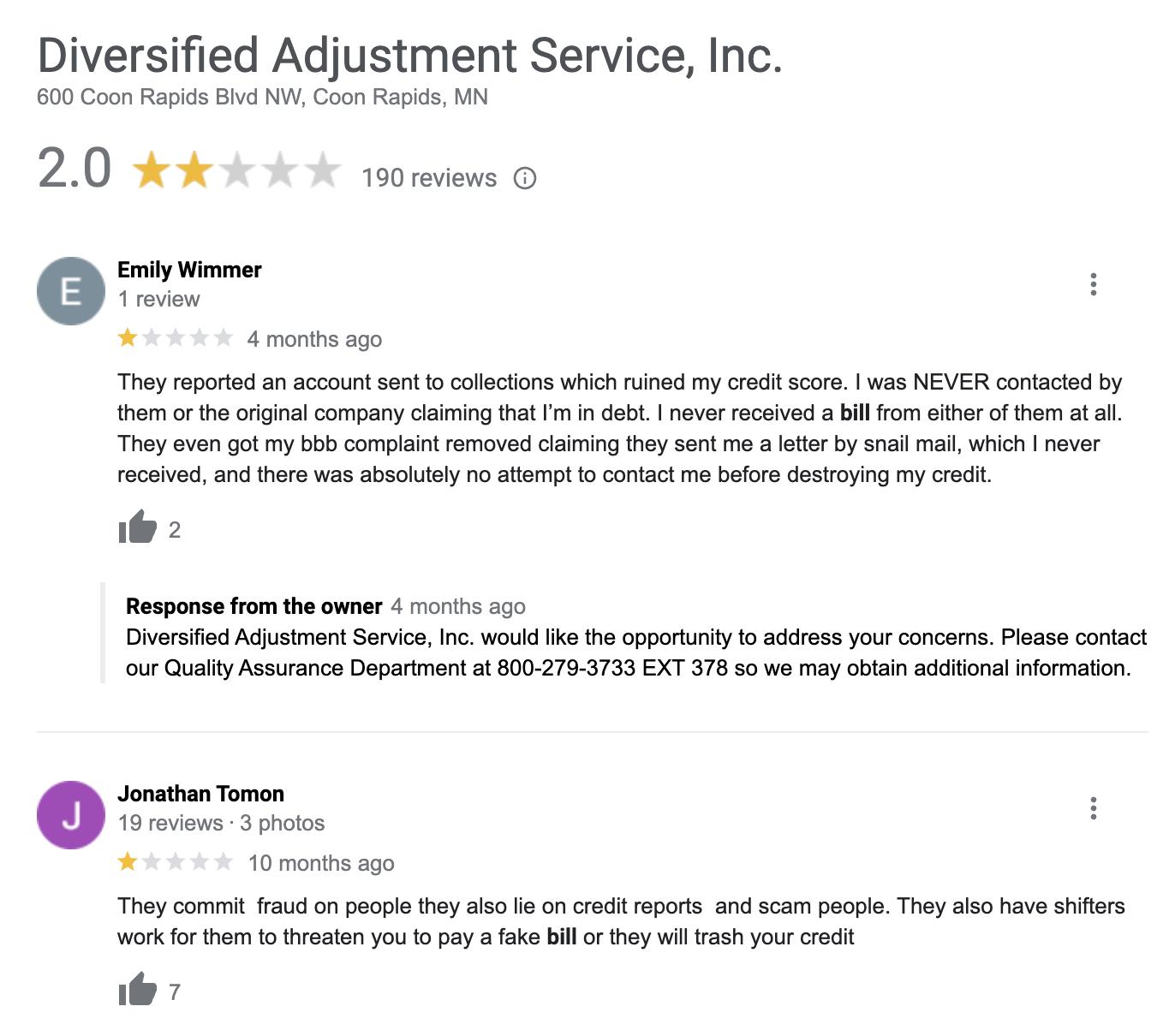

Diversified Adjustment Services Inc. reviews

That said, Diversified Adjustment has a mixed reputation based on customer complaints. As of 2023, the company has nearly 200 complaints registered against them with the Better Business Bureau and more than 500 complaints listed on the Consumer Financial Protection Bureau (CFPB) website.

Many complaints allege harassing phone calls and false accusations of debt, which is why it’s important to know your rights and verify your debt before proceeding.

