Tom Bradbury – 79-year-old founder and self-described “chief culture officer” of Atlanta-area Southeast regional homebuilding powerhouse Smith Douglas in the depths of The Great Recession in 2008 – declared an unapologetic goal for his team six years ago. It was to evolve into one of homebuilding’s “enduring, closely-held” brands – along the lines of a David Weekley Homes, Highland Homes, Ashton Woods, Shea Homes – and to spool up, 10X, from about $108 million in revenues in 2016 to above $1 billion in 2024.

Just like them.

You are viewing: Who Owns Smith Douglas Homes

At the very same moment Bradbury put out that claim about his firm’s accelerated growth trajectory – and mind you, that was just after his firm scraped through a “near-extinction moment” coming out of the GFC – he unveiled one of his secret weapons for getting to the goal: His hiring of former protege-become-rock-star Greg Bennett to rejoin him as chief operating officer of an operation with rocket-fuel in its DNA.

We wrote here at the time:

Read more : Who Did Madison Sadri Nanny For

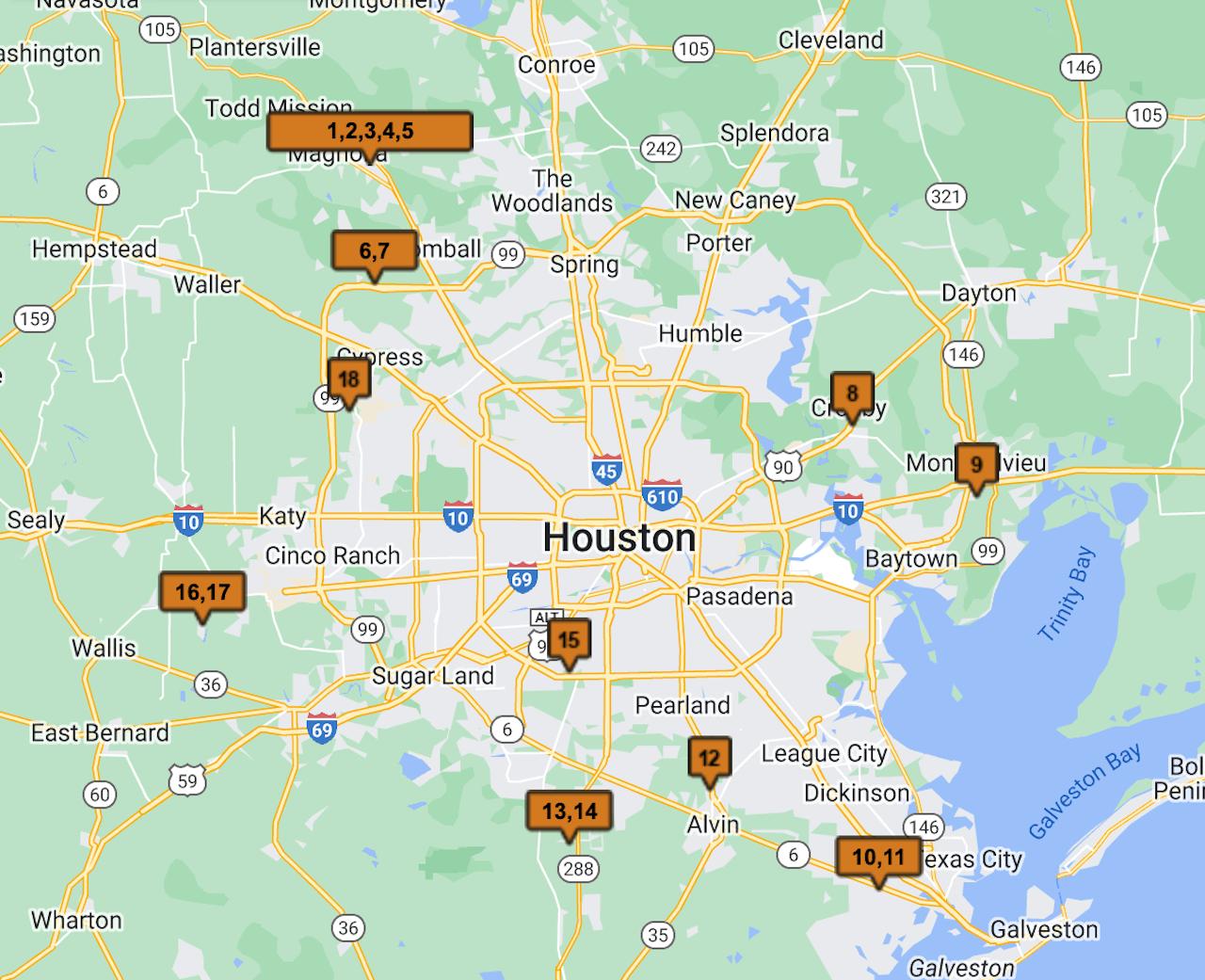

Now, fast-forward to a news announcement that came through yesterday, announcing Smith Douglas’ purchase of the assets of Houston-based Devon Street Homes.

Combining Smith Douglas’ reported $755 million in 2022 homebuilding revenues, and Devon Street Home’s $107 million last year – totaling $862 million – would any knowledgable homebuilding observer doubt that Tom Bradbury’s $1 billion revenue promise by 2024 is beyond reach?

Don’t bet on it.

We want to unpack this acquisition for what principal and strategic stakeholders may want to understand about the dynamics and mechanics of the new residential real estate construction, development, and investment marketplace. Specifically, the ways these forces and conditions impact privately-held companies, whose capital access options require them to navigate some narrower and more costly pathways to business stabilization and sustainable growth.

Let’s check first, details of the Smith Douglas Homes-Devon Street Homes combination released in a statement late yesterday:

Read more : Who Is God’s Daughter

One of the first contextual observations here: A private-to-private acquisition propelling a Southeast-based regional player into Texas is somewhat of an M&A market expansion rarity. In most cases in recent homebuilding M&A deal-flow, it is a Texas-based operator acquiring a Southeast-market springboard for expansion.

Across Tom Bradbury’s almost 50 years of experience in homebuilding, his company’s purchase of a Texas-based, operationally excellent, entry-level and first-time-buyer oriented firm such as Devon Street has a “full-circle” sense to it. As we wrote here in 2017:

It’s this operational point of distinction that supports a critical, essentially revenue-funded business that regional land banks, developers, and other capital providers find to be particularly attractive.

Alignment with hungry-for-growth, Houston entry-level-oriented boot-strapper Stephen Ray and his team felt like just the fit as a Smith Douglas Manifest Destiny, says Bennett.

As Bennett looks ahead at additional opportunities to bring the Smith Douglas SMART system into Houston and beyond, the business culture, capital optionality, and operational focus of the organization draw constantly from the seemingly ever-flowing spring of founder Tom Bradbury.

Source: https://t-tees.com

Category: WHO