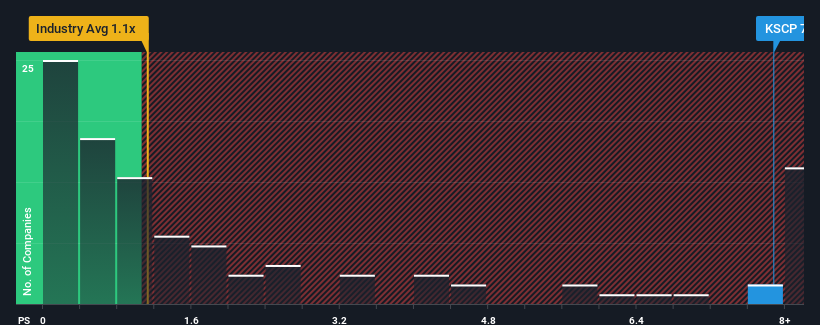

Knightscope, Inc. (NASDAQ:KSCP) has seen a significant drop of 35% in its shares over the past month, erasing much of its previous strong performance. Shareholders have suffered a staggering loss of 60% over the past year. Despite the sharp decline, caution is advised when considering Knightscope as an investment due to its high price-to-sales ratio (P/S) of 7.9x. This ratio is considerably higher than the industry average of 1.1x, warranting further investigation to determine if it is justified.

A Closer Look at Knightscope’s Recent Performance

Knightscope has demonstrated superior revenue growth compared to its industry peers, which has likely contributed to its high P/S ratio. On the surface, this suggests that investors believe in the company’s ability to sustain its impressive revenue performance. However, existing shareholders may be concerned about the long-term viability of the stock.

Read more : Why Does My Windshield Wiper Skip

For a more comprehensive analysis of Knightscope’s future prospects, it is advisable to explore our detailed report on the company.

Forecasted Revenue Growth for Knightscope

A steep P/S ratio like Knightscope’s is only justifiable when the company’s growth prospects surpass those of the industry as a whole. Fortunately, Knightscope has shown remarkable revenue growth over the past year, with a staggering increase of 180%. Over a three-year period, revenue has risen by an impressive 234%, primarily driven by its short-term performance. Shareholders have undoubtedly welcomed these medium-term growth rates.

Looking ahead, industry analysts predict a growth rate of 50% for Knightscope in the coming year. This estimate far exceeds the industry average forecast of 11% growth. Given this information, it becomes clear why Knightscope’s P/S ratio is significantly higher than the industry average. Investors seem reluctant to sell a stock that exhibits the potential for a more prosperous future.

Decoding Knightscope’s P/S Ratio

Read more : Why Is My Dog Licking Her Private Area So Much

Despite a substantial drop in share price, Knightscope’s P/S ratio remains remarkably elevated. While relying solely on the price-to-sales ratio to make investment decisions is not advisable, it can serve as a valuable indicator of a company’s future prospects.

Delving deeper into Knightscope’s analyst forecasts reveals that its optimistic revenue outlook contributes to its high P/S ratio. Investors perceive the likelihood of a revenue decline as remote, justifying the inflated ratio. Under these circumstances, a significant decline in share price seems unlikely in the near future.

Before making any investment decisions, it is crucial to familiarize yourself with the 5 warning signs for Knightscope (3 of which may raise concerns), which we have uncovered. Additionally, if you find value in profitable companies, be sure to explore our list of interesting companies that trade at a low price-to-earnings ratio (P/E) and have demonstrated earnings growth.

If you have any feedback or concerns regarding this article, feel free to get in touch with us directly or email the editorial team at [email protected]. Please note that this article is based on historical data and analyst forecasts, using an unbiased methodology. It is not intended as financial advice and does not consider individual objectives or financial situations. Our aim is to provide long-term focused analysis driven by fundamental data. It is important to note that our analysis may not include the latest price-sensitive company announcements or qualitative material. Simply Wall St does not hold any positions in the stocks mentioned.

Source: https://t-tees.com

Category: WHY