Diversified Adjustment Services has an average rating of 2 out of 5 stars from many Google reviews. Many of these reviews come from consumers who claim they’re being contacted about invalid T-Mobile debts. Check out some real Diversified Adjustment Services reviews here:

Diversified Adjustment Services phone number

Should you need to contact the company, you can do so by phone at 800-279-3733 or by mail at P.O. Box 32145, Fridley, MN 55432. According to the company’s website, phone representatives are available primarily during regular business hours, though you can contact them until 8:00 p.m. (CST) Monday through Thursday.

Read more : Who Is The Father Of Eboni Nichols’ Baby

See the Diversified Adjustment’s office in Coon Rapids the photo below.

How to respond to Diversified Adjustment Service, Inc.

It’s easy to get flustered by repeated phone calls, and it’s even worse when you get slapped with a lawsuit. But you can respond by asserting your rights and seeking verification of your debt.

I’m being harassed by Diversified Adjustment

Even if the debt is legitimately yours, debt collectors are forbidden from harassing practices by the federal Fair Debt Collection Practices Act (FDCPA). This law prohibits debt collectors from practices that include:

- Contacting you before 8:00 a.m.

- Contacting you after 9:00 p.m.

- Calling you more than once per day.

- Failing to identify their identity as a debt collector.

- Calling your friends and family (or coworkers) about your debt.

- Using vulgar, offensive, or intimidating language.

- Threatening you with arrest for not paying your debt.

- Refusing to validate your debt.

You can report FDCPA violations to the Federal Trade Commission (FTC) using the FTC website or by calling 877-382-4357. Alternatively, you can report the company through the CFPB’s website or by calling 855-411-2372.

I’ve been sued by Diversified Adjustment

If you’ve received notice that Diversified Adjustment is suing you over your debt, your first step is to respond to the lawsuit by filing an Answer with the court. An Answer is an official response indicating your willingness to contest the lawsuit.

Act fast — some jurisdictions only allow a two-week window to respond, after which the judge may render a default judgment in favor of Diversified Adjustment.

Respond to a debt lawsuit in minutes.

I’m not sure the debt is mine

If you’re unsure whether your debt is legitimate, you can verify it by asking Diversified Adjustment to send you a Debt Validation Letter. This document will clearly connect you to the debt by:

- Identifying your original creditor.

- Demonstrating that you owe the debt.

- Listing the amount you owe.

- Documenting the most recent payment (if any).

- Recording the age of the debt.

Remember, failing to provide you with a Debt Validation Letter is also an FDCPA violation, which you can report at the numbers above.

Still have questions about validating your debt? Check out this helpful video:

Resolve your debt with Diversified Adjustment Service, Inc.

Filing an Answer with the court will give you time to verify that the debt is yours and take steps toward a lower settlement.

Open up negotiations with SoloSettle

Your first step is to send an initial offer. SoloSettle by SoloSuit makes this easy.

Your initial offer will open negotiations between you and the collector. Agree to pay 60% of your total debt amount. Diversified Adjustment may refuse to accept this and present a counteroffer. The goal is to arrive at an amount you and the company can live with.

Let’s look at an example.

Read more : Who Is The Lady In John 2

Start using SoloSettle today to resolve your debt.

Document the settlement amount

Under no circumstances should you accept a debt settlement without getting it in writing. A settlement agreement through SoloSettle will provide clear documentation that the debt is resolved for the agreed-upon amount. Make sure you also save any correspondence with Diversified Adjustment to verify the settlement process.

It’s not out of the question to think that a debt collector might go behind your back and seek a default judgment even after reaching an agreement. Having the agreement in writing will protect you from this.

Commit to your repayment plan

Once you settle your debt, you’ll commit to the repayment plan negotiated between you and Diversified Adjustment. The company website allows you to make payments online for greater convenience, or SoloSettle can help you arrange payments.

Unfortunately, a settlement will lower your credit score — but so can outstanding debt. Resolving your debt once and for all will let you move forward and start rebuilding your credit.

There is life after debt

Debt collectors can leave you stressed. But it’s important to remember that there is life after debt. Resolve your debt quickly by negotiating a lower settlement through SoloSettle. Then, you can move on and start fresh.

Settle your debt online.

