In addition to the plethora of New York State (NYS) taxes imposed on residents and businesses, New York City (NYC or city) has its own distinct set of business taxes, administered and collected by the NYC Department of Finance (DOF). The DOF collects more than $33.2 billion in revenue for the city and values more than 1 million properties with a total market value of $988 billion.

Taxpayers who own a business that operates in NYC must need to understand NYC’s taxes . NNot only could these taxes result in significant liabilities, but the DOF has been increasing its audit activity, particularly targeting businesses based out of state that maintain an office or employees in NYC. This discussion serves as a primer for those who may not be familiar with the range of taxes imposed by the city separate from state-level taxes. It is not meant to be an authoritative guide to NYC taxes (and does not cover NYC taxes administered by NYS, such as NYC sales taxes), but simply to attune you to the nature of these taxes, who is subject to them, and what issues tend to create the most audit risk.

You are viewing: Who Must File Nyc Unincorporated Business Tax

Corporate Income Taxes

NYC taxes both C corporations and flow-through entities at the entity level. Since 2015, there are three separate income tax regimes:

- The new business corporation tax (BCT) for federal C corporations (mostly following the new NYS Article 9-A rules with market-based sourcing).

- The pre-existing general corporation tax (GCT) that applies only to federal S corporations since 2015 (using cost of performance sourcing).

- The unincorporated business tax (UBT) for partnerships/LLCs/Schedule C businesses (with cost of performance sourcing).

For all three, the old three-factor formula was completely phased out by 2018 and replaced with a single -factor receipts method for sourcing business income.

The NYC BCT conforms with most aspects of NYS corporate tax reform, with a few notable exceptions. First, as mentioned above, it only applies to federal C corporations. Second, NYC did not incorporate an economic nexus standard. Third, the BCT created a higher (9%) tax rate for major financial institutions with more than $100 billion in assets. All other entities (except qualified manufacturing corporations that can use a reduced rate) pay tax at the rate of 8.85%.

NYC has not yet begun revising its regulations; instead, it is waiting until NYS completes the regulation-writing process, with the intention to adopt most, but not all, of NYS’s business corporation tax regulations, where the BCT statute mirrors the state’s corporate tax statute. For now it appears that taxpayers may rely on the state’s draft regulations if they are interpreting an identical statutory provision of the NYS corporate tax; however, the state’s draft regulations are in flux themselves, complicating the process of interpreting and applying the new BCT provisions.

Upon adopting the BCT as of 2015, NYC did not abandon the old GCT regime, which previously applied to all corporations, as the city does not recognize the federal or state “S” election. Instead, the GCT now applies only to federal S corporations, regardless of whether the corporation makes an S election. GCT is imposed at a rate of 8.85%, with a single receipts factor to apportion income based on cost of performance. Under the existing GCT rules, investment income (defined more broadly than under the new BCT) is separately apportioned using an issuer’s allocation percentage published by the city.

Unincorporated Business Tax

NYC imposes UBT at a rate of 4% on any unincorporated business—that is, any trade or business engaged in or conducted by an individual (sole proprietorship) or unincorporated entity, including a partnership or LLC. If an individual or an unincorporated entity carries on two or more unincorporated businesses in NYC, they will be treated as one unincorporated business for the purposes of the tax. Moreover, an unincorporated business can be treated as doing business in the city and subject to UBT by virtue of its interest in an underlying entity that does business in the city. The entity does not need to have an office or location in the city to be subject to UBT; it only need carry on activities in the city with some regularity.

The UBT is a broad tax, with exemptions limited to:

- Employees, officers, and directors (unless an individual is in the “trade or business” of being a director).

- Trading for one’s own account (potentially a full or partial exemption).

- Holding, leasing, and managing real estate.

- Sales representatives without a city office.

- Tax-exempt trusts.

- Entities subject to NYC corporate taxes.

Entities that otherwise engage in business in NYC but claim an exemption from the tax on one of the above bases are often closely scrutinized by the DOF to confirm that they’re entitled to the exemption.

