As the timeless adage goes, “time is money,” and for many individuals, this translates into dedicating extra hours to the workplace in the hopes of boosting their income. However, as the minutes clock into overtime, a pertinent question emerges: Is overtime taxed more? This inquiry holds significant weight in the pursuit of financial stability.

Exploring the nuances of taxation on overtime earnings is a topic that often sparks curiosity and concern among working individuals. In this article, we’ll navigate the complex terrain of taxation to uncover whether overtime does come with a higher tax bill. Join us on this journey as we clarify the financial implications of putting in those extra hours at work.

You are viewing: Why Is Overtime Taxed Higher

Is Overtime Taxed More Than Regular Pay?

It’s crucial to clear a common confusion here: overtime pay itself is not taxed at a higher rate. Instead, the higher tax liability often stems from the fact that the extra income can push an individual into a higher tax bracket, triggering a higher tax rate on the portion of income within that bracket.

In the realm of taxation, the distinction between overtime and regular pay lies in the way these earnings are categorized. While both are subject to federal income tax, overtime pay can sometimes fall into a higher tax bracket due to its sporadic nature and the potential to significantly boost an individual’s annual income.

Recognize that the progressive nature of the U.S. tax system means higher income is taxed at higher rates. When overtime pay pushes an individual’s total income into a higher bracket, the portion within that bracket is subject to a higher tax rate.

Moreover, extra earnings from overtime might be subject to other taxes, such as Social Security and Medicare taxes. These payroll taxes are calculated as a percentage of income and can further contribute to a comparatively higher tax rate on overtime earnings.

How Are Overtime Taxes Calculated

Unlike regular pay, overtime earnings introduce more considerations into the equation. Here’s a breakdown of how overtime taxes are calculated:

Hourly Overtime Rate

The first step involves determining the hourly overtime rate. Overtime is typically calculated at a rate of 1.5 times the regular hourly pay. For instance, if the standard hourly wage is $20, the overtime rate becomes $30 per hour.

Weekly Overtime Threshold

Overtime is often triggered when an employee exceeds a certain number of hours within a week. The standard threshold for overtime pay in the United States is usually set at 40 hours per week. Any hours worked beyond this threshold qualify for overtime.

Calculating Overtime Earnings

Once the hourly overtime rate and the weekly threshold are established, the calculation involves multiplying the overtime rate by the number of overtime hours worked.

For example, if an employee works 45 hours in a week i.e. 5 extra hours with a $30 per hour overtime rate, the overtime earnings would be calculated as 5 hours x $30. As a result, there would be an earning of extra $150 for the week.

You can also arrive at the calculation as follows:

$20 x 1.5 x 5 = $ 150

To learn more about the rules that govern this calculation, check out our Comprehensive Guide to Overtime Pay.

Did You Know?

In a notable move to strengthen workers’ rights and economic security, the U.S. Department of Labor introduced an overtime protection proposal in 2023 to extend overtime protections to 3.6 million salaried workers.

Key elements of the proposed rule include:

- Reinstating and broadening overtime protections for low-paid salaried workers

- Refining the identification of exempt employees

- Preventing future erosion of overtime safeguards

- Restoring overtime protections for the U.S. territories

- Secure overtime pay for those earning less than $55,000 annually

Tax Withholding

Tax withholding is the process by which employers deduct taxes from an employee’s wages or salary and remit those withheld amounts to the government on the employee’s behalf. The purpose of tax withholding is to ensure that individuals meet their tax obligations throughout the year rather than having to pay a large sum when filing their annual tax returns.

When an individual starts a new job, they typically complete a Form W-4, which helps the employer determine the appropriate amount to withhold from the employee’s pay for federal income taxes. The W-4 Form includes information such as the individual’s filing status, number of dependents, and any extra amount they want to withhold.

As an individual starts earning overtime pay, their tax withholding encompasses several types of taxes, including:

Federal Income Tax

The amount withheld is based on the individual’s income, filing status, and allowances claimed on the W-4.

Social Security Tax

This tax funds the Social Security program and is withheld at a fixed percentage of the individual’s wages up to a certain income limit.

Medicare Tax

Similar to the Social Security tax, it’s withheld at a fixed percentage to fund the Medicare program.

Did You Know?

The present 2024 social security tax rate stands at 6.2% for both the employer and the employee, resulting in a combined total of 12.4%. Similarly, the current Medicare rate is 1.45% for both the employer and the employee, amounting to a total of 2.9%. Both of these fall under the Federal Insurance Contributions Act (FICA).

