The stock market is volatile. It’s been that way for a long time, and it will continue to be so until the end of time. But why are equities volatile fundamentally? What drives this volatility? How does volatility actually work? Can one profit from it? We’ll explore all of this and a whole lot more.

Let’s get into it.

You are viewing: Why Are Equities Volatile

How Are Stock Prices Set?

Before we get into why equities are volatile, it’s vital to understand how stock prices are determined.

That’s because the volatility of equities ultimately relates to changes in stock prices.

More on this further down when we talk about how volatility is measured.

Stock prices are, broadly speaking, a representation of the total market capitalization (or simply “market cap”) of a company.

The market cap is calculated by multiplying the current stock price by the total number of shares outstanding.

But how is the current stock price actually determined?

It’s broadly a function of two things:

- the present value of future expectations, and

- demand and supply

In the short term, a stock’s price is ultimately set by simple supply and demand.

In the medium to long term, however, it’s more a function of the intrinsic value of the business.

The intrinsic value refers to what the stock/business should be worth; or what it’s actually worth.

That in turn is based on the present value of future cash flows.

From a demand and supply perspective, however, more demand for a company’s stock will cause an increase in price (and vice versa).

And this leads us to the question of why are equities volatile?

Related Course: Investment Analysis & Portfolio Management (with Excel®)

This Article features a concept that is covered extensively in our course on Investment Analysis & Portfolio Management (with Excel®).

If you’re interested in learning how to quantify risk for stocks and portfolios, working with real world data, then you should definitely check out the course.

Why Are Equities Volatile?

The reason why equities are volatile has little to do with their underlying fundamentals or even the economy as such.

Instead, volatility in stocks largely comes from investors themselves – specifically, how they behave when making investment decisions.

Put differently, equities are volatile fundamentally because of significant changes in the demand and supply of stocks (as a result of investor decision-making).

Traditional Finance, particularly Asset Pricing, typically relies on the assumption that all investors are rational.

In such a world, demand and supply would only react to changes in the intrinsic value of businesses.

The reality is quite different for the most part, however.

One factor that affects share price movements outside the “rational norm” is what economists call “animal spirits.”

Coined by John Maynard Keynes, and recently repopularised by Robert Shiller and George Akerlof’s Animal Spirits book, Animal Spirits essentially refers to people’s willingness to take risks and act impulsively.

This, coupled with other irrational behaviour and human biases that can contribute to the diversion of stock prices from their intrinsic values.

Sufficiently large shifts in demand and supply can result in drastic changes in stock prices, resulting in significant volatility of equities as a whole.

This in turn can result in greater market volatility, which then results in increased volatility in stocks as investors react to the overall market volatility.

Let’s explore this school of thought further.

Why Do Stock Prices Change?

The answer to this question is essentially the same as the answer to how stock prices are set – supply and demand.

At least in the short term, supply and demand are perhaps the only real factors that cause a stock’s price to change.

The “fundamentals” might determine the intrinsic value of the stock, but if the “market” decides a company should be worth more or they really want to own more of the stock, the market will buy more of the stock and push the market cap higher.

Read more : Why Does My Left Shoulder Hurt When I Cough

Even if that market cap is significantly greater than the intrinsic value of the business.

In some cases, the equity market can push a company’s market cap far above or below what it might actually be, sometimes within a very short period of time, by exploiting certain oversights.