If an unincorporated business is carried on both within and without NYC, a portion of its business income must be allocated to the city. Like with the BCT and GCT, the UBT uses only receipts to apportion business income. Like the GCT, it sources most receipts based on where the service or income-generating activity is performed, other than sales of tangible property, activities of a registered broker-dealer, management services to a registered investment company, and receipts from publishing. Also similar to the GCT, the UBT still separately allocates investment income using the issuer’s allocation percentage.

As mentioned, DOF has been increasing its audits and scrutiny of unincorporated businesses, focusing on several different issues. Despite the lack of specific guidance on how to allocate income from various types of services, the city has been taking a closer look at how UBT taxpayers allocate income to the city. This is particularly true of entities that use customer-based sourcing, on the basis that they are a broker-dealer. Although the UBT permits a registered broker-dealer to use customer-based sourcing—allowing a NYC-based business to avoid UBT on much of its business income if its customers are primarily based outside the city—the entity using this methodology must be registered with the SEC and FINRA as a broker-dealer. In addition, if the registered-broker dealer also owns or is owned by another nonregistered entity, customer-based sourcing applies only to the receipts from the registered entity. Other business receipts must be sourced using the location where the service was performed.

The DOF is also taking a closer look at many individuals that file a Schedule C to report business income using a NYC address but do not file a UBT return. That may be because the business fits within one of the exempt categories, such as a taxpayer who includes board of director’s fees on their Schedule C, but it may invite closer scrutiny as to whether the taxpayer is engaged in a NYC trade or business.

Read more : Who Can Administer Iv Therapy

One of the most frequently audited UBT issues is the required addback to taxable income of payments to partners. Under the UBT, “no deduction shall be allowed…for amounts paid or incurred to a proprietor or partners for services or use of capital.” The city interprets this provision broadly, requiring the addback of payments to direct and indirect partners (e.g., an individual officer of a corporate partner), with only narrow exceptions. Although a partnership can deduct a payment to a corporate partner for things like administrative services provided by the employees of the corporate partner to the partnership, these arrangements are closely scrutinized. Issues also arise when an employee becomes a partner during the calendar year; the taxpayer must substantiate payments that are deductible as employee compensation and nondeductible as payments to partners. On audit, taxpayers will be required to furnish records like partnership agreements, proof of capital contribution, last paystub as an employee, announcement of promotion, or bonus accrual information (such as contracts, memos and calculations), all in order to substantiate the deduction.

Commercial Rent Tax

Of all the NYC business taxes, commercial rent tax (CRT) often comes as the biggest surprise, particularly when out-of-state businesses receive a 10-year audit notice. CRT is imposed on tenants of properties used for commercial purposes south of 96th Street in Manhattan at a rate of 6% of base rent (gross rent less certain statutory deductions), but the effective tax rate is 3.9% because only 65% of base rent is subject to tax. CRT, which dates back to 1963, formerly also applied to the outer boroughs and Manhattan north of 96th street, until in the law was changed in1995. Importantly, CRT is only imposed on the tenant, not the landlord. It is never included in lease payments and a landlord is not obligated to inform tenants about their potential CRT obligation.

All commercial tenants with annual or annualized rents less than $250,000 are exempt, although a return may need to be filed. The CRT is phased-in for tenants with base rents between $250,000 and $300,000. Effective on Jul. 1, 2018, a tax credit eliminates CRT for base rents between $250,000 and $500,000, but only for businesses with no more than $5 million of total (not net) income. A partial credit is available on a sliding scale, up to $10 million in total income and $550,000 in annual base rent.

There are other exemptions, but taxpayers need to be careful that they fall within these narrow categories:

- Tenants that are governmental or nonprofit religious, charitable, and educational organizations.

- Tenants located in the former World Trade Center area (see the DOF website for the odd configuration of the exempt area).

- Tenants occupying retail space in certain parts of Lower Manhattan, and eligible tenants in the Commercial Revitalization Program (beware of the very specific requirements, including application process).

- Tenants who use the premises for 14 days or fewer in a tax year.

- Tenants (other than an operator of a hotel) who rent more than 75% of the rentable floor space to others for residential purposes.