State and Local Income Taxes

Depending on the individual’s state and local tax regulations, the authorities may withhold extra amounts to cover these taxes. State income tax rates vary, and some states may have specific rules for taxing overtime income. Understanding the tax landscape in the relevant state or locality is essential for accurate calculations.

A time-tracking solution with overtime alerts facilitates precise tax withholding calculations for overtime by accurately recording work hours, ensuring compliance with both local and federal labor regulations.

These withheld taxes are then sent to the relevant tax authorities, and at the end of the tax year, the individual reconciles their total tax liability by filing a tax return. If too much was withheld, they may receive a refund; if too little was withheld, they may owe additional taxes.

Why Is Overtime Taxed More?

Navigating the U.S. Income Tax brackets is a nuanced journey with different tax rates as earnings increase. By boosting an individual’s total income, overtime earnings can become subject to these higher tax rates, creating the impression of a weightier tax burden.

One key feature that needs to be highlighted here is the Marginal Tax Rate. Marginal tax rate refers to the percentage of tax applied to the last dollar of income earned. For example, if an individual is in the 22% tax bracket, the marginal tax rate is 22%.

If their income increases and pushes them into the next bracket with a 24% tax rate, the marginal tax rate for that extra income becomes 24%. The overall average or effective tax rate may be lower than the marginal tax rate, as the lower tax rates from the previous brackets still apply to the income within those brackets.

Understanding the marginal tax rate is crucial for individuals to assess the impact of extra income, such as overtime pay or a salary increase, on their overall tax liability. It helps in making informed financial decisions by considering how each extra dollar earned will be taxed at the current tax bracket.

2024-2025 Tax Brackets

As of 2024, the U.S. tax brackets continue to reflect the progressive structure, with varying rates for different income levels. Incorporating these brackets into the analysis provides a real-time perspective on how overtime earnings may be taxed, aiding individuals in making informed financial decisions.

In the U.S., individuals can choose from various statuses that significantly influence their tax liability as follows:

Single Filer

This designation applies to those who are unmarried, not legally separated, or widowed as of the tax year’s last day, offering a distinct standard deduction but potential eligibility for specific tax credits.

Married Filing Separately

This allows married individuals to keep their finances separate, though this choice may result in higher tax rates and reduced credit eligibility.

Head of Household

This status is tailored for unmarried individuals providing a home for a qualifying child or dependent, offering specific tax advantages.

Married Filing Jointly

This allows married couples to combine income and deductions, often resulting in a higher standard deduction and more favorable tax brackets. However, both spouses share liability for the entire tax owed.

Markedly, the choice of filing status is crucial, impacting tax outcomes. Individuals are advised to carefully consider their circumstances or seek professional advice for optimal results.

Below are the latest tax brackets for each of these types of tax filings:

Single Filer

Tax Rate

Taxable Income

Tax Due

10%

Not over $11,600

10% of taxable income

12%

Over $11,600 but not over $47,150

$1,160 plus 12% of the excess over $11,600

22%

Over $47,150 but not over $100,525

$5,426 plus 22% of the excess over $47,150

24%

Over $100,525 but not over $191,950

$17,168.50 plus 24% of the excess over $100,525

32%

Over $191,950 but not over $243,725

$39,110.50 plus 32% of the excess over $191,150

35%

Over $243,725 but not over $609,350

$55,678.50 plus 35% of the excess over $243,725

37%

Over $609,350

$183,647.25 plus 37% of the excess over $609,350

Married Filing Separately

Tax Rate

Taxable Income

Tax Due

10%

Not over $11,600

10% of taxable income

12%

Over $11,600 but not over $47,150

$1,160 plus 12% of the excess over $11,600

22%

Over $47,150 but not over $100,525

$5,426 plus 22% of the excess over $47,150

24%

Over $100,525 but not over $191,950

$17,168.50 plus 24% of the excess over $100,525

32%

Over $191,950 but not over $243,725

$39,110.50 plus 32% of the excess over $191,150

35%

Over $243,725 but not over $365,600

$55,678.50 plus 35% of the excess over $243,725

37%

Over $365,600

$98,334.75 plus 37% of the excess over $365,600

Head of Household

Tax Rate

Taxable Income

Tax Due

10%

Not over $16,550

10% of taxable income

12%

Over $16,550 but not over $63,100

$1,655 plus 12% of the excess over $16,550

22%

Over $63,100 but not over $100,500

$7,241 plus 22% of the excess over $63,100

24%

Over $100,500 but not over $191,950

$15,469 plus 24% of the excess over $100,500

32%

Over $191,950 but not over $243,700

$37,417 plus 32% of the excess over $191,150

35%

Over $243,700 but not over $609,350

$53,977 plus 35% of the excess over $243,700

37%

Over $609,350

Read more : Why Is It Rude To Ask A Woman Her Age

$181,954.50 plus 37% of the excess over $609,350

Married Filing Jointly

Tax Rate

Taxable Income

Tax Due

10%

Not over $23,200

10% of taxable income

12%

Over $23,200 but not over $94,300

$2,320 plus 12% of the excess over $23,200

22%

Over $94,300 but not over $201,050

$10,852 plus 22% of the excess over $94,300

24%

Over $201,050 but not over $383,900

$34,337 plus 24% of the excess over $201,050

32%

Over $383,900 but not over $487,450

$78,221 plus 32% of the excess over $383,900

35%

Over $487,450 but not over $731,200

$111,357 plus 35% of the excess over $487,450

37%

Over $731,200

$196,669.50 plus 37% of the excess over $731,200

Example

Consider a single filer individual earning $47,000 annually, falling into the 12% tax bracket. If this individual takes on overtime, pushing their total income to $50000, the excess over the initial bracket becomes subject to the higher 22% tax rate. Their marginal tax rate would also be considered as 22%.

In this scenario, the portion of income till $47,150 would be taxed at 12%, but the $2850 earnings beyond that would be taxed at the higher 22% rate. This shift in tax rates continues with each subsequent bracket.

Now, if the individual’s total income surpasses $100,525 due to substantial overtime, the portion exceeding this threshold would be taxed at the even higher 24% rate. The pattern persists as earnings climb into the 35% and 37% brackets.

As a result of this, the perception of overtime facing a weightier tax burden is rooted in the reality of navigating through progressively higher tax rates as income levels rise.

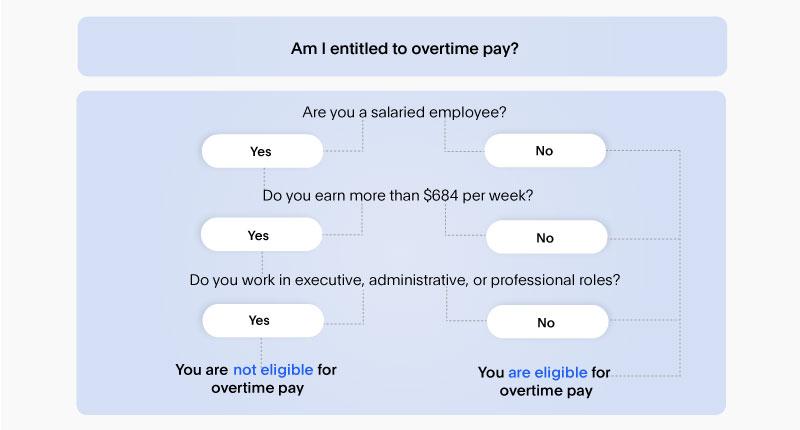

Overtime Tax Laws & Exceptions

The Fair Labor Standards Act (FLSA) primarily governs overtime laws in the United States. Here are some key pointers:

- Overtime is typically calculated on a weekly basis. If an employee works more than 40 hours in a workweek, the extra hours are considered overtime.

- Most employees are entitled to overtime pay for hours worked beyond 40 in a workweek unless they fall under exempt categories.

- Non-exempt employees are generally entitled to receive overtime pay at a rate of at least one and a half times their regular hourly rate for each overtime hour worked.

- The FLSA defines the workweek as a fixed and regularly recurring period of 168 hours, typically seven consecutive 24-hour periods.

- Private employers usually compensate non-exempt employees for overtime hours with monetary payment, while public sector employees may receive compensatory time off in certain cases.

- Some states have their own overtime laws, which may provide more protection or different thresholds. Employers must comply with both federal and state regulations, and the law that offers the greater benefit to the employee prevails.

- Employers are required to maintain accurate records of employees’ work hours and wages, including overtime hours and pay.

- Violations of overtime laws may result in penalties, fines, and back pay obligations for employers.

However, no specific tax laws apply exclusively to overtime earnings. Instead, overtime pay is subject to the same federal income tax regulations as regular earnings.

This is because tax implications are always calculated based on gross earnings rather than regular and overtime earnings separately. So, the same taxes that are applicable to regular earnings (be it FICA taxes or state taxes) are applicable to overtime taxes as well.