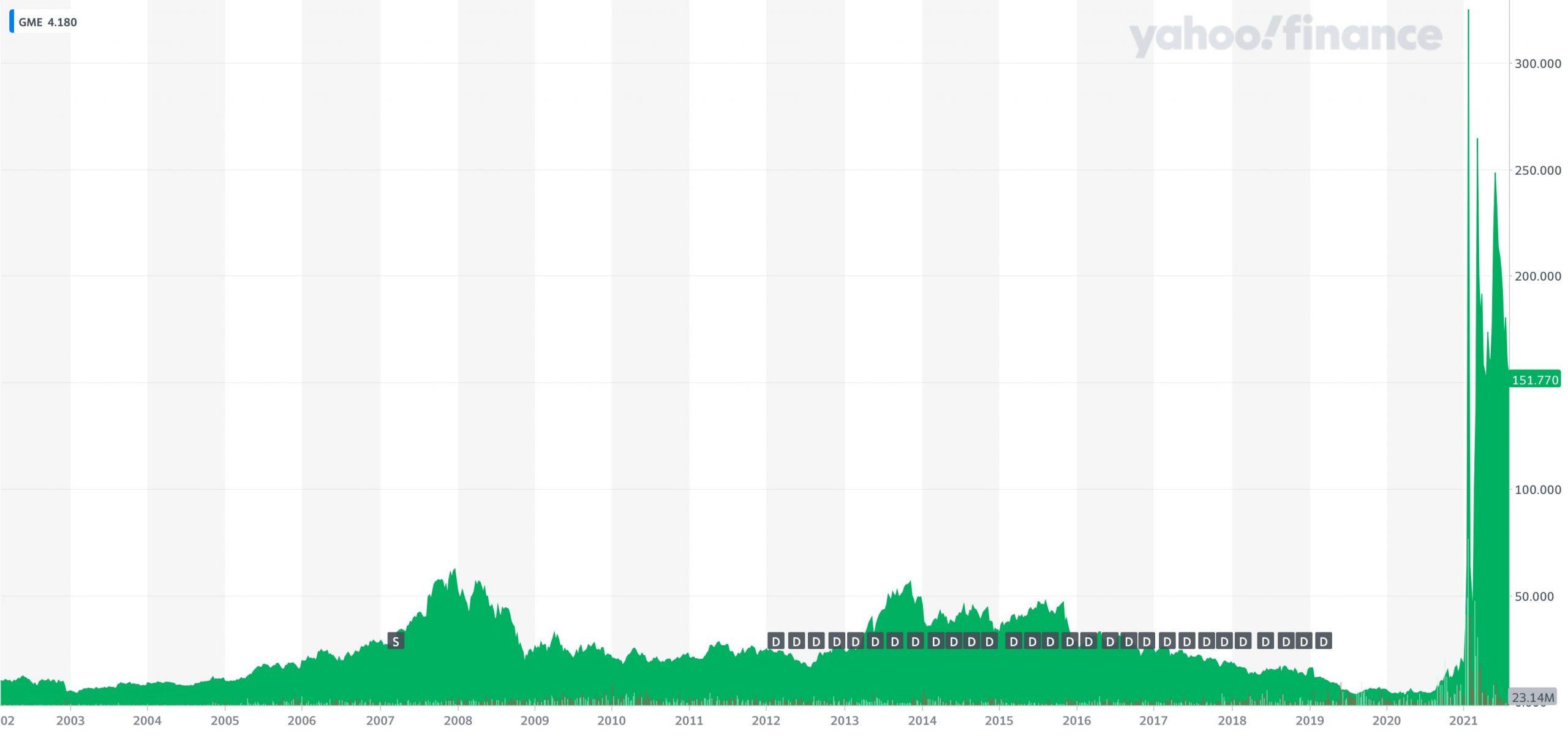

GameStop (NASDAQ: GME) in the US is an excellent example of this.

There are many examples of stocks moving up and down very quickly, and these situations present investors with examples of volatility.

What Is Volatility?

Volatility refers to the amount of fluctuation in a security over any particular timeframe.

We typically measure volatility using the standard deviation, which is basically a way of measuring dispersion around the mean value.

A high level of volatility means that the stock moves significantly from its average value.

When we talk about volatility, we usually refer to daily percent changes in stock prices.