- Tenants who use the premises for certain dramatic or musical arts performances for fewer than four weeks of the year.

A “tenant subject to tax” is a person who pays or is required to pay rent for premises as a lessee, sub-lessee, licensee, or concessionaire. A tenant includes entities that are “disregarded” for income tax purposes. A tenant can be a related entity/individual, including where—

- a building is owned by a corporation of which the tenant is an officer or holder of all or part of the stock,

- the tenant is a corporation and the building is owned by a subsidiary corporation or by a parent corporation, and

- the tenant is a partner in a partnership.

“Rent” for purposes of CRT includes the amount paid or required to be paid by the tenant for use or occupancy of the premises for an annual period, whether received in money or otherwise, including all credits and property or services of any kind and real estate taxes, water rents or charges, sewer rents, or any other expenses (including insurance) normally payable by a landlord who owns the property. CRT may also be the aggregation of rent due for two or more locations (e.g., floors) at the same taxable premise. Expenses for the improvement, repair, or maintenance of the tenant’s premises are generally not considered rent for CRT purposes.

Note that all NYC income tax returns (BCT, GCT, UBT) include a question as to whether the taxpayer pays rent greater than $200,000 for commercial purposes south of 96th Street, and then asks whether the taxpayer has filed all required CRT returns. Incorrectly checking the “no” box can result in an audit for as many as 10 years (particularly if the taxpayer uses an NYC address in the CRT zone and takes a rental expense deduction), as well as nonfiling, underpayment, and negligence penalties. Statistics published by NYC indicate that total CRT liabilities have increased by an average of 5.3% annually since tax year 2005, reflecting both increasing rents and increased enforcement. NYC also charges interest on underpayments of CRT, as well as other NYC business taxes, of 9% annually, compounded daily, so the impact of a 10-year audit on a CRT nonfiler can be substantial. Unlike penalties, interest is statutory and cannot be abated.

For the last six years or so, NYC has conducted a CRT audit initiative directed at lessees of advertising signs and billboards, since they are considered “taxable premises.” As part of the initiative, the DOF has offered to accept the tax and interest due for the six most recent tax years on billboards, as compared with 10-year audits for other CRT taxpayers.

For nonfilers of CRT or any other NYC business tax who have not previously filed returns and who have not already been contacted by the DOF for that tax type, the city has a voluntary disclosure program. Taxpayers may come forward and disclose on an anonymous basis the nature of the noncompliance, including the specific year it arose and the approximate amount of tax liability for each year of nonfiling. Taxpayers may request a three-year lookback to resolve all outstanding liabilities. If eligible they file three years of returns and pay the tax and interest, and all penalties are abated. For CRT, a taxpayer is not eligible for voluntary disclosure if they are under audit for NYC business income taxes (BCT, GCT, or UBT).

Utility Tax

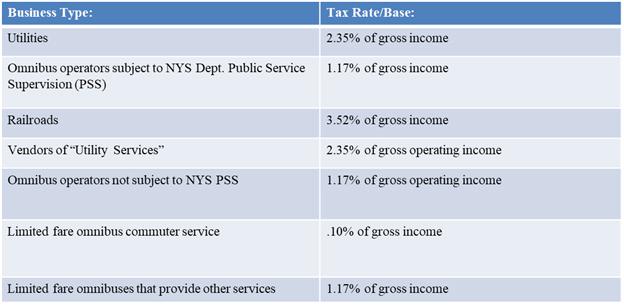

NYC imposes an excise tax on all “utilities” and “vendors of utility services,” including operators of omnibuses. The basic utility tax rate is 2.35% of gross income (for utilities) or gross operating income (for vendors of utility services), but different rates apply to bus companies and railroads:

The NYC Tax Appeals Tribunal recently affirmed an Administrative Law Judge’s determination that Sprint’s long distance telecommunications access charges were not subject to the city’s utility tax, In the Matter of U.S. Sprint Communications Company LP. Specifically, the NYC Tax Appeals Tribunal held that General City Law section 20-b prohibits the Utility Tax from being imposed on a “transaction originating or consummated outside the territorial limits” of the city. The Tribunal noted:

“Because no long distance call to or from a Sprint Customer in the City can be completed without access provided by the City local exchange carrier to Sprint’s long distance switch, a tax on receipts for charges for such access would be a tax on such transactions and, therefore, is prohibited by GCL §20-b. Although the access itself is provided in the City, the prohibition under GCL §20 applies ‘notwithstanding that some act be necessarily performed with respect to such transaction within’ the City, such as the City local exchange carrier’s provision of local access to Sprint’s long distance switch in the City.”