That said, the FLSA governs overtime pay, and certain employees may be exempt from its overtime provisions. Exemptions are generally based on the type of work an employee performs, their salary level, and how they are paid.

Here are some common overtime exemptions:

Executive, Administrative, and Professional Employees

Employees who meet specific criteria related to their job duties, salary level, and manner of compensation may be exempt from overtime. These are often referred to as the “white-collar” exemptions.

Outside Sales Employees

Individuals whose primary responsibility involves generating sales or securing orders outside the employer’s place of business may qualify for an exemption from overtime.

Computer Employees

Certain computer professionals may be exempt if they meet specific criteria related to their job duties, salary, and whether they are paid on a salary or fee basis.

Highly Compensated Employees

Employees earning a total annual compensation above a certain threshold may be exempt from overtime. This exemption applies if they customarily and regularly carry out at least one of the exempt duties/responsibilities of an executive, administrative, or professional employee as mentioned in the standard exemption tests.

Certain Agricultural and Farm Workers

Some agricultural and farm workers are exempt from overtime under specific conditions.

However, meeting the salary threshold alone does not automatically exempt an employee. Their job duties must also align with the criteria outlined in the FLSA. In addition, state labor laws may have their own set of exemptions or may differ from federal regulations. So, both need to be considered when determining overtime eligibility.

Strategies for Managing Overtime Taxes

When overtime earnings increase tax liability, it requires some strategic planning. Individuals can employ the following effective strategies to manage their tax implications when earning overtime:

Tax Planning and Forecasting

Regularly reviewing income, including overtime earnings, and using tax calculators allows for accurate estimations of potential tax liability. This proactive approach facilitates better financial planning and avoids unexpected tax burdens.

Adjusting Withholding on W-4

Completing the W-4 form accurately, considering both regular and overtime income, helps align the amount withheld with actual tax liability. Adjusting withholding allowances prevents underpayment and potential penalties.

Exploring Tax-Advantaged Accounts:

Contributing to tax-advantaged retirement accounts, such as a 401(k) or an Individual Retirement Account (IRA), using overtime earnings can reduce taxable income. Moreover, it can provide potential long-term tax benefits.

Itemizing Deductions

Considering itemizing deductions instead of taking the standard deduction, especially with higher taxable income from overtime, can help maximize deductions and reduce overall taxable income.

Utilizing Tax Credits

Exploring available tax credits, such as the Child Tax Credit or Education Credits, helps reduce the amount of taxes owed. Furthermore, understanding eligibility criteria ensures that credits aligned with personal circumstances can be claimed.

Monitoring State and Local Tax Laws

Staying informed about state and local tax regulations ensures accurate tax calculations and compliance with regional tax requirements, which can vary widely.

Investing in Professional Advice

Consulting with a tax professional or financial advisor provides personalized guidance tailored to unique financial situations. Professionals can offer insights into specific deductions, credits, and strategies aligned with individual goals.

Saving for Tax Payments

Setting aside a portion of overtime earnings for tax payments helps avoid financial strain when tax payments are due, ensuring the necessary funds are available.

Considering Deferred Compensation

Exploring potential deferred compensation plans offered by employers allows employees to defer a portion of their income. This potentially reduces immediate tax liabilities while saving for the future.

Staying Informed About Legislative Changes

Being aware of changes in tax laws, especially those related to overtime pay, helps individuals stay ahead of legislative updates that can impact tax rates, deductions, and credits.

By implementing these strategies, individuals can proactively manage their overtime taxes to optimize their financial outcomes and minimize potential surprises come tax season.

Is Working Overtime Worth It?

Whether working overtime is worth it depends on various factors, including personal, financial, and career considerations. One key aspect to evaluate is the rate of overtime pay and its contribution to the overall income. Overtime is typically compensated at a higher rate, providing a financial incentive.

The rationale behind this higher pay rate often lies in acknowledging the extra effort and time commitment associated with working beyond standard hours. Employers commonly use this approach to acknowledge and reward employees for their dedication and willingness to go the extra mile.

However, delving into the financial implications demands a nuanced understanding of how increased income can intersect with the tax landscape. Higher earnings may push the individual into a higher tax bracket, potentially affecting the net financial gain.

In conclusion, the delicate interplay between increased earnings, tax considerations, and the ultimate net financial gain emphasizes the importance of a thorough evaluation before embarking on overtime commitments. Approaching this decision with a holistic mindset empowers individuals to make well-informed choices. This, in turn, ensures that their pursuit of extra income harmoniously aligns with their broader financial objectives.

Source: https://t-tees.com

Category: WHY