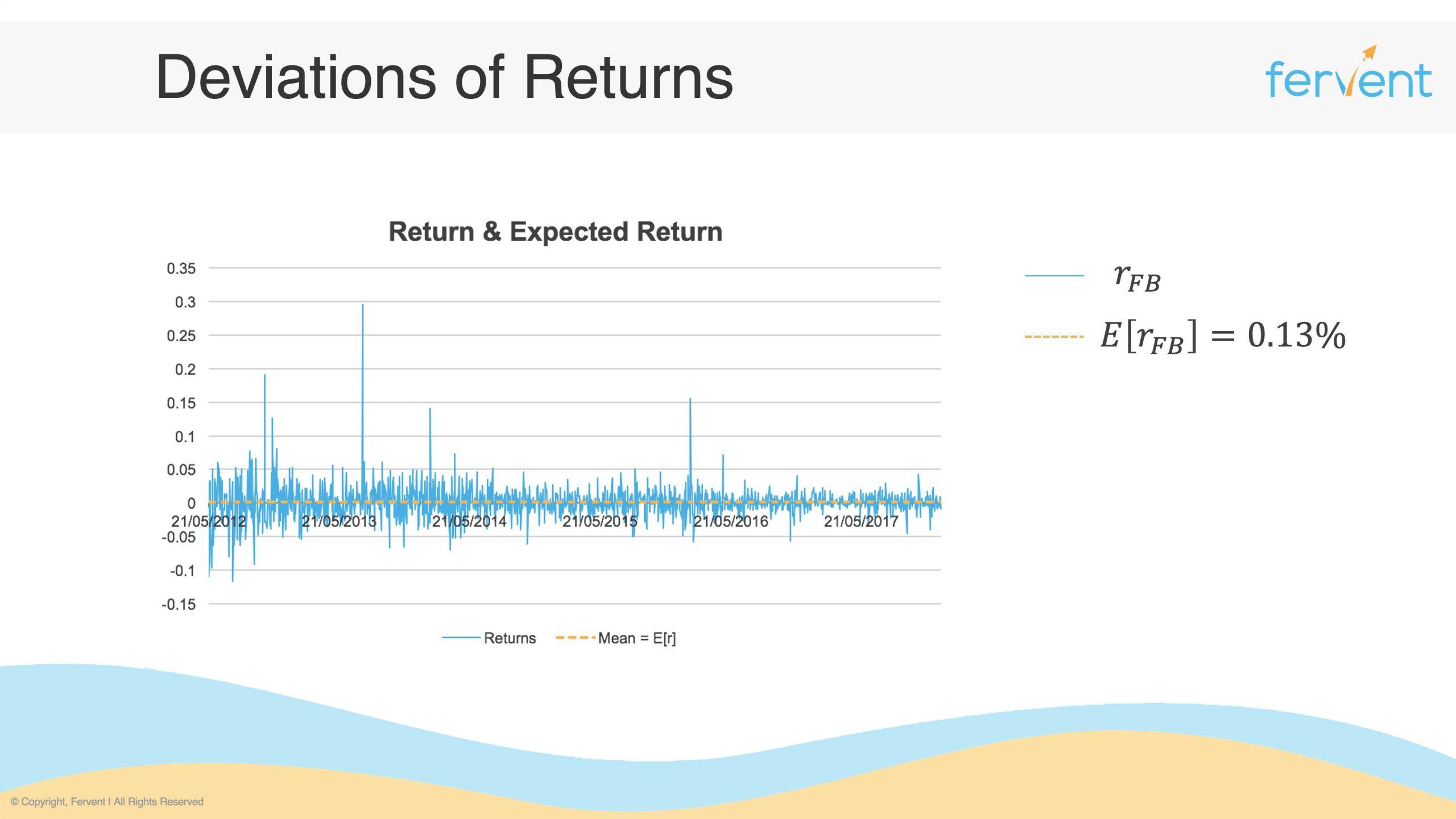

So, for example, here’s the volatility of Facebook’s stock price which we’ve called the “deviations of returns”.

The blue line represents the daily returns of Facebook.

You can see how random and variable they are.

That variability is captured by the volatility (or the standard deviation of stock returns).

Just in case you’re thinking if Facebook is a particularly volatile stock, know that you’d see a very similar chart regardless of which stock’s daily returns you plot out.

Now, while we typically work with daily data, one could also work with weekly, monthly, or annual prices and see similar (but not identical) effects.

Put more simply, high volatility would be represented by large swings in a stock’s price in a specified period of time.

Similarly, market volatility would be represented by large swings in the stock market prices in a specific period of time.

Volatility can also be thought of as a measure of how uncertain the market is about the stock’s price in the short term.

You’ll typically see greater stock market volatility when uncertainty is high among investors.

How Does Volatility Work?

While stock returns are completely random, unpredictable, and volatile, the level of volatility can often vary between and across stocks.

For some stocks, volatility can appear out of nowhere and then disappear almost as quickly.

For others, it can be a sort of roller-coaster ride with varying levels of volatility over time.