If the city, on audit, attempts to impose utility tax on a transaction that does not occur wholly within the city, practitioners and businesses should dispute the adjustments and appeal based on the utility tax’s enabling legislation and case precedent.

Read more : Who Walked Out Jesus Ramos

Real Property Transfer Tax

New York City imposes a transfer tax on conveyances of real property or interests therein when the consideration for the sale or transfer exceeds $25,000. The tax applies to traditional deed transfers and transfers of controlling economic interests in real property. The real property transfer tax (RPTT) is imposed in addition to the NYS real estate transfer tax (RETT). So, a business or individual selling (or acquiring) real property in NYC to (or from) a third party will generally pay RPTT and RETT on the transaction, unless an exemption applies. The RPTT is generally imposed on the grantor (seller), but the grantee (purchaser) is jointly and severally liable for the payment of the tax.

Certain property transfers are exempt from the tax but must be reported on an RPTT return—for instance, a deed, instrument, or transaction to or from a nonprofit formed and operated exclusively for religious, charitable, or educational purposes or for the prevention of cruelty to children or animals (the “tax-exempt entity statutory exemption”), or to any government body exempt from payment of the tax. Another exemption often claimed—and scrutinized by DOF on audit—is the mere change in form exemption. (The RPTT does not apply to the extent that there is no change in the beneficial ownership of the property interest conveyed.) In contrast to NYC’s RPTT, the NYS RETT does not provide for a similar tax-exempt entity statutory exemption. This is just one example of how the RPTT and RETT differ.

The current rate depends on the type of property and the amount of consideration. For certain residential properties, if the consideration for the transfer is $500,000 or less, the rate is 1% of consideration. If the consideration is in excess of $500,000, however, the rate is 1.425%. These rates apply to the conveyance (by deed or economic interest) of the following residential properties:

- A one- to three-family house.

- An individual residential condominium unit.

- An individual cooperative apartment.

It also applies to a grant, assignment, or surrender or transfer of an economic interest in a leasehold interest in a one- to three-family house or an individual dwelling unit in a home of more than three families living independently of each other.

A tricky RPTT issue is the sale of multiple apartments. Practitioners need to beware of the city’s bulk sale rules and rates. For example, an acquisition of two or more residential cooperative apartments may be subject to the bulk sale—in other words, commercial, non-Real Estate Investment Trust (REIT)—tax rate of 2.625%.

In general, for all other transfers (other than REIT transfers), where the consideration for the conveyance is $500,000 or less, the RPTT rate is 1.425% and where it exceeds $500,000, the rate is 2.625%. REIT transfers are taxed at half of the otherwise applicable rate, if certain conditions are met.

Beginning on Jul. 1, 2019, conveyances (by deed or transfers or acquisitions of a controlling interest in any entity with an interest is real property) in NYC, are subject to new NYS real estate transfer taxes (RETT), other than conveyances made pursuant to a binding written contract entered into on or before April, 2019. Specifically, in addition to the regular NYS RETT rate of $2 for each $500 of consideration (or fractional part thereof), there is an additional RETT tax of $1.25 for each $500 of consideration if the consideration for the residential property located in NYC is $3 million or more. And for nonresidential transfers, where the consideration for the conveyance is $2 million or more, an additional RETT tax of $1.25 for each $500 of consideration applies.