How to Answer a Summons for debt collection in all 50 states

Here’s a list of guides on how to respond to a debt collection lawsuit in each state:

The Ultimate 50 State Guide

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont; Vermont (Small Claims court)

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Guides on how to resolve debt with every debt collector

Are you being sued by a debt collector? We’re making guides on how to resolve debt with each one.

- 11 Charter Communications

- AAA Collections

- Aargon Agency Inc

- Absolute Resolutions Investments LLC

- ACEI Collections

- Account Services

- Accredited Collection Services

- Accredited Collection Services

- Advanced Recovery Systems

- AES NCT

- AFNI Collections

- Alco Capital Group LLC

- Aldous and Associates

- Alliance Collections

- Alliance One

- Alliant Capital Management

- Alpha Recovery Corp

- Alltran Financial

- Alltran Health

- Alorica Inc.

- Amcol Clmbia in Court

- American Coradius International

- American Profit Recovery

- American Recovery Service

- Americollect

- AmSher Collection Services

- Apelles LLC

- AR Resources

- ARC Collections

- ARM Solutions

- Arrow Financial Services

- ARS National Services

- ARSC Debt Collectors

- ARS National Services

- ARstrat

- AscensionPoint Recovery Services

- Asset Acceptance LLC

- Asset Recovery Solutions

- Associated Credit Services

- Atlantic Credit and Finance

- Atradius Collections

- Automated Collection Services, Inc.

- Autovest LLC

- Avante USA

- Avantus

- AWA Collections

- Balekian Hayes

- Bay Area Receivables

- BCA Financial Services

- BC Services

- Benuck and Rainey

- Berlin-Wheeler

- Bluebonnet Financial LLC

- Bonneville Collections

- Bull City Financial

- Bureaus Investment Group

- Cach LLC

- Caine and Weiner

- Capio Partners

- Capital Accounts

- Capital Collections

- Capital Management Services

- CardWorks

- Carmel Financial/New Coast Direct

- Cavalry SPV I LLC

- CBCInnovis

- CBCS Collections

- CBE Group

- CBV Collections

- CCB Credit Services

- CCS Collections

- CCS Offices

- Central Mediation Services

- Central Portfolio Control

- Cerastes LLC

- Choice Recovery

- Choice Recovery Inc

- CKS Financial

- CKMS Financial

- Client Services

- CMRE Financial Services

- COAF

- Coast Professional

- Comenity Bank Debt Collection

- Commonwealth Financial

- ConServe Debt Collection

- Consumer Collection Management

- Contract Callers Inc

- Convergent Healthcare Recoveries

- Convergent Outsourcing

- Couch Conville & Blitt

- Covington Credit

- CRDT First

- Credco in Court

- Credence Resource Management

- Credit Bureau Systems

- Credit Control Corporation

- Credit Management Company

- Credit Management LP

- Credit Systems

- Credit Systems

- CSIEZPay

- CTC Debt Collector

- CVCS Debt Collection

- Cypress Financial Recoveries

- D&A Services

- Daniels, Norelli, Cecere & Tavel P.C.

- DCM Services

- Debt Recovery Solutions

- Delanor Kemper & Associates

- Department Stores National Bank

- Direct Recovery Associates

- Discover Collections

- Diversified Adjustment

- Diversified Consultants

- Diversified Recovery Bureau

- DNF Associates, LLC

- Dodeka LLC

- DRS Credit

- Dynamic Collectors

- Eagle Loan

- Eagle Accounts Group, Inc.

- Eastern Account System

- EduCap

- Ellington and Associates Collections

- Encore Capital Group

- Enerson Law

- Enerson Law LLC

- Enhanced Recovery Company

- EOS CCA

- ERC Collections

- ERSolutions

- Estate Information Services

- Equable Ascent Financial

- Everest Business Funding

- Executive Credit Management

- Faber and Brand

- Factual Data

- Falls Collection Service

- FBCS

- FCO Collections and Outsourcing

- FIA Card Services

- fin rec svc (Financial Recovery Services)