Increasing volatility is usually associated with a stock that is falling, but that’s not a rule by any means.

Rising or even spiking volatility could be associated with news that comes out which could have an impact on either a single stock or broad sectors of the market.

When the news breaks, assuming it’s bad news, many investors might panic and sell their positions, which will cause the price to drop.

Falling prices might cause more investors to sell their positions, and on and on.

The more people sell their positions, the more uncertain the value of the company becomes, causing an increase in volatility.

Sometimes, the price could fall very quickly but spring right back to where it was when the news broke.

This perhaps best explains why volatility can be seen as a representation of the market’s uncertainty.

And generally speaking, folks in Finance tend to work with the VIX index as the proxy for market uncertainty.

How Is Volatility Measured?

As we mentioned earlier, volatility is measured using the standard deviation.

Here’s what it looks like for a random stock :

If the equation above is freaking you out, or if equations in general tend to intimidate you, take a look at our Financial Math Primer course.

It’s designed to help you get the mathematical foundation you’ve always needed.

Read more : Why Am I Craving Steak

If you’d like to explore the volatility of stocks in more detail, check out our sister article.

While the standard deviation is the main measure for volatility, there are other related concepts including (but not limited to):

- Maximum Drawdown – the largest historical loss for a given asset within a given timeframe)

- Value at Risk – the highest loss possible at a predefined likelihood level

- Beta – the risk of a stock relative to the overall stock market

- Implied Volatility (IV) – this largely relates to Options (derivative instruments)

- Realized Volatility (RV) – a daily measure of standard deviation obtained by using intraday stock price data

It’s common for investors to work with these – and other proxies for volatility like the VIX index – when exploring the volatility of equities or a volatile market.

Is Volatility Good or Bad?

Okay, now that you know why equities are volatile and how volatility actually works, perhaps you’re wondering if volatility is “good” or “bad”.

In truth, volatility is both good and bad.

But it can also be neither.

The fact is, how you view volatility is entirely dependent on your style of investing.

If you are a “buy and hold” investor, typically holding positions for at least a year, then volatility in the short term may mean nothing to you.

It will simply represent a short spike one way or another in your account value.

Over time, these short spikes in volatility generally tend to work out in your favour.

If you trade on shorter timeframes, volatility can only be good or bad.

It would certainly benefit you to follow it closely prior to making investment decisions.

Are There Any Volatility Investing Strategies?

While professional traders watch volatility closely, even retail / individual investors can benefit from a few strategies when it comes to investment intended to be held in shorter timeframes.

Lower volatility environments are sometimes known to come at peaks of a market.

Experienced investors might avoid placing long positions when volatility is low because there is a higher likelihood of losing money when volatility increases.

Alternatively, there are those in the market who buy assets when volatility spikes and is at its highest.

Remember previously when we said volatility comes in quickly and disappears almost as quickly?

This is sometimes known as “catching a falling knife.”

It’s very difficult to know what’s going on when volatility is spiking.

Think of April 2020 when world markets were in freefall as a result of the Covid-19 pandemic.

While you can go back and clearly see excellent buying opportunities across the board, there was no way to know what would happen on the other side of the pandemic, so the risk was very high to start buying assets.

In the long run, for the most part, it’s best to just work with an index fund that tracks the overall market.

This is especially true if you don’t have time to actively research stocks and conduct investment analysis and portfolio management.

Final Thoughts: Volatility in Equities

Volatility may not be the most important metric to consider before opening a new position, but it is certainly important to understand as an investor.

It is a measure of risk and somewhat represents the changes in the price of stocks.

Volatility can also be seen as a representation of how uncertain the market is about the price of a certain asset or market index.

While it can be measured in a few different ways, we typically estimate it using the standard deviation.

While implementing a successful trading strategy based on volatility is very difficult, it can be a good guide to choose whether to enter the market with a position.

Note that it really is just a guide – NOT a crystal ball.

Markets can change dramatically and often in unpredictable ways , especially in the short term.

Related Course: Investment Analysis & Portfolio Management (with Excel®)

Do you want to leverage the power of Excel® and learn how to rigorously analyse investments and manage portfolios?

Explore the Course

(Or get unlimited access to all our finance and investing courses with the Superlearner All Access Pass).

Source: https://t-tees.com

Category: WHY