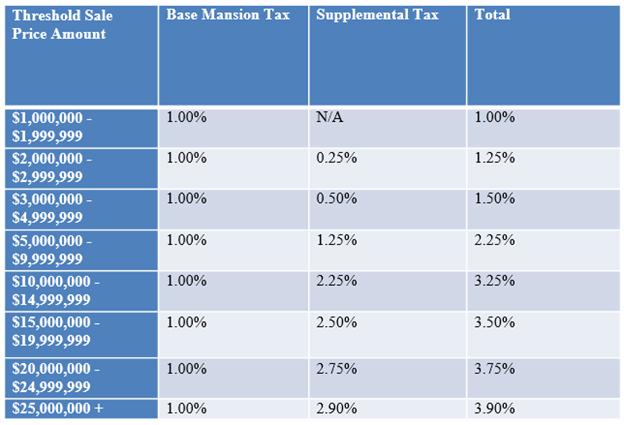

And then there’s the additional RETT tax of 1% of the sale price (referred to as the “mansion tax”) of residential real property where consideration is $1 million or more, and the new supplemental tax that was enacted as a part of Governor Cuomo’s budget bill. The supplemental tax is on the conveyance of residential real property located in NYC, or interest therein, when the consideration is $2 million or more. Unlike the regular RETT, which is imposed on the grantor, the mansion tax and new supplemental tax are imposed on the grantee. The tax rate for the supplemental tax is an incremental rate, as follows:

Finally, new reporting requirements apply for certain residential deed transfers occurring on or after Sep. 13, 2019. The legislation amends NYS Tax Law section 1409(a), with a corresponding amendment to NYC Administrative Code section 11-2105. It requires any LLC buyer or LLC seller of a one- to four-family residential dwelling to disclose the names and business addresses of all “members, managers and any other authorized persons” of the LLC. And if any member, manager, or authorized person of such LLC is itself an LLC or other business entity, the names and addresses of the “shareholders, directors, officers, members, managers and partners” of that entity must be disclosed “until full disclosure of the ultimate ownership by natural persons is achieved.”

Other NYC Taxes

NYC imposes and administers several other taxes not covered here, including but not limited to cigarette and other tobacco products tax; commercial motor vehicle tax; horse race admission tax; hotel room occupancy tax; mortgage recording tax; retail beer, wine and liquor license tax; and taxicab license transfer tax. NYS also administers NYC’s sales taxes, which differ in various respects from the state’s tax.

For businesses that operate in the city, tax planning and compliance should include consideration of the wide variety and scope of entity-level taxes, some of which exist in very few other local jurisdictions in the country. Practitioners and business owners should understand that NYS and NYC, while conforming to some extent as a result of the recent corporate taxreform, have very different tax regimes that continue to evolve on a daily basis.

Elizabeth Pascal, JD, is a partner in the state and local tax group of Hodgson Russ LLP, with a focus on New York State, New York City, and multistate tax issues. She assists individual and business clients with New York State and New York City audits, including residency, withholding tax, unincorporated business tax, commercial rent tax, and corporate tax audits. Liz has also helped many clients successfully navigate New York State’s voluntary disclosure process. She works with each client to determine the optimal strategy to resolve tax issues, whether negotiation through the audit process, litigation, or tax planning. Prior to joining Hodgson Russ, Liz served as an intern for U.S. District Judge William Skretny in the Western District of New York. She can be reached at [email protected] or 716-848-1622.

Debra Herman is a partner in the New York City office of Hodgson Russ LLP’s state & local tax practice. She is widely recognized for her experience in state and local taxation. Debra works with a variety of clients to address the state and local tax impact of their multistate activities from both a planning and an audit and controversy viewpoint and on complex transactions, with a focus on New York State tax matters. Debra counsels clients with respect to corporate income and franchise taxes, bank taxes, utility taxes, unincorporated business taxes, sales and use taxes, gross receipts taxes, excise taxes on real property transfers, rent and occupancy taxes, and withholding taxes. She also has extensive experience working with high-net-worth clients on residence and other personal income tax matters and successfully representing clients in all phases of tax disputes, including audits and litigation at the federal, state, and local levels, as well as criminal tax investigations. Debra served as the chair of the State and Local Tax Committee of the New York City Bar Association and is currently Chair-Elect of the American Bar Association, Tax Section, State and Local Tax Committee.

Source: https://t-tees.com

Category: WHO