- First Federal Credit Credit Control

- First Financial Bank

- First Portfolio Ventures LLC

- First Progress

- FirstPoint Collection Resources

- Firstsource Advantage

- FMA Alliance

- FNB Omaha

- Forster & Garbus

- Franklin Collection Services

- Freedom Plus

- Freshview Solutions

- Frontline Asset

- Frost Arnett

- Fulton Friedman & Gullace LLP

- Galaxy International Purchasing, LLC

- GC Debt Collection

- GC Services

- General Revenue Corporation

- GLA Collections

- Glass Mountain Capital

- Glasser and Glasser

- Global Credit Collection Corp

- Global Trust Management

- GMAC Financing

- Golden 1 Credit Union

- Grant and Weber

- Grant Mercantile Agency

- Gulf Coast Collection Bureau

- Gurstel

- Halsted Financial Services

- Harris and Harris

- Harvard Collection

- Harvest Credit Management

- Helvey and Associates

- Hollis Cobb

- Holloway Moxley

- Hosto Buchan

- Howard Lee Schiff

- H&R Accounts

- HRRG

- Hudson & Keyse LLC?

- Hunter Warfield

- IC System

- Impact Receivables Management

- Innovative Recovery

- Integras Capital Recovery LLC

- Javitch Block

- JHPDE Finance 1 LLC

- JP Receivables Management Partners

- JPMCB card

- Kenneth Eisen and Associates

- KeyBank student loans

- Kinum

- Kirschenbaum, Phillips & Levy P.C.

- KLS Financial Services

- Kramer & Frank

- Lakeside Collection

- Lending Club

- Lincoln and Morgan Kabbage

- Linebarger Goggan Blair & Sampson LLP

- Lockhart Collection Agency

- LJ Ross Associates

- LTD Collections

- Malcolm S. Gerald and Associates

- Malen & Associates

- Mandarich Law Group

- Mannbracken

- Marcam Associates

- MARS Inc. Collections

- MBA Law

- MCA Management Company

- McCarthy, Burgess & Wolff

- Meade & Associates

- Medicredit

- Mercantile Adjustment Bureau

- Merchants Credit Association

- MGM Collections

- Michael J Adams PC

- Midland Funding LLC

- Mid-South Adjustment

- Monarch Recovery

- Monterey Financial

- Moss Law Firm

- Mountain Land Collections

- MRS Associates

- MRS BPO

- MSW Capital LLC

- Mullooly, Jeffrey, Rooney & Flynn

- Nathan and Nathan PC

- National Collegiate Trust

- National Credit Adjusters

- National Credit Care

- National Credit Systems

- National Enterprise Systems

- National Recovery Agency

- National Recovery Solutions

- Nationstar

- Nationwide Credit

- Nationwide Recovery Services

- Nationwide Recovery Systems

- NCEP LLC

- NCO Financial Systems Incorporated

- North American Recovery

- Northland Group

- Northstar Capital Acquisition

- Northstar Location Services

- NPAS

- NRC Collection Agency

- Oliver Adjustment Company

- Oliphant Financial, LLC

- Oportun

- P&B Capital Group

- PCB Collections Agency

- Palisades Collection LLC

- Pallida LLC

- Paragon Contracting Services

- Paragon Revenue Group

- Payday Loan Debt Collectors

- Pendrick Capital Partners

- Penn Credit

- Perdue Brandon

- Persolve LLC

- Phillips & Cohen Associates

- Phoenix Financial Services

- Pioneer Credit Recovery

- PMAB LLC

- PRA Group, Inc.

- Pressler, Felt & Warshaw LLP

- Prestige Services, Inc.

- Prince Parker and Associates

- ProCollect

- Professional Finance Company

- Progressive Management Systems

- Provest Law

- PYOD LLC

- Quaternary Collection Agency

- RAB Collection Agency

- Rash Curtis and Associates

- Radius Global SOL

- Radius Global Solutions

- Rawlings Company

- Razor Capital

- Real Time Resolutions

- Receivables Performance Management

- Regents and Associates

- Reliant Capital Solutions

- RentGrow

- Resurgent

- Resurgent Capital Services and LVNV Funding

- Revco Solutions

- Revenue Enterprises LLC

- Revenue Group

- RGS Financial, Inc.

- RMP LLC in Court

- RMP Services

- RS Clark and Associates

- RSIEH

- RSIEH

- RTR Financial Services

- Rubin & Rothman

- Salander Enterprises LLC

- Samara Portfolio Management

- SCA Collections

- Scott Parnell and Associates

- Second Round Collections

- Second Round Sub LLC

- Selip & Stylianou LLP

- Sequium Asset Solutions

- Sessoms and Rogers

- Sherman Acquisition

- Sherman Financial Group

- SIMM Associates

- Source Receivables Management

- Southern Management Systems

- Southwest Credit Group

- Spire Recovery Solutions

- SRS Company

- Stark Collection Agency

- State Collection Service

- Stenger and Stenger

- Stillman Law Office

- Summit Account Resolution

- Sunrise Credit Services

- Superlative RM Debt Collector

- Suttell and Hammer

- Synergetic Communication

- Synerprise Consulting

- The Law Office of Michael J Scott

- Trellis Company

- Troy Capital

- TRS Recovery Services

- TrueAccord

- Tulsa Teachers Credit Union

- UCB Collection

- UHG 1, LLC

- Unifin

- Unifin Debt Collector

- Unifund

- Universal Credit Services

- US Bank Collections

- USAA collections

- USCB America

- Valentine and Kebartas

- Valley Servicing

- Vance & Huffman LLC

- Van Ru Credit Corporation

- Velo Law Office

- Velocity Investments

- Viking Client Services

- Wakefield and Associates

- Waypoint Resource Group

- WCTCB

- Weinberg and Associates

- Weltman, Weinberg & Reis

- Westwood Funding

- Williams and Fudge

- Wilshire Consumer Credit

- Wolpoff & Abramson

- Worldwide Asset Purchasing

- www.AutomotiveCredit.com

- Zarzaur & Schwartz

- Zwicker & Associates

Settle your medical debt

Having a health challenge is stressful, but dealing medical debt on top of it is overwhelming. Here are some resources on how to manage medical debt.

- Am I Responsible for My Spouse’s Medical Debt?

- Do I Need a Lawyer for Medical Bills?

- Do I Need a Lawyer to Fight Medical Bill Debt?

- Does Bankruptcy Clear Medical Debt?

- How Much Do Collection Agencies Pay for Medical Debt?

- How to Find Medical Debt Forgiveness Programs

- Is There a Statute of Limitations on Medical Bills?

- Medical Debt Statute of Limitations by State

- Summoned to Court for Medical Bills — What Do I Do?

- Summoned to Court for Medical Bills? What to Do Next

Guides on arbitration

If the thought of going to court stresses you out, you’re not alone. Many Americans who are sued for credit card debt utilize a Motion to Compel Arbitration to push their case out of court and into arbitration.

Below are some resources on how to use an arbitration clause to your advantage and win a debt lawsuit.

- How Arbitration Works

- How to Find an Arbitration Clause in Your Credit Agreement

- How to Make a Motion to Compel Arbitration

- How to Make a Motion to Compel Arbitration in Florida

- How to Make a Motion to Compel Arbitration Without an Attorney

- How Credit Card Arbitration Works

- Motion to Compel Arbitration in California

- Sample Motion to Compel Arbitration

Stop calls from debt collectors

Do you keep getting calls from an unknown number, only to realize that it’s a debt collector on the other line? If you’ve been called by any of the following numbers, chances are you have collectors coming after you, and we’ll tell you how to stop them.

- 1-800-390-7584

- 800-289-8004

- 800-955-6600

- 8009556600

- 877-366-0169

- 877-591-0747

- 800-278-2420

- 800-604-0064

- 800-846-6406

- 877-317-0948

- 888-899-4332

- 888-912-7925

- 202-367-9070

- 502-267-7522

Federal debt collection laws can protect you

Knowing your rights makes it easier to stand up for your rights. Below, we’ve compiled all our articles on federal debt collection laws that protect you from unfair practices.

- 15 USC 1692 Explained

- Does the Fair Credit Reporting Act Work in Florida?

- FDCPA Violations List

- How to File an FDCPA Complaint Against Your Debt Collector (Ultimate Guide)

- How to Make a Fair Debt Collection Practices Act Demand Letter

- How to Submit a Transunion Dispute

- How to Submit an Equifax Dispute

- How to Submit an Experian Dispute

- What Debt Collectors Cannot Do — FDCPA Explained

- What Does Account Information Disputed by Consumer Meets FCRA Requirements Mean?

- What does “meets FCRA requirements” mean?

- What does FCRA stand for?

- What is the Consumer Credit Protection Act

Source: https://t-tees.com

Category